Flying high: Jayride achieves record trips booked in Q1, forecasts cash flow positive in FY24

Flying high: Jayride achieves record trips booked in Q1. Image: Getty.

- Jayride achieves record trips booked in Q1 FY24 as world embraces travel again

- New travel agent portal launches during quarter for expanded total addressable market

- Jayride forecasting to be cashflow positive in FY24 as also completes fixed savings activity

Airport transfers marketplace Jayride has enjoyed a solid start to the new financial year with record trips booked and the company positioned to be cash flow positive in FY24.

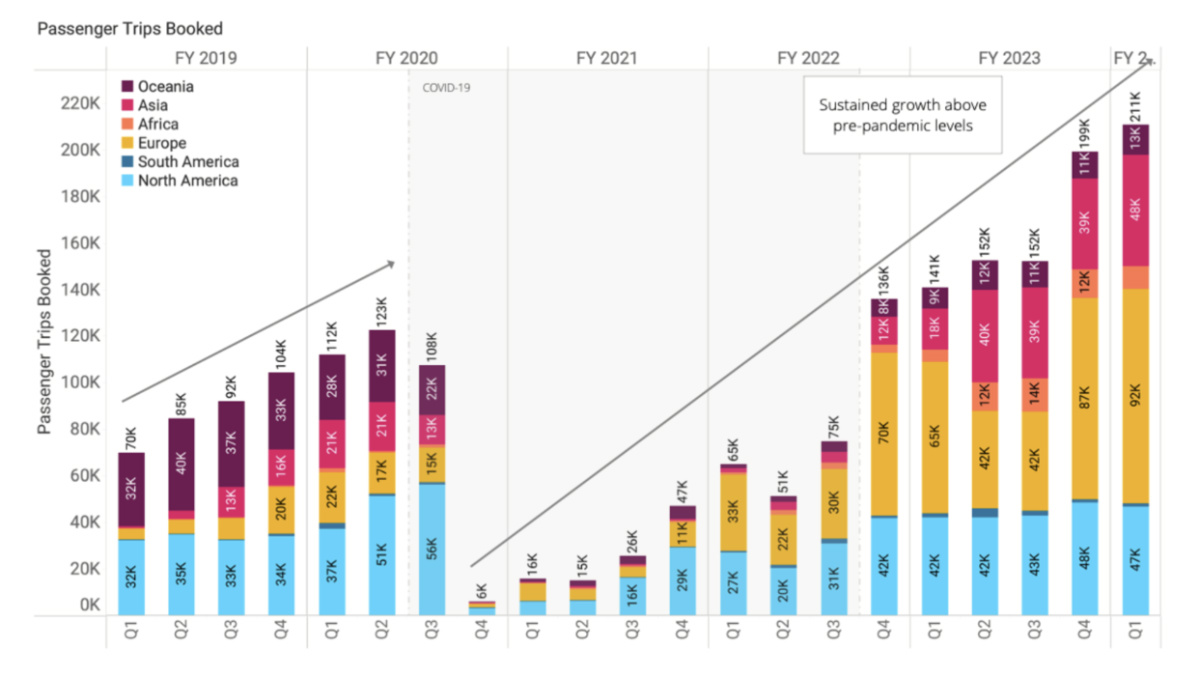

Jayride Group (ASX:JAY) has announced its Q1 FY24 results including passenger trips booked growing to record levels, up 50% on the prior corresponding period (pcp) and net revenue rising 24% on pcp.

JAY is a marketplace for airport transfers on globally, with travellers able to evaluate and secure rides from a selection of over 3,700 ride service providers, catering to more than 1,600 airports situated in 110+ countries worldwide.

This expansive network encompasses 95% of all airport-related journeys, spanning regions across the Americas, Europe, Middle East, Africa, Asia, and the Pacific.

During Q1, JAY’s new travel agent portal was launched successfully for expanded total addressable market and higher average order values.

The company reported initial traction as promising with travel agents booking larger cart sizes with attractive unit economics and a clearer path to grow trips booked at higher net revenue per trip in FY24.

Ride tracker use was also expanded in Q1 to grow volume through key travel brand partners.

JAY, which listed on the ASX in 2018, is now forecasting it will be cashflow positive this financial year.

“We are executing our strategy to grow trips and enhance unit economics, to achieve our objective of cash flow positive for FY24,” Managing director Rod Bishop says.

“With multiple growth initiatives launched through FY23 that have traction, we are set to drive growth in passenger trips booked at enhanced unit economics throughout the year ahead.”

Strong growth in Asian bookings

Passenger trips booked increased to a record level of 211k trips for Q1 FY24, including 160% growth in the Asian destination versus pcp.

Trips booked reached peak levels in July with 85k trips for the month, then reducing in line with normal seasonality for the northern hemisphere summer peak season.

Net revenue remained at the record $1.5 million level in Q1 FY24 with JAY saying net revenue per trip was impacted by higher volume of trips in Asian destinations and by improved refund rates with further scope for improvements in coming quarters.

Source: Jayride Group

Jayride completes fixed costs savings activity

JAY has undertaken a cost savings activity which will decrease its annual fixed cost base by 15%, to save a total of $1.25 million annually from October 2023.

The annual fixed cost savings include:

- $400k/year saving in non-variable operating cost through optimisation of transport sourcing teams

- $775k/year saving in growth and business improvement costs through consolidation of middle management and leadership roles

- $90K/year saving in share-based payments to team members related to the above.

Jay has also recently reduced its customer service team by 20 roles following completion of the European summer and enhancements to workflows.

The company is forecasting its contribution profit margin on passenger trips booked to improve.

“To enable Jayride’s next phase of growth and drive better customer outcomes we have reduced our company’s fixed cost base,” Bishop says.

“These changes are in line with our strategy to grow the company on a leaner cost base, and in line with previous disclosures.

Bishop says previously JAY committed to roll off some business improvement costs which had been temporarily elevated following its November 2022 placement.

“This cost savings activity is now completed and will improve the company’s operating profitability and cashflows as we grow to reach more travellers and achieve cashflow positive for FY24,” he says.

Placement and entitlement offer

Jay has completed a placement to new institutional investors to raise $400k and has launched a non-renounceable entitlement offer to raise up to $2.2 million for a total of $2.6 million in funding.

At launch the combined proceeds from the placement, secured commitments and underwritings are $1.5 million of the maximum $2.6 million.

The entitlement offer is due to close at 5pm (AEDT) on October 23.

This article was developed in collaboration with Jayride Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.