Everyone will be able to afford an electric car in 3 years

Pic: gorodenkoff / iStock / Getty Images Plus via Getty Images

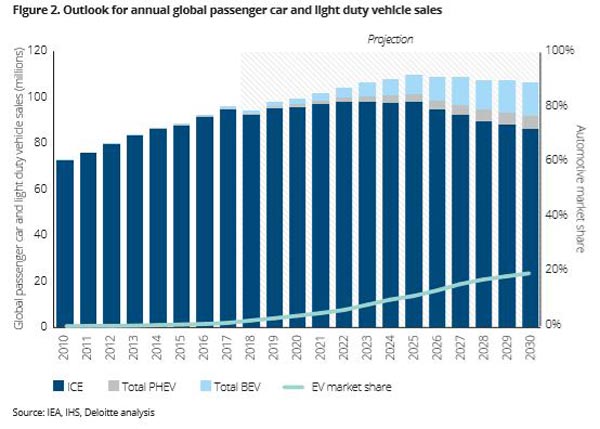

By 2022 electric vehicles (EVs) will cost the same as a regular car, and demand will continue to outstrip supply until 2030, says one of the big four accounting firms.

Deloitte says while the upfront cost of EVs still remains the biggest barrier for consumers, as technology improves this and other consumer concerns will gradually ease over time.

The firm predicts that the cost of “battery electric vehicles” (BEVs) will match petrol and diesel in the UK by 2021 and globally by 2022.

This is expected to see the number of EVs on the roads spike by a huge 950 per cent to 21 million by 2030, with BEVs accounting for 70 per cent of total EV sales.

After years of being seen as a “fringe technology”, EVs are finally nearing a tipping point, Deloitte says.

Michael Woodward, UK automotive partner at Deloitte, says 2018 was a record year, with global sales surpassing 2 million EVs for the first time — double the amount sold in 2017.

“In the UK, the cost of petrol and diesel vehicle ownership will converge with electric over the next five years,” he said.

“Supported by existing government subsidies and technology advances, this tipping point could be reached as early as 2021.

“From this point, cost will no longer be a barrier to purchase, and owning an EV will become a realistic, viable option for new buyers.”

However, with established carmakers rapidly ramping up supply and the emergence of new entrants, supply and demand are set to converge by 2030.

“Whilst there is a distinct trend developing in the EV market, the story is not a clear cut one,” Mr Woodward said.

“As manufacturers increase their capacity, our projections suggest that supply will vastly outweigh consumer demand by approximately 14 million units over the next decade.

“This gearing up of EV production is driving a wide ‘expectation gap’ and manufacturers, both incumbent and new entrants alike, will need to adapt towards this new competitive landscape.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

More EVs means more lithium (and other battery metals)

Roskill battery analyst Jose Lazuen told Stockhead late last year that Volkswagen’s first mass market competitor to the Tesla Model 3 is expected to start rolling-off the assembly line by 2022.

“This is exactly the year when we assume a real inflection point in EV demand — when EVs become truly affordable,” Mr Lazuen says.

The 150GwH of battery capacity that VW says it will need by 2025 represents 11 per cent of global automotive lithium-ion demand by 2025.

German high-performance sports car maker Porsche has revealed it plans to double production of a car it hasn’t even released yet as it vies for market share.

Porsche is set on producing 40,000 of its electric Taycan cars instead of the initial 20,000 it was targeting, CNBC reported.

These EVs reportedly start from around $80,000 and are due for release in the US by the end of this year.

Other carmakers like Jaguar, Audi and Ford have also either released EV models or announced plans to start producing them.

Japanese heavyweights Toyota and Panasonic, meanwhile, are partnering to make batteries for EVs, starting before the end of 2020.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.