Energy Action launches ‘strategic review’; puts itself up for sale

Pic: gorodenkoff / iStock / Getty Images Plus via Getty Images

Energy manager Energy Action is putting itself up for sale, saying current energy market conditions make this the right time to look for a buyer.

The company (ASX:EAX) did not go into specifically what market conditions those would be.

Demand for energy management services — helping businesses manage utility bills and getting better deals — is rising, but the market is still in its infancy.

Few companies are making a profit, and only one of six listed companies in the sector has breached the $100 million market cap threshold — Buddy earlier in 2018, before its share price fell back from from 40c to under 15c.

Energy Action has engaged PricewaterhouseCoopers to look for a buyer, or in corporate speak: “conduct a review of the various strategic options available to the Company to maximise value for its shareholders”.

The company has reduced debt by $3 million in fiscal 2018. Loans stood at $7.8 million as at the end of December.

Energy Action hasn’t yet released its full-year results, but its half-year results showed a profit of $1 million and cash of $810,000.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Stockhead is seeking comment from Energy Action.

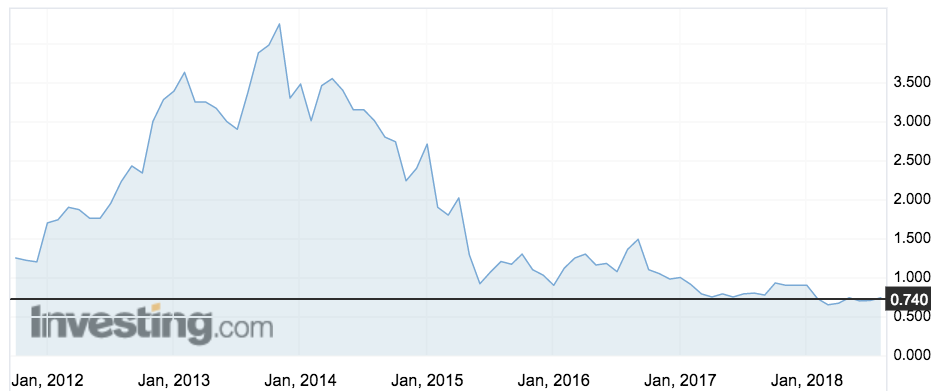

The news left Energy Action’s share price — which has underperformed since February inspite of a $1.2 million solar panel contract win in May — unmoved at 74c.

Energy Action has been listed since 2011 but peaked in 2013 and has never regained the lost ground.

Its shares hit an all-time low in May of 61c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.