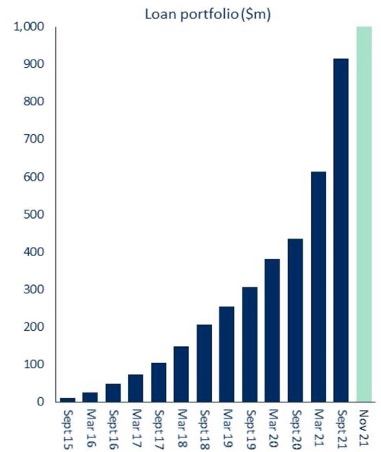

Fintech Plenti pulls further away from competition as it racks up $1bn loan book

Pic: Getty Getty

Plenti’s record half has paved the way for its maiden profit and an ambitious target of a $5bn loan book.

The non-bank lending sector has been a major beneficiary of the Open Banking initiative, and over the last few years, the burgeoning sector has been taking market share away from traditional lenders.

According to data, there are now more than 600 non-bank lenders in Australia, which make up 7% of all debt financing in the country.

ASX-listed fintech lender Plenti Group (ASX:PLT) is head of the pack, after delivering another record half that saw its loan book ballooning to $1bn.

Speaking directly with Stockhead, Plenti CEO Daniel Foggo said that being a fintech lending pioneer, Plenti was the first listed fintech to achieve a $1bn loan portfolio.

“Reaching the $1bn loan book has put us some way ahead of our competition,“ Foggo told Stockhead.

“And I think there’s a virtuous circle effect of being the largest in your space, as we’re able to pull further away by investing in new technology to improve the customer experiences we deliver.”

Plenti has been able to achieve this milestone in just seven years, having been founded in 2014 and listing in September 2020.

Its loan book has grown from strength to strength from what was virtually a standing start.

The massive growth has been underpinned largely by its automotive loan segment, which has increased in double digits every year.

“The automotive market is a vast market and Plenti still only has a 2% penetration despite the growth we’ve achieved in the past year,” Foggo said.

The segment is huge, and in Australia it’s a $35-$40bn annual market, which gives Plenti a long runway for further growth.

And that doesn’t include the electric vehicle (EV) market, which is expected to explode in the coming years after a recent push from the government.

Plenti is jumping on the EV opportunity early, launching a suite of loan products and tools for EV buying customers.

The company said its EV loan product will offer a 50-basis point discount on its already highly competitive combustion engine lending rates.

Customers will also have the ability to borrow additional amounts to fund EV-related infrastructure such as chargers, downloadable vehicle upgrades and other accessories.

“We’re working to bring on a number of different manufacturer partners as EVs are launched in this market, which will help us grow our auto originations quite significantly over the next 12 months.”

Maiden profit and $5bn loan book target

After another record half that saw loan originations jump by 183% and reach $915m, Foggo has now set an ambitious target of reaching a $5 billion loan portfolio by calendar 2025.

“If we just keep funding what we fund today, our loan book will grow to $2bn, but we’ve got great confidence in our ability to grow more than that across all three of our lending verticals,” Foggo said.

Plenti’s three verticals encompass auto lending, personal loans, and renewable energy (solar and battery systems) where a buy-now-pay-later finance option is available.

The company has also projected to deliver its maiden bottom line Cash NPAT profitability in the second half, estimating it at over $1m.

This will be achieved on the back of its cost-to-income ratio which is now below 50%, on track to meet the medium target less than 35%.

In August, Plenti demonstrated how its top-line growth is converting into strong margin growth with a marquee asset-backed securitisation (ABS) deal.

The company issued $306.3m of notes backed by loans in its automotive lending portfolio, which was given a AAA rating by Moody’s.

Operational costs are also showing a downward trend.

“We’ve provided an investor presentation chart that shows the originations we’ve achieved for every period per employee.”

“And the really pleasing thing here is, we had about seven employees per million dollars worth of funding a couple of years ago, and that has substantially reduced to well below two now,” Foggo said.

He says that having the visibility of profitability is important for investors to see, proving that the business model works.

“We look to continue to grow and scale, and derive more and more attractive economics as we drive efficiencies in our business.”

This article was developed in collaboration with Plenti Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.