Envirosuite calls for global ESG standard after Tesla booted from key index

Envirosuite has called for a global ESG standard to avoid confusion and assist investors to understand what is involved after Tesla was axed from a leading ESG index. Image: Getty

Envirosuite has called for a global ESG standard to avoid confusion and assist investors to understand what is involved after Tesla was axed from a leading ESG index.

Environmental technology company Envirosuite (ASX:EVS) believes Tesla founder and CEO Elon Musk makes a fair point when he questions ESG ratings, calling for a globally recognised standard.

The global electrical vehicle manufacturer found itself booted out of the widely followed S&P 500 ESG Index, which focuses on companies prioritising environmental, social and governance issues (ESG).

The news came after fatal car crashes linked to Tesla’s autopilot technology, claims of racism at its Fremont factory and a lack of published details related to its low carbon strategy or business conduct codes

Dorn said its other issues and lack of disclosures relative to industry peers should raise concerns for investors looking to judge the company across ESG criteria.

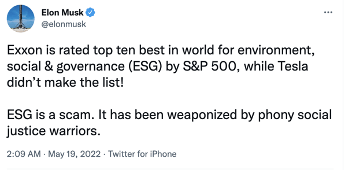

Of course, Tesla founder and CEO Elon Musk was quick to tweet on the axing, which saw further pressure on its recent tech selloff-weary share price.

Need for global standard for ESG

Envirosuite prides itself on its ability to help companies to deliver against ESG credentials as an ASX tech company. It is one of few companies with technology that can hold companies accountable to ESG practices.

“Elon makes a fair point when he questions ESG ratings,” CEO and managing director Jason Cooper said.

“Firstly, ESG isn’t clearly defined, and the second thing is that there isn’t a globally recognised standard so depending on the framework used, the rating could be misleading.

“In Tesla’s case, yes they are a company focused on accelerating the world’s transition to sustainable energy, however, this doesn’t discount the potentially negative impact they have in other areas.”

Cooper said a critical aspect about ESG is actual measurement and it needs to be seen as more than a trend.

“For companies, it’s important to know your baseline to make improvements that enable positive outcomes for more than just industry.

“Prosperity can’t come at the cost of people and planet.”

Cooper said the recent federal election result demonstrated people are putting more weight behind those who are focused on enabling positive environmental outcomes in balance with needs of the economy.

“As we’ve witnessed in the sectors that we work with such as Aviation and Mining, there is strategic value for organisations to consider environmental and social factors in order to grow,” he said.

“It’s becoming increasingly difficult for organisations to expand their operations without first considering their environmental or sustainable impact and engaging with their communities and stakeholders.”

He said generally, ESG doesn’t discriminate based on the sector or goods or services a company provides.

“It’s more leaning towards – are you measuring your impact, are you monitoring how you’re performing and are you actively making changes to reduce impact or improve outcomes for the greater good and not just the company?”

This article was developed in collaboration with a Envirosuite, advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Disclosure: The author held shares in Tesla (NASDAQ:TSLA) at the time of writing this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.