From high-tech cancer fighters to AI-wielding crime busters, these are some of the most innovative firms on the ASX

Pic: Getty Images

A recent lunch put together in Sydney by Jane Morgan Management and Éthica Capital saw a number of the ASX’s most innovative biotech and tech companies present and pitch to an audience of potential investors on the lookout for the next big thing.

Stockhead was there, at the fancy establishment… The Establishment – eating, chatting, taking notes, eating some more, and generally trying to absorb some of the seriously brainiac-developed knowhow on offer.

Here then, in some sort of nutshell, is what we learned…

The forum highlighted innovations aimed at transforming healthcare, enhancing connectivity, and advancing cybersecurity, reflecting dynamic growth and investment potential within these burgeoning sectors.

Sectors and company missions that fall firmly within the concept of the ‘Exponential Age’ we’re fast progressing into – a time of profound change and growth in technology and communications.

In particular, the event underscored a strong focus on innovative healthcare solutions, with companies including BlinkLab, Imugene and and BCAL Diagnostics summarising groundbreaking technologies.

There was also significant discussion on the importance of secure connectivity and cybersecurity in an increasingly digital world, as illustrated by Elsight and WhiteHawk, as well as the need to streamline and simplify the complex tasks of professional wealth management – which is where Praemium’s platform comes in.

First up to the dais and grabbing the mic, we heard from…

Blinklab (ASX:BB1)

Focused on revolutionising mental healthcare, this innovative Aussie company has set about tackling the significant challenges in autism diagnosis with an AI-driven smartphone app, developed in collaboration with big brains at Princeton University.

This technology is set to impact a market with a staggering $700 billion potential in the US alone by 2024.

BlinkLab’s platform leverages minuscule facial reflexes – hence ‘blink’ – to generate digital biomarkers for autism and aims to reduce the high costs and subjectivity associated with traditional diagnostic methods.

The BlinkLab application aims to streamline the early diagnosis of conditions like autism spectrum disorder (ASD) and ADHD in children as young as 18 months old.

“We can bring that diagnostic age to a lower age and we can totally disrupt the way these kids have been treated,” said BlinkLab chairman Brian Leedman at the investor lunch, adding:

“This is the world’s first digital application on a smartphone solely on a smartphone that can analyse a child’s face and diagnose autism or ADHD, simply by looking at their reflex action.”

Validated in over 6,000 subjects, this innovation promises a scalable, effective solution for early and precise diagnosis, facilitating better developmental outcomes.

Following a raise of $7 million at 20 cents/share, BlinkLab was the first healthcare IPO cab off the rank for the ASX in 2024.

And its share price made an immediate impression on the bourse, too. Since listing a month or so ago, BB1 is up roughly 90% at the time of writing.

Leedman is hoping to replicate his success as a founder of ResApp – a smartphone app able to identify a Covid-19 infection from a person’s cough, which was sold to pharmaceutical giant Pfizer for $179m in 2021.

What next? The company is aiming to pull in investment to finalise an FDA Class II medical device registration study in partnership with leading US university hospitals.

“If you want to invest in AI, because it’s an investment commodity these days, you have to invest in companies exposed to AI. And that’s what BlinkLab is,” said Leedman.

BB1 share price

Cynata Therapeutics (ASX:CYP)

Melbourne-based Cynata Therapeutics is pioneering the use of its proprietary Cymerus technology for scalable production of consistent, allogeneic mesenchymal stem cells (MSCs).

The company, via its CEO and MD Dr Kilian Kelly, shared some compelling updates on its clinical trials, including promising treatments for conditions such as graft-versus-host disease (GvHD) and diabetic foot ulcers.

Utilising induced pluripotent stem cell technology, Cynata aims to meet substantial unmet medical needs, demonstrating safety and efficacy in diverse indications such as osteoarthritis and renal transplantation.

Cynata’s strategic partnership with Fujifilm and a strong financial backing underscore its significant market potential.

“This platform allows us to make an effectively limitless number of therapeutic stem cell doses from a single blood donation,” noted Dr Kelly, adding:

“We treated 15 patients, and we saw really encouraging results. So 13 out of 15 showed an improvement of at least one grade, and eight showed complete response, which means that the GvHD resolved entirely.

