Here’s why you’ve been valuing cryptocurrencies all wrong

Pic: Thinkhubstudio / iStock / Getty Images Plus via Getty Images

Cryptocurrencies are usually measured by their market value — but their true valuations are still eluding investors says Henrik Anderson, Chief Investment Officer of leading Australian crypto fund Apollo Capital.

Most people value cryptocurrencies by their market value. How else can they be valued?

The field of valuing cryptocurrencies remains nascent. This is a new asset-class. We’ll most likely need new methods when valuing crypto-assets.

To date there is no standard for valuations, it is still very much an evolving field.

When you break it down, it all depends on what type of crypto-asset you have. The ecosystem is much larger than than just cryptocurrencies. There are crypto-commodities, utility-tokens, tokenised securities and even digital collectables (like Crypto Kitties).

In the future, these distinctions between crypto-assets will become clearer. It’ll be like how we differentiate between conventional assets like real estate, stocks or bonds.

I really like this quote by Chris Burniske, co-founder of Placeholder Ventures a New York Crypto firm:

“It’s still early days for crypto asset valuations… Given we have a whole new asset class on our hands, we have a fantastic opportunity to craft the theory that people will use to price these assets for decades to come. People win Nobel Prizes for that kind of thing.”

What’s wrong with comparing coins simply by their market value?

True valuations are still eluding most crypto investors. The most popular site for crypto prices is coinmarketcap.com. But coinmarketcap.com only shows the current market capitalisation at its current supply.

Sites like onchainfx.com take into account the full dilution of these assets, which gives a more complete picture of the valuation.

But the dollar value does not take into account how often those tokens have been used or traded or whether the tokens have even been launched yet.

The only way to truly value each token is to compare how much it is used and what functionality it has or might have in the future. You need to look at the technology and how it differentiate itself. A lot of tokens don’t offer something unique.

Do you think the average crypto investor is fully aware of the value of their assets?

I don’t think valuation information is widely out there at all. When you see mainstream conversations about crypto, the first thing they discuss is the market cap.

But consider the comparison between bitcoin (BTC) and ether (ETH) – at $151 billion and $62 billion respectively.

The dollar value fails to take into account how much it is used in transactions or the true utility of the token – given that one is a store of value and a currency, and the other is a utility token to fuel the use of smart contracts. These are completely different use cases.

I don’t see many people talking about true valuations in crypto at all. It is still very much an emerging field practised by some institutional investors. But as this new asset class matures we need to think hard about these things.

Using the example of bitcoin, how do you believe it is best valued?

When you look at a token like bitcoin in its current form, the way you can look at it is more like a commodity, comparable to gold. Some have called Bitcoin gold for a new generation, or Gold 2.0.

Some would even argue it is better because the supply of bitcoin is known and it can be transferred easily and stored and transferred at a relatively low cost.

Since we know the value of all gold in circulation we can try to estimate the value of bitcoin based on its adoption.

