IOUpay records growth across key metrics in positive start to September quarter

Pic: Getty Images

IOUpay has announced a positive start to the first half of September quarter including growth in new merchants and consumer activation.

Malaysia-focused fintech IOUpay (ASX:IOU) has announced strong transaction volumes for the first half of the September quarter reflecting increased activity following cultural holidays in the previous quarter.

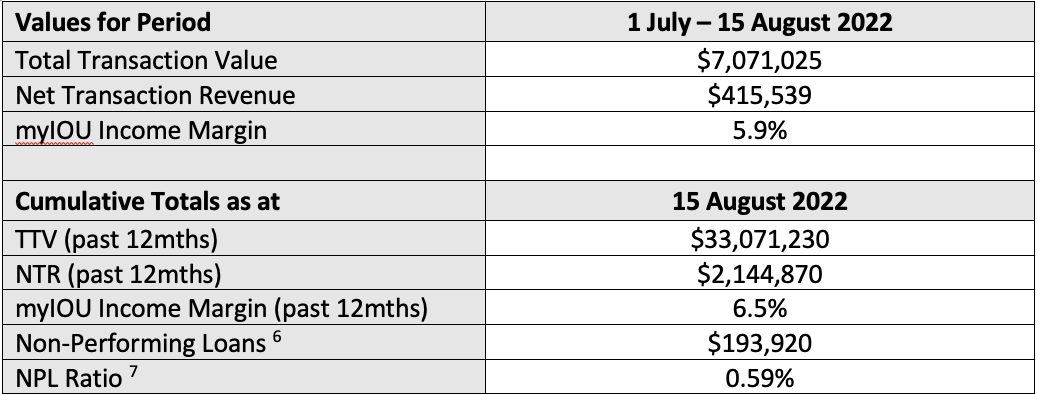

For the first half of the September Quarter (July 1-August 15) more than $7 million in total transaction value (TTV) was recorded for myIOU BNPL, delivering ~$415k in net transaction revenue (NTR).

Non-Performing Loans (NPL) of ~$194k and NPL Ratio 0.59% continue to indicate modest delinquencies and reinforce strong credit quality control strategy.

IOUpay said NPL reflects its targeted consumer acquisition process, including sophisticated credit scoring technology to authenticate customers and independently check credit profiles.

It is also continually assessing and managing merchant relationship performance to ensure alignment with values and expectations which benefits the credit management process.

Growth in sign-ups

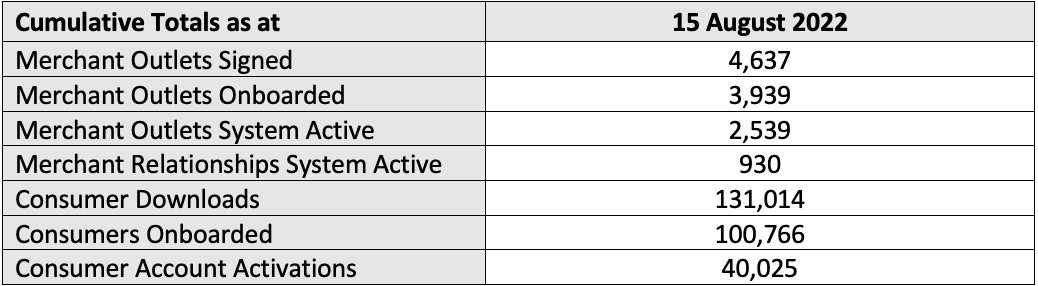

The company continues to see growth in consumer and merchant sign-ups, approval and onboarding since its June 2021 launch including cumulatively:

- 2,539 merchant outlets activated and listed on myIOU (up 6% since June 30, 2022)

- 40,025 consumer activated accounts (up 18% since June 30, 2022)

The myIOU income margin of 5.9% is below the average margin over the past 12 months but consistent with the company’s internal expectations. Effective annualised returns for individual transaction profiles remain within IOUpay’s target range.

The myIOU income margin for the 12 months to August 15 is 6.5%, which also remains within the company’s target range.

The company continues its focus on building a community of quality merchants and consumers as part of its ‘best-in-class’ brand positioning in Southeast Asia.

Merchant and consumer activation

During the period, 58 new merchants operating 132 outlets around Malaysia were added to the myIOU platform.

New merchants were added to 12 industry vertical categories. Key industry verticals with numerous merchants added since 30 June include:

- Automotive (11 merchants with 16 outlets)

- Beauty & Wellness (10 merchants with 20 outlets)

- Electronics & Gadgets (10 merchants with 43 outlets)

- Fashion (6 merchants with 12 outlets)

- Home & Living (10 merchants with 22 outlets).

Active consumer engagement has continued into the Q1 FY23. As measured against results as of June 30, consumer downloads are up 20%, consumer onboarding is up 22% and consumer account activation is up 18%.

Almost 77% of consumers who download the myIOU app complete the onboarding process and, most significantly, more than 30% of those who download the app go on to complete a transaction. These ratios have remained consistent over time with a growth trend in activation to transaction identified since the launch of myIOU 2.0 mid-March.

Product development update

IOUpay is collaborating with Virtualflex Sdn Bhd to provide a co-branded myIOU KA$Hplus prepaid Visa card under a collaboration agreement.

The Stage 1 rollout (including issuance of cards to selected myIOU customers) was officially launched on July 15.

The Stage 2 integration remains subject to Bank Negara Malaysia (BNM) approval for the linkage to the myIOU BNPL service.

IOUpay is working with VirtualFlex to satisfy BNM’s approval requirements.

The second tranche payment for the balance of IOUpay’s investment in Malaysian specialised finance company I.Destinasi Sdn Bhd (IDSB) is due to be completed by August 31.

IOUpay expects to provide a further update on completion of the second tranche over the coming week.

The first stage of a marketing programme to market myIOU BNPL services into IDSB’s high credit quality, civil servant customer base, remains on track to be rolled out Q1 FY23.

This article was developed in collaboration with IOUpay, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.