“Our process overcomes these challenges. So by using this IPSC technology, we can make all of the cells we ever need from one donor, one time.”

This trialling is now complete. The initial data the company announced earlier this year was indeed compelling, though, and came from the first 16 patients at the 10-week follow-up point.

“And what we saw was that the extent of healing in the stem cell treatment group was close to 90% after 10 weeks,” confirmed Dr Kelly.

CYP share price

Imugene (ASX:IMU)

Imugene stands out as a frontrunner in immuno-oncology with a robust market capitalisation of $637m and significant cash reserves of $114.1m, reflecting strong investor confidence already.

The innovative platform technologies, including CAR T cell therapy, oncolytic viruses, and B cell immunotherapy, target a wide range of cancers such as blood cancers, breast cancer, and solid tumours.

The company’s active clinical trials, including the VAXINIA Phase 1 for solid tumours and the PD1-Vaxx Phase 2 for neoPOLEM, highlight Imugene’s strategic approach to targeting multiple high-impact disease areas.

With an experienced management team that boasts over 150 years of combined experience in drug development and approvals, Imugene has positioned itself extremely well to target significant therapeutic advancements in highly challenging disease areas.

“We have four unique cancer fighting platforms, and four very active studies,” said the company’s CEO and MD Leslie Chong at the event, proudly adding:

“We’re addressing the scourge of this world, which is cancer – not only solid tumours, but blood cancers as well.”

IMU share price

BCAL Diagnostics (ASX:BDX)

Founded in 2010, BCAL Diagnostics is pioneering the early detection of breast cancer through its innovative blood test – BREASTEST.

The test, poised for commercial launch in Australia in late 2024, represents a significant advancement in screening, particularly for women with dense breast tissue where traditional imaging methods fall short.

The company has collected more than 5,000 prospective blood samples to refine its machine-learning algorithms, ensuring the test’s effectiveness and scalability.

Meanwhile, BCAL’s strategic partnerships and planned expansion into the US market in 2025 highlight its commitment to transforming breast cancer screening globally.

“We’ve taken 14 years since 2010 to develop the test, which we’re about to launch in the market later this year,” said the company’s executive chair Jayne Shaw.

“The breast test is a game-changing technology that is going to lead to improved survivability rates for all women.”

Early diagnosis is the key to improved detection for cancer, continued Shaw, who further revealed BCAL is launching the test as an adjunct to mammograms, which she notes is “really important as it has been the standard of care for breast cancer diagnosis for the last 30 years”.

“Our platform, which has been developed over many years, basically can identify breast cancer and non-breast cancer patients with a 90% sensitivity and an 85% specificity.”

BDX share price

Elsight (ASX:ELS)

The event changed tack somewhat in the second half – less bio, more tech.

Elsight is in the drone communications and connectivity game. That’s a niche but increasingly important area of specialisation in a world that’s rapidly evolving supply chain systems and communications.

Elsight’s Halo system is the first AI-powered connectivity solution for drones and other unmanned systems, guaranteeing, says the company, constant uptime and connection between drones and ground control stations – stationary, portable or mobile.

The company’s proprietary bonding technology incorporates both software and hardware elements to deliver reliable, secure, high bandwidth, real-time connectivity – even in the most challenging locations, situations and terrain.

Elsight was founded in 2009, and since has grown to provide robust, secured connectivity tech to drone manufacturers, operators and integrators globally.

“What Elsight does is provide what we call the picks and shovels to the industry, and mainly then the brain of the system on drones or autonomous rovers,” said the company’s CEO Yoav Amitai via a video link.

“Elsight is essentially what we call connection confidence, making sure that anything that needs to be connected will be connected in the most reliable way,” he added.

“We see a massive growth also coming from Homeland Security and government applications, which initially, we were mainly focused on the commercial market.”

Amitai added that, while government and military contractors would be the first markets that spring to mind for drone comms applications, the marketplace for Elsight is growing and working in all sorts of different directions, including consumer/retail deliveries, agriculture, mining, medical and other industries.