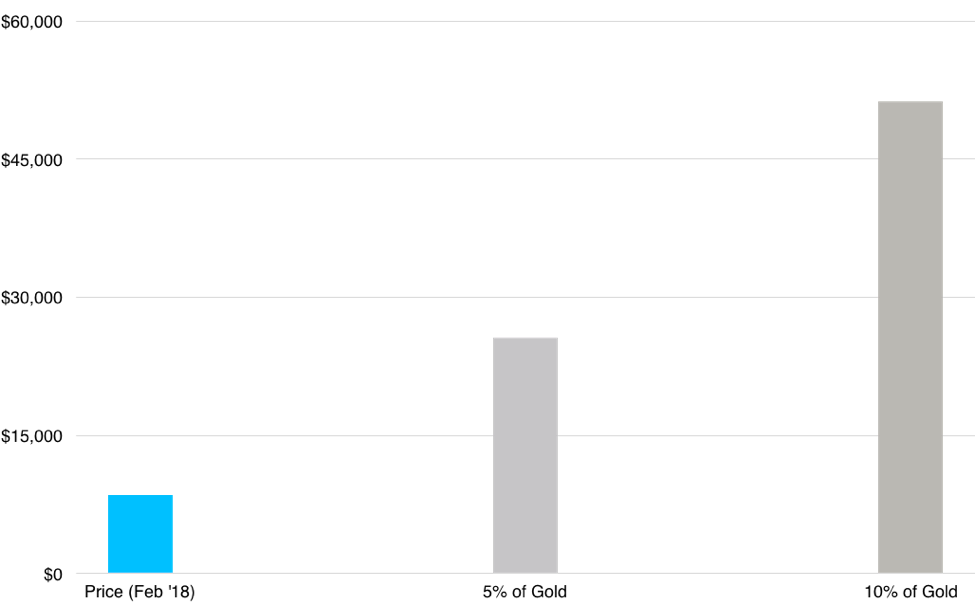

If Bitcoin were to take 5 per cent of the Gold market, 1 BTC would be worth approximately $US25,000 and at 10 per cent approximately $US50,000. (See graph below)

For other assets, that have more of a clear utility, we can use a more general model like the equation of exchange: MV=PQ .

(M is the money supply, V is velocity or the number of times per year the average dollar is spent, P is the price of goods and services and Q is quantity of goods and services.)

This relates the network value with the value transacted on the network combined with the velocity of the token. While perhaps counter-intuitive, a higher velocity implies a lower network value.

With a higher velocity, you can achieve the same transaction value with a token of a lower value. For this reason, we see some projects trying to tie up tokens to reduce the overall velocity of the network, and therefore increase its value.

What alternative valuations are used in the industry?

