Growth aplenty as Plenti delivers positive cash NPAT for FY22

Pic: Getty Images

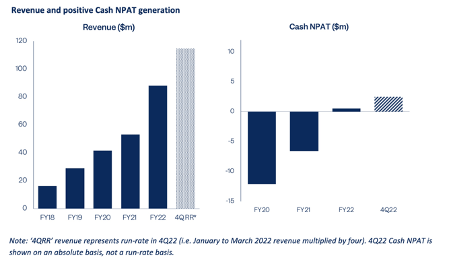

In a year of rapid growth for Plenti, the company has achieved full-year positive cash NPAT for the first time as it continues to capture market share across its key lending verticals.

Fintech lender Plenti (ASX:PLT) has announced solid full year results for the year ended March 31, 2022 (FY22), including achieving a major milestone of positive full-year Cash NPAT for the first time.

Plenti delivered full year Cash NPAT of $0.5 million, with second half Cash NPAT of $2.7 million. The company started reporting positive monthly Cash NPAT for the first time in October 2021. Since then, monthly Cash NPAT has risen each month.

In other achievements for FY22, the company recorded record loan originations of $1.1 billion, up 134% year-on-year (YoY), and record loan book of $1.3 billion (up 111% YoY) and record interest revenue of $87.3 million (up 72% YoY).

Plenti’s larger loan portfolio generated interest revenue of $87.3 million, up 72% on the prior year. Run-rate revenue reached around $115 million by the final quarter of the year.

Growth across key lending verticals

The company continued to grow across its three key lending verticals – automotive, renewable energy and personal loans.

Growth was particularly strong in automotive finance, where annual loan originations of $639 million were 177% above the prior year.

Plenti launched its commercial automotive lending during the year, which has almost doubled the size of the company’s automotive loan market opportunity.

Renewable energy originations grew to $98 million, 72% above the prior year.

Partnerships played a key role during the year: Plenti entered into several with large energy retailers and a financier agreement with an electric vehicle manufacturer.

Technology-led growth

The company continued to demonstrate operational leverage inherent in its technology-led business model by materially reducing its cost-to-income ratio to 48% from 55% in the prior year. The cost-to-income ratio reduced to 44% in the second half. Strong revenue growth and continual operational efficiency improvements have been credited with the positive cash NPAT result for FY22.

Plenti delivered significant advancements in its technology platform across customer experience, credit decisioning and pricing, as well as partner integrations in FY 22.

The company has more than 45 engineers, product managers and designers delivering its market-leading technology, enabling Plenti to continually innovate, drive loan origination growth and increase operational efficiency.

Credit where credit is due

Plenti has also delivered market-leading credit performance in FY22 with a 0.54% net loss rate, down from 0.96% in FY21. 90+ days arrears were at 0.26% at the end of the year, versus 0.31% at the end of FY21.

The average Equifax credit score on the loan portfolio increased from 821 at the start of the period to 838 at the end of the period.

The strength of this credit performance in part reflects Plenti’s deliberate shift towards lower-risk automotive and renewable energy loans, which now represent ~68% of the loan portfolio.

Strong financial position

Plenti began offering loans as a private company in 2014 before listing on the ASX in September 2020.

The company continued to diversify and deepen its funding sources in 2021, establishing a third warehouse facility with a specific tranche to fund electric vehicles.

The company also successfully completed two ABS transactions across $586 million of loan automotive, renewable energy and personal loan receivables, reducing funding costs and Plenti’s equity funding contribution to these receivables.

Combined with lower funding costs from its retail platform, these reduced the overall funding rate in the second half to a record low.

Plenti entered into a corporate debt facility agreement in March 2022 for an initial draw of $18 million with an Australian funder to provide capital to support its ongoing business growth.

The facility limit is linked to the size of Plenti’s securitised loan portfolio, providing the ability to access more capital in-line with loan book growth.

Growing expectations of central bank rate increases meant Plenti experienced increases in funding costs on new loan originations during the latter part of FY22.

The company said higher funding costs on new loan originations will be partially been mitigated through increases in borrower rates.

Plenti expects borrower rates to continue to increase over the coming months as the market adjusts to higher funding costs.

Focus on market leadership

Plenti said its strategy is to establish market leadership positions in each of its lending verticals, extend its technology advantages and optimise its funding.

The company aims to return to focusing on achieving market share gains in the second half. Cash NPAT is forecast to continue increasing FY23, weighted towards the second half.

Plenti’s priorities include achieving a $5 billion loan portfolio in 2025, continuing full year Cash NPAT and profitability growth and reducing cost-to-income to less than 40%.

Ticking off milestones

Plenti CEO and founder Daniel Foggo said achieving positive cash NPAT in FY22 was a major milestone and a testament to the strength of its technology-led business model and talented team.

“It rounds out what has been an exceptional year of growth as we continue to capture market share in all lending verticals and set new industry standards,” he said.

“With our diverse funding options, continually improving operational efficiencies as we scale, and strong risk management track record, we are well placed to continue delivering profitable growth.”

This article was developed in collaboration with Plenti, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.