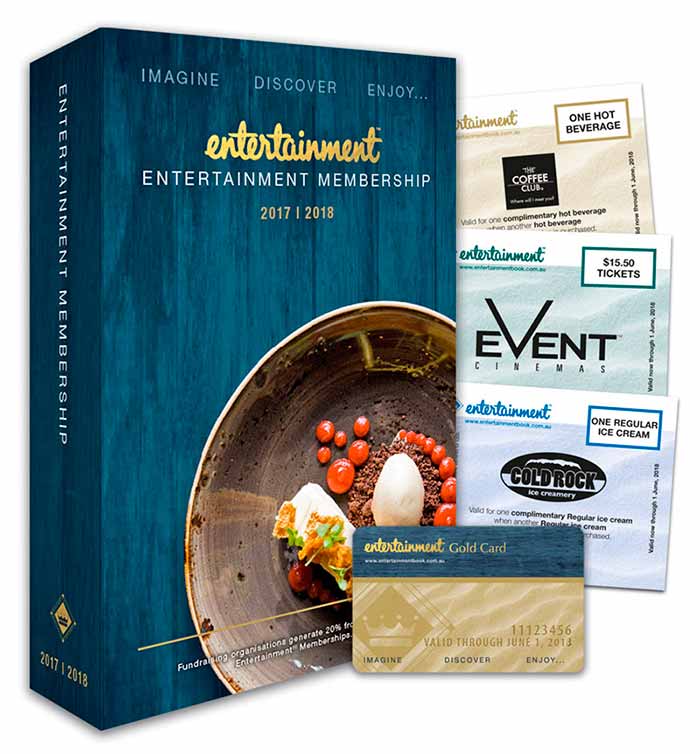

Entertainment Book is the ‘gift that keeps on giving’ for BPS Technology

Pic: Yuichiro Chino / Moment via Getty Images

As far as BPS Technology boss Trevor Dietz is concerned, Entertainment Book ‘is the gift that keeps on giving’.

BPS — best known for operating the Bartercard exchange system — last year paid $25 million for the voucher service.

Entertainment Book is a consumer loyalty program with about 1.5 million users, which raises funds for various community groups by offering discounted services such as meals at local restaurants, access to leisure facilities and the like.

Funded via an issue of shares, BPS’s subsequent share price weakness has prompted some large investors to seek a board spill.

When disclosing the group’s latest earnings on Tuesday, BPS’s chief executive Dietz, could barely conceal his enthusiasm for the contribution from Entertainment Book.

“Entertainment is really the gift that keeps on giving,” he said. “It is a wonderful business.

“The untapped potential that lies within it will continue to provide massive growth opportunity and increased earnings capacity for many, many years to come.”

Just how good a business is made clear by the fact that prior to acquisition, Entertainment Book was generating a gross profit, as measured by earnings before interest, tax, depreciation and amortization (EBITDA) of $4.5 million which, in the first year of ownership by BPS, was raised to $6 million.

And the contribution can only grow as the push continues to shift the user base of this arm of the business across to a mobile app. Already, close to half the membership of the various programs operated by Entertainment Book have moved across to the digital platform, which is helping to drive a decline in costs.

The cross-over to a majority online take-up is likely in the year ahead.

Just in the latest year, the digital shift shaved $350,000 off the annual printing bill.

With the Entertainment Book acquisition, and along with other moves to broaden the group’s activities, BPS Technology now prefers to describe itself as a fintech platforms business, as it has expanded well beyond its Bartercard roots.

“We are pivoting entire platforms,” Dietz says of the work that is now underway which is “enabling platforms to generate new streams of income”.

“The [printed Entertainment] Book will always remain … but without question we will move to digital application,” Dietz said.

“It allows instantaneous updating” of offers and information, which will be increasingly important in driving further revenue growth and earnings of this arm of the group’s business.

“It is no longer enough just to get a discount,” Dietz says of the Entertainment Book division, since a mobile app will enable users to ”book, pay, rate the experience and book” the next experience.

The entire BPS business is heavily focused on digitalisation, with this drive to continue in fiscal ’18.

And the link forged with Alipay, the payments arm of China’s e-commerce giant, this will also help to open the door for merchants to gain access to the Chinese consumer walking past their door.

But despite the optimism of senior management at BPS about the near term growth prospects, it is in the process of fending off a push for a board spill.

Investors who paid 94c to take up shares in the placement last August to fund the Entertainment Book buy, are seeking retribution, since they are underwater with shares in BPS trading at around 76c Tuesday, following the release of the latest earnings.

Describing BPS as “hard driven, well managed”, Dietz did confirm that work is underway to bolster the board of directors via the appointment of additional independent non-executive directors.

But he was circumspect in his comments in the light of the fact that the disgruntled investors have yet to outline their case, with BPS, for its part, yet to schedule a shareholder meeting to consider board changes.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.