Fatfish investee Fatberry delivers yet another record quarter, continues exponential growth run

Fatberry continues to be one of the best investments for tech venture Fatfish. Pic: Getty Images

Malaysia-based insurtech company Fatberry continues its record run – delivering its best ever month, quarter and half-year results for majority owner, Fatfish.

Insurtech company Fatberry continues to be one of the best investments for tech venture Fatfish (ASX:FFG), having just delivered another exponential record growth in sales.

The Malaysia-based company reported a record 36.7% monthly increase on gross sales of insurance premiums to RM 1,771,454 (or around A$569,599) in June.

This has resulted in the best half ever for Fatberry, which saw total record sales of insurance premiums worth RM 6,149,686 (or around A$1,977,391) for the period covering January to June 2021.

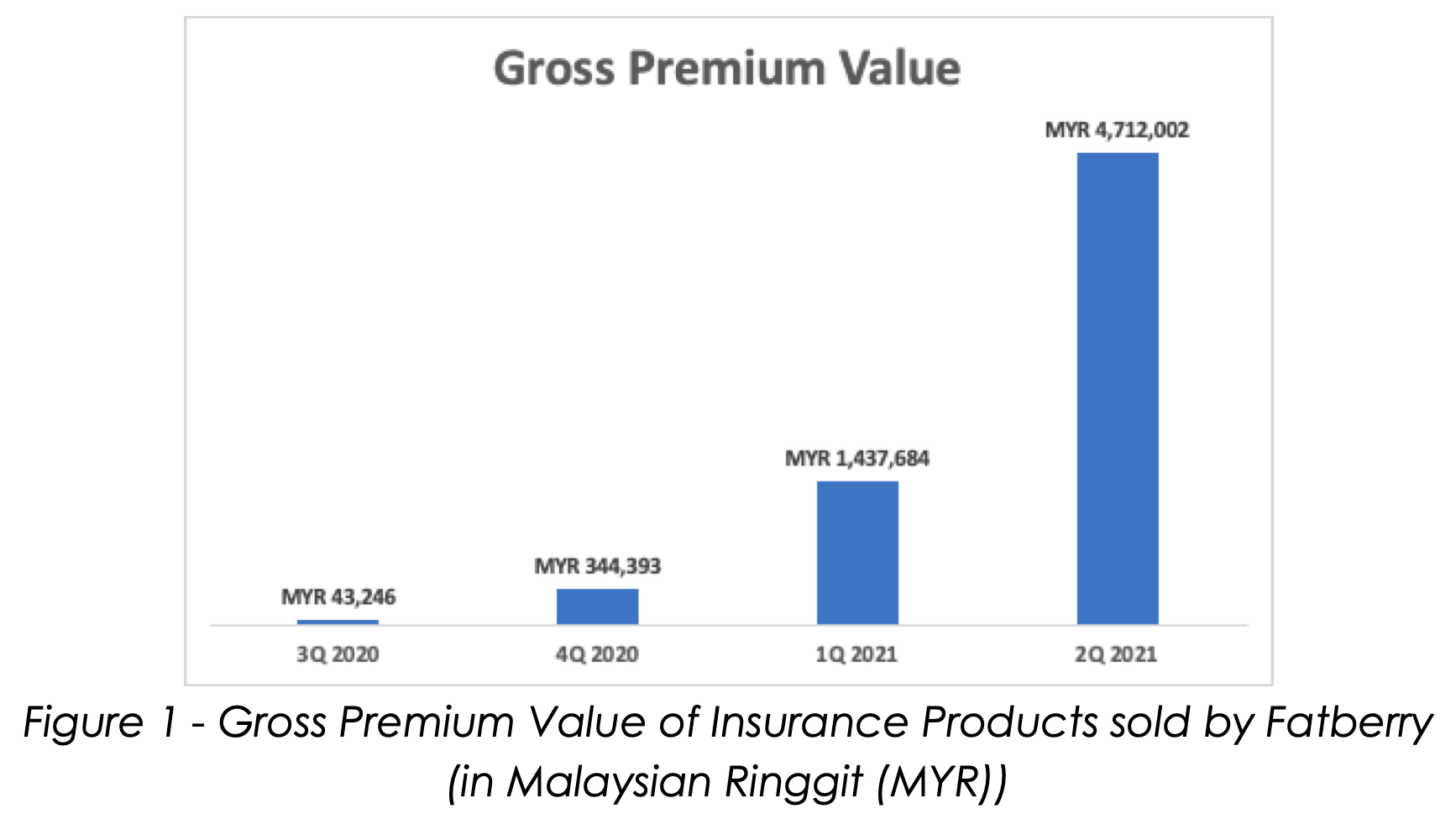

The strong sales figures have also set new quarterly sales records, where its quarter-on-quarter growth over the last year is now at a very impressive average growth rate of 478% per quarter.

Today’s record results followed strong results in May, where Fatberry had a reported record revenue of $409k, almost tripling the amount of the previous record in January.

“Fatberry is riding on a very strong growth momentum,” commented Fatberry CEO John Tan.

“We are breaking our own records every quarter, and growth is seen continuously in all operational measurements, from visitor counts on our website to overall sales performance.”

Opportunities in Southeast Asia

With its acquisition of Fatberry, FFG’s strategic rationale is to try to capitalise on the increasing digitisation of the southeast Asian economy, amid rapidly changing patterns in consumer behaviour.

Insurance is one of the industries at the forefront of that shift, which leaves Fatberry’s insurtech platform well-placed to drive growth as a leading comparator site for digital insurance plans.

In Malaysia alone, the online market for insurance grew to be worth $2.7bn in 2020, FFG said, citing industry research from the Motor Intelligence group.

Fatberry currently offers motor insurance, motorbike insurance, personal accident insurance and travel insurance products.

The platform also plans to offer further insurance products in new areas, and expects to be launching a new product category before the end of September.

In June, the company had raised $800,000 in new Series-A funding to finance its next stage of growth.

FFG participated in that funding round, as did its venture partner, the Swedish-based tech company Abelco. Both FFG and Abelco collectively own an aggregate 61% stake in Fatberry.

FFG has also said that synergies exist between Fatberry and its other investment, Smartfunding – a licensed Singapore-based financial services business that’s focused on building out a BNPL platform serving key Southeast Asian markets.

FFG’s focus meanwhile is on the emerging global technology trend, with investments mainly in the Southeast Asia region.

CEO Kin Wai Lau told Stockhead in March that recent momentum is the result of a multi-year strategy to build out a regional tech investment group.

“We saw opportunities in Southeast Asia because over the last 5-10 years, everyone became more connected – through both their home line and via smartphones,” he said.

This article was developed in collaboration with Fatfish, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.