Government support will drive EV uptake, report says

Pic: Morsa Images / DigitalVision via Getty Images

Government support is crucial to rapid electric vehicle (EV) adoption in Australia, according to a new report.

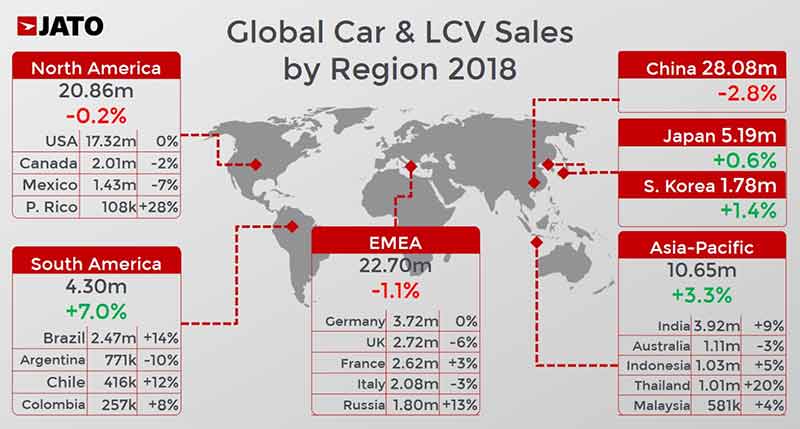

In 2018, a challenging year for carmakers, about 86 million vehicles were sold.

EV sales, growing strongly from a low base, represented just two per cent of this total.

A new S&P Global Platts report on the future of EV technology predicts EV market share “is on track” for 10 per cent by 2025.

But just how quickly this happens “will largely be determined by the level of government support”.

This includes mandating tighter vehicle emission requirements and EV incentives – for both the car industry and consumers.

For many carmakers and their suppliers, including battery manufacturers, the next few years will be tough, which makes regulatory certainty all the more important.

Escalating R&D costs will weigh on the earnings of carmakers and their suppliers, especially battery manufacturers, Platts says.

Carmakers are already teaming with suppliers (and each other) to mitigate these costs, but government incentives and clear, consistent regulation could put a rocket under EV adoption.

Platts says the highest uptake invariably comes from those jurisdictions with the best government support.

These governments have rolled out strict emissions standards plus incentives like tax exemptions or credits to drivers who switch to EVs, preferential parking, toll rebates, and low-emission zones.

How does Australia measure up?

In a word; poorly.

Australian governments have not done a particularly good job encouraging EV uptake thus far; a recent Senate report admitted as much.

The first recommendation of this report was basic: prioritise the development of a national EV strategy and an inter-governmental taskforce to lead its implementation.

China is the clear frontrunner here.

The Chinese government’s control of the economy means it can mandate an EV adoption rate for the entire country through new vehicle emissions requirements and incentives.

China is targeting new energy vehicles (NEV) sales of at least 7 per cent in the domestic market by 2020, and 20 per cent by 2025.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Europe has just set some aggressive targets, despite some resistance from Germany, one of the world’s largest carmakers.

The UK and France have already announced that they will ban sales of light vehicles with combustion engines by 2040.

And Norway, the market share leader for EVs, has found that value-added tax (VAT) and vehicle registration tax exemptions, free access to toll roads, and circulation tax rebates are most effective in influencing the purchase of EVs.

In Northern Europe generally, the adoption of EVs has been encouraged by cutting the initial price of the vehicle, Platts says.

“We believe there is a strong consensus regarding the need to reduce greenhouse emissions among European nations,” Platts says.

European leaders have set sales targets of zero-and-low emissions vehicles (ZLEV) of 15 per cent of new car sales by 2025 and 35 per cent by 2030.

These sales targets are nonbinding and exact no penalties from them.

However — the European Commission, the European Parliament, and the European Council want to cut new car CO2 emissions by 15 per cent by 2025 and by 37.5 per cent by 2030, “relative to a 2021 baseline”.

“Manufacturers failing to meet these emissions targets will pay a penalty per vehicle for every gram per kilometre (g/km) by which the manufacturer’s fleet average CO2 exceeds its target,” Platts says.

~70g CO²/Km by 2030 is a tough new #EU target vs 118g CO²/Km today. No ICE car can comply with 2030 limit today unless they have a #battery. Those carmakers unable to ramp-up #EV plans will stop selling cars in EU or export to countries with more lax limits. Some will dissapear. https://t.co/asVaLWBH96

— Jose Lazuen (@JoseLazuen) December 19, 2018

In the US, it’s all about the Trump factor.

In April 2018, the US Environmental Protection Agency (EPA) decided that current emission standards — EVs being 5 per cent of new sales in 2025 — were too strict.

“We see the Trump administration relaxing current fuel efficiency targets for 2025,” Platts says.

“The lack of certainty complicates automakers’ decision-making regarding long-term investments.”

The US car market is now essentially split in two, Platts says; those states with strict EV-friendly regulations and incentives, and those without.

14 states, including California, require ca makers to meet a level of zero-emissions vehicle sales or buy credits to comply.

Carmakers are more likely to build fleets that comply with more-stringent emission standards, rather than split production into two, Platts says.

“In addition, there is no guarantee that the Trump administration will remain in office beyond the next election, and that its current policy directives … will stay in place,” Platts says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.