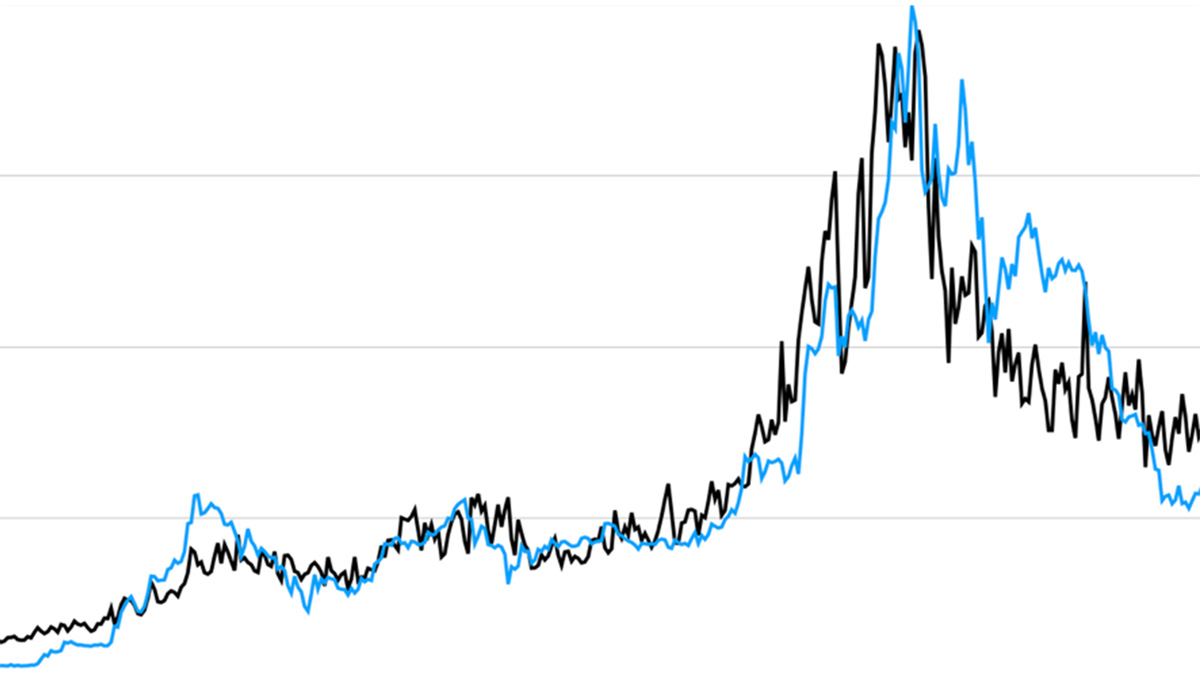

Computer networking pioneer Robert Metcalfe proposed in the 1940s that the value of a communication network is directly proportional to the number of nodes in the network squared. This is known as Metcalfe’s Law.

Recent research has shown that this model works quite well in estimating the revenue of network based companies like Facebook and Tencent. There we use the number of active users as “nodes” in the network.

Few things probably have greater network effect than money and cryptocurrencies. So when we apply this kind of model to cryptocurrencies we get a very close relationship between the price and the number of active users.

The graph below shows Metcalfe’s Law applied to the price of ether (blue) compared to the number of active users (black).

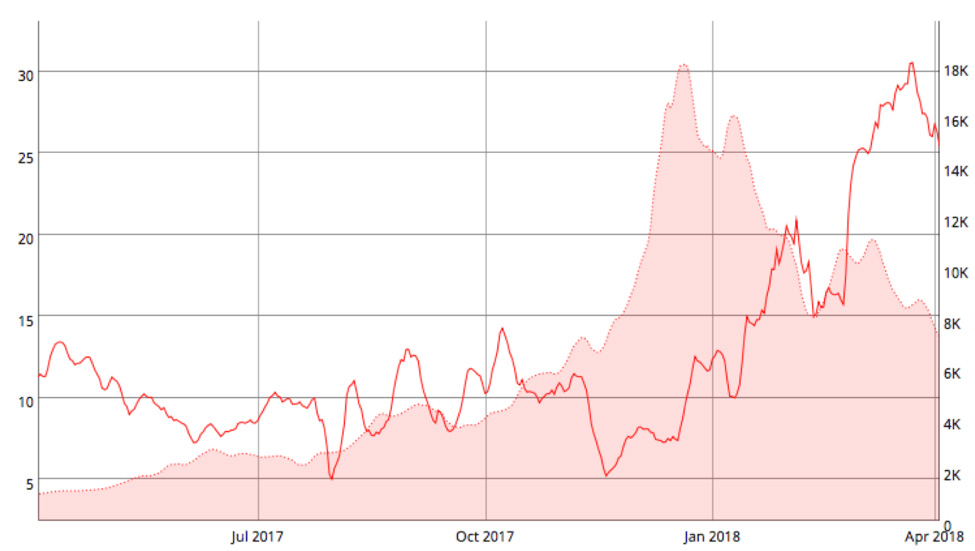

Finally, we can look at crypto using the “NVT” ratio, which has been called the price/earnings ratio of crypto. This means we take the network value over the transactions value on the blockchain.

Essentially, that relates the use of the cryptocurrency to the market cap to give you the relative valuation of the token.

It is not without problems. For example, it’s hard to know what is a utility transaction versus pure speculation.

There are other problems: privacy coins with shielded or invisible transactions make it impossible to measure the NVT ratio.

Furthermore, if something like NVT ratio became a popular valuation metric, there would be a risk of a large amount of spam transactions in order to manipulate the true utility value.

The graph below shows the NVT ratio of Bitcoin (red line) and price (red area).

Henrik Andersson is the chief investment officer for crypto fund, Apollo Capital.

He has over 17 years experience in global financial markets, with almost a decade on Wall Street. Henrik has extensive experience across three continents as a quantitative analyst, senior research analyst and in institutional equity sales.

Apollo Capital is Australia’s premier crypto fund, allowing sophisticated wholesale investors to gain access to investment opportunities within the crypto asset market.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.