Here’s how much cash the world’s largest tech companies are hoarding

Pic: nespix / iStock / Getty Images Plus via Getty Images

The cash-generating ability of the US tech giants is readily apparent to anyone with even a passing interest in the Nasdaq.

Case in point; Apple just chalked up revenues of US$81 billion for the June quarter (BHP FY20 full-year revenue: $42.9bn).

BHP is also expected to pay out 100% of its earnings as dividends.

So what do the US tech behemoths do with their money? Research from CBA this week shows they like to hoard a lot of it.

“The giant tech companies are the omnipotent earners and hoarders of cash,” said rates strategists Martin Whetton and Phillip Brown.

With their massive cash stash, companies like Microsoft and Apple are also big players in global bond markets, where they earn interest on liquid debt positions.

Broadly speaking, the pandemic has been good for big tech as business models faced minimal disruption from lockdowns.

The sector has also outperformed the US market through the middle of the year, accounting for an outsized chunk of the S&P500’s recent gains as investors assess the impact of higher inflation in the post-Covid recovery.

That outperformance can be partly reflected by the growth of their cash piles and short-term liquid investments.

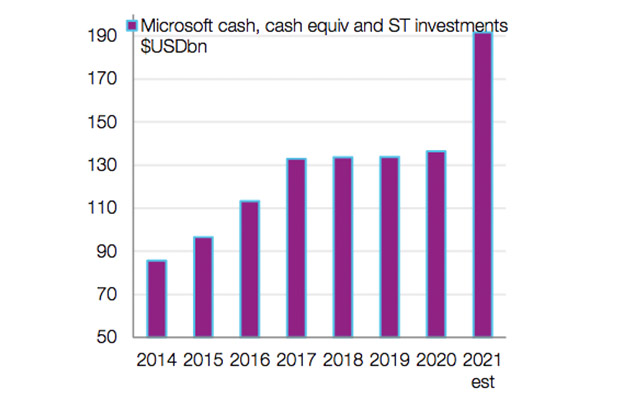

And Whetton and Brown estimate that Microsoft will close out 2021 with around US$190 billion on deck:

That’s bigger than the current market cap of Commonwealth Bank (~$176bn), just in cold hard cash on the balance sheet.

Healthy growth in iPhone sales will also flow through to Apple’s bank account, with CBA flagging a 2021 cash balance of around US$60billion, up from ~US$40 billion last year.

A by-product of all the money is that the US tech majors have also come to play a key role in global capital markets.

Apple’s corporate treasury department holds more money in cash and liquid fixed-income investments than the size of many mutual funds, CBA says.

That works out well for banks, who would prefer that it doesn’t park all that money on deposit because they can’t lend it out at the same speed (which reduces profitability).

Some would argue that they should use more of that money for dividends or stock buybacks.

But with tens of billions in spare change, there’s a not-zero chance that the corporate finance divisions of the global tech behemoths take the view that they will do whatever they like with it.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.