“We targeted the drone market because it was a nascent market, because it’s very hard to say this is the market leader and we thought that we can become the market leader,” said Amitai, reinforcing that Elsight is a “deep brand” in this space.

ELS share price

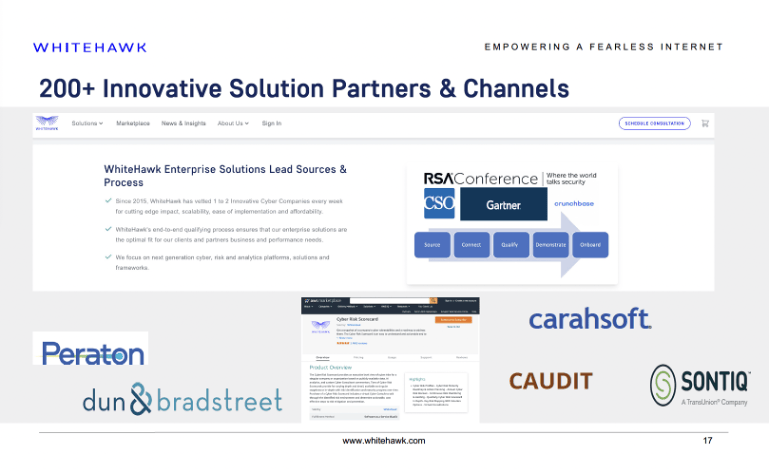

WhiteHawk (ASX:WHK)

WhiteHawk’s CEO and founder Terry Roberts, a former deputy director of US Naval Intelligence, highlighted her company’s evolution from a cyber risk advisory to a major online cybersecurity exchange integrating advanced AI technologies.

Roberts says Whitehawk’s platforms offer comprehensive cyber risk management solutions that automate and scale risk mitigation for businesses and organisations.

The WhiteHawk team developed the first online cyber-risk-to-resilience-focused cybersecurity exchange platform of end-to-end cyber risk software as a service (SaaS) and platform as a service (PaaS) products and services. They provide automated and scalable cyber risk scoping, prioritisation and mitigation solutions for businesses and organisations of all sizes.

If all that sounds like a whole lot of inscrutable jargon, here’s Roberts breaking down some key points in more digestible language:

“Cyber risk monitoring and reporting is now a commodity, just like credit monitoring,” says the CEO, adding that the focus of her business enables industries such as insurance and finance to better manage underwriting processes and business loans.

“Our approach costs 10% of what a traditional cybersecurity approach costs, offering significant savings – especially critical for state and local governments and small enterprises,” said Roberts.

Roberts emphasised there are three main points of risk for every company and organisation in the digital age: “Financial, which has always existed, but now they can come at your finances through cyber, through your supply chain.”

“It’s our estimation that 90% of all cyber events are never reported, and that we’re losing two to 3% of our GNP every year because the majority is not reported.”

Re the AI component, Roberts notes that the company began “with basic AI, but now we’ve definitely moved into advanced [AI tech]… And with the growth of our data sets that we now have access to, we’re well on our way to cyber-focused, generative AI.

“We’ve proven the platform, and now we’re getting ready to scale it, leveraging our advancements in AI and cybersecurity analytics.”

