Integrated Research plunges after warning shareholders of flat revenue, lower profit growth

Pic: Yuichiro Chino / Moment via Getty Images

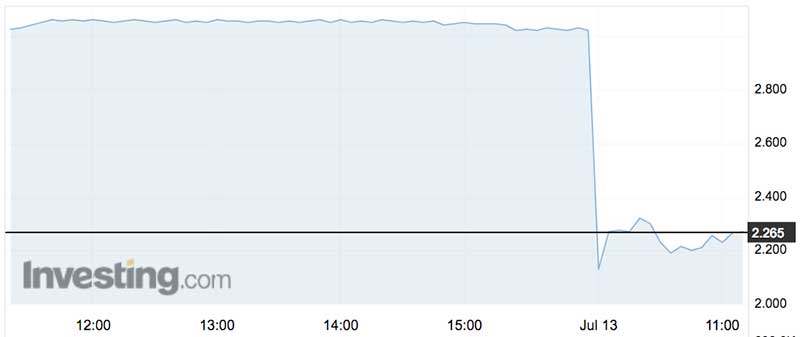

Software maker Integrated Research has plunged today after issuing an after-market warning on Thursday that full-year revenue growth will be flat and profit growth will be lower.

The shares fell 30 per cent to an intraday low of $2.12 in early Friday trade. They were trading at $2.25 at 11.15am AEST.

Integrated Research (ASX:IRI) yesterday told investors that after-tax profit growth would be 1 per cent to 5 per cent compared to the previous financial year.

That compared to growth of 16 per cent to $18.5 million last year.

“The result was primarily a function of the cyclical downswing in infrastructure and an underperforming European operation,” company secretary David Purdue told investors.

Integrated Research makes software that keeps critical computer systems such as payments and communications platforms running smoothly.

The stock has taken a beating in recent weeks, falling from around $3.80 in May to $3.02 at Thursday’s close.

Last month Stockhead noted differing views among analysts on the stock’s outlook.

Long time supporter Bell Potter reckoned Integrated Research shares were a screaming buy with a $4.15 price target.

“There is no clear reason for the share price fall,” its analysts told clients in a note.

Another broker, Wilson’s, wasn’t so gung-ho, slapping a ‘sell’ on the shares, with a $2.65 12-month price target, due to concerns over income from software licence payments.

“Though the result is disappointing, the fundamentals of the business remain sound with stronger licence growth anticipated for the new financial year,” Integrated told investors.

The company had $11.2 million in cash and no debt.

Full-year results are expected on August 16.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.