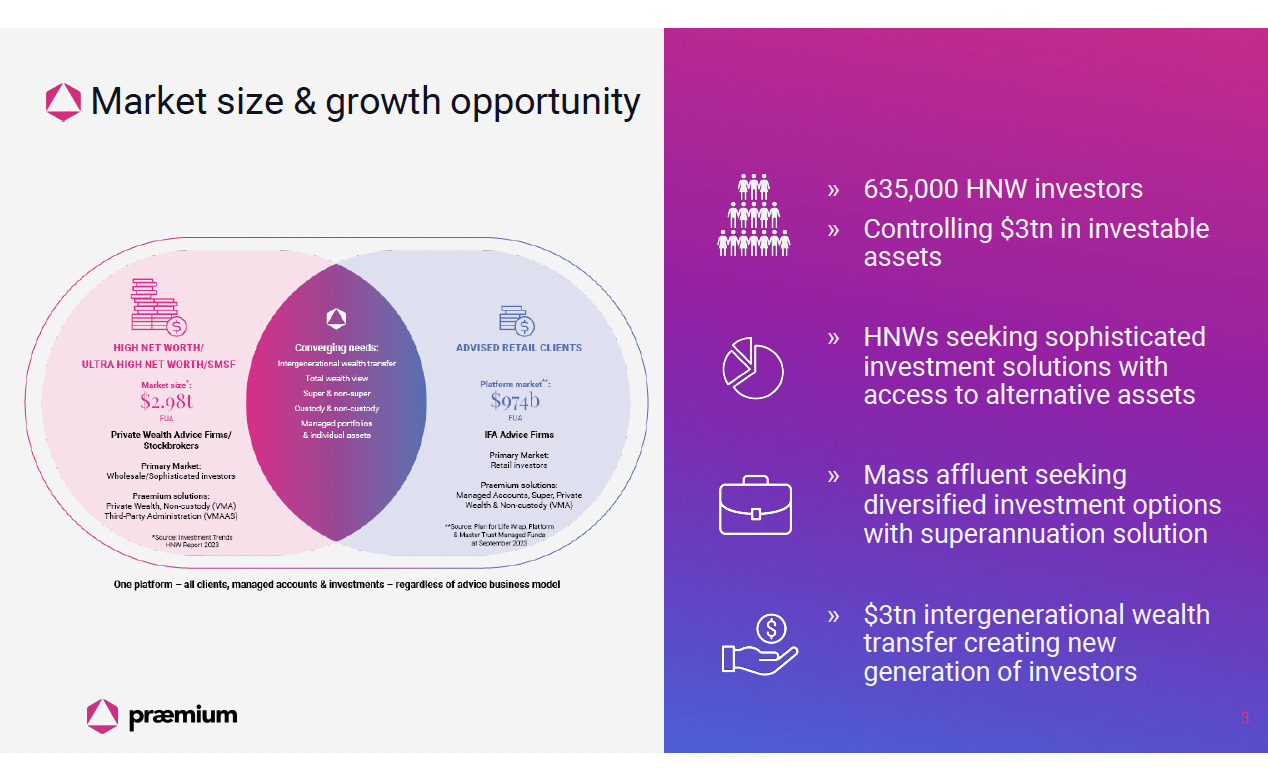

Praemium (ASX:PPS)

Professional wealth management is a complex and time-consuming business, one that leading Australian investment platform Praemium is dedicated to simplifying for its array of largely high-end financial-industry clientele.

Praemium’s platform administers and reports on more than $285 billion in FUA (funds under administration) for some of Australia’s largest and most reputable institutions, private wealth firms and financial advice practices.

And it’s a broader market it’s tapped into that, in part, represents some 635,000 high net worth investors controlling $3 trillion in investible assets.

That’s high net worth investors seeking diversified investment options and the best in superannuation and tax-related solutions among other things.

“As Australians you understand how complex the superannuation system in this country and how complex the taxation system is, too,” said the company’s CFO David Coulter at the investor lunch.

“These markets are very well served by professional financial planners. And that’s our market. They’re our customers. We’re not a business-to-consumer solution. We’re a business-to-business offering to financial planners.”

Where does technology come in here? Coulter noted that the well established business recognised the potential for its offerings to revolutionise this important aspect of finance and its focus has always been on delivering a next-gen platform that “provides an exceptional client experience”.

Users of Praemium (private wealth firms, stockbrokers, advisers) can better than ever provide their clients with what they need in terms of custodial and non-custodial solutions, all through an easy-to-use, integrated single-platform, streamlined service.

At just the tip of the iceberg here we’re talking digital tools for client and business reporting, customisable product solutions for superannuation/SMSFs, savings and domestic and international investment requirements; an Adviser Portal offering a dashboard-style view of clients; portfolio management options and a wealth of databasing tools that make corporate actions and tax management easy to handle.

It’s about outsourcing non-advice-related tasks to improve efficiency in client engagement.

In terms of performance, Coulter noted that Praemium is “winning our fair share of market share shift from institutional incumbents”, adding that it is the “leader in the areas of the market that have the most significant weight of investible assets”.

PPS share price

At Stockhead we tell it like it is. While Elsight is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.