Deloitte says APAC is the cornerstone of the global semiconductor industry – so where does Australia fit in?

Pic: nespix / iStock / Getty Images Plus via Getty Images

Last week the NSW Government opened expressions of interest to host the Semiconductor Sector Services Bureau (S3B) – which is aimed at enhancing the capability, workforce, market connectedness and competitiveness of NSW and Australia’s semiconductor sector.

Basically, the objective is to address market frictions and failures that curtail our participation in global semiconductor markets and get a foot in the door.

The S3B will be mostly funded by the NSW Government through the Emerging Industry Infrastructure Fund.

The NSW Government today launched an EOI for a Semiconductor Sector Service Bureau. It will turbocharge our capacity to compete in global semiconductor markets. Find out more here: https://t.co/AE9iYnojmr @NSWCSE pic.twitter.com/Oih2edcmqd

— Gabrielle Upton MP (@gabrielleupton) October 19, 2021

Sydney probably won’t quite rival Silicon Valley but it’s a smart move in the right direction.

Earlier this month Deloitte released its annual semiconductor report Anchor of global semiconductor – Asia Pacific Takes Off, which stressed that the Asia Pacific region will accelerate the pace of R&D and innovation around semiconductors in order to compete and excel in such a highly competitive environment.

And this is expected to transform the Asia Pacific into the cornerstone of the world’s semiconductor industry.

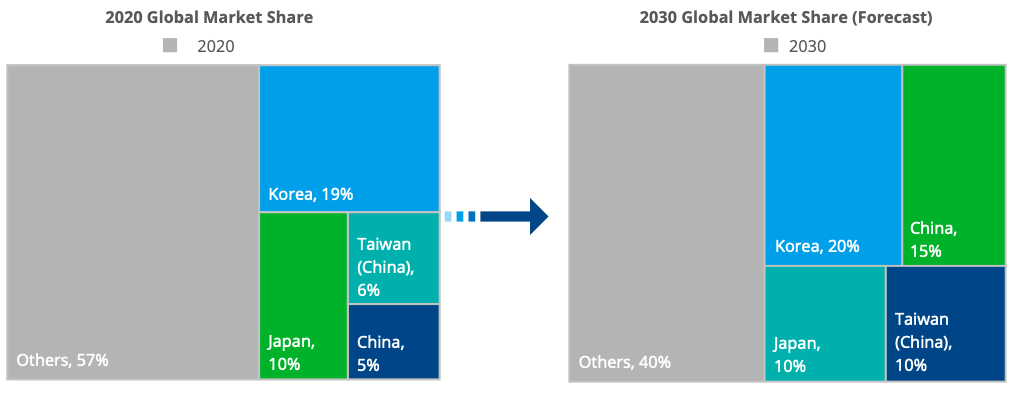

APAC could represent 62% of the market by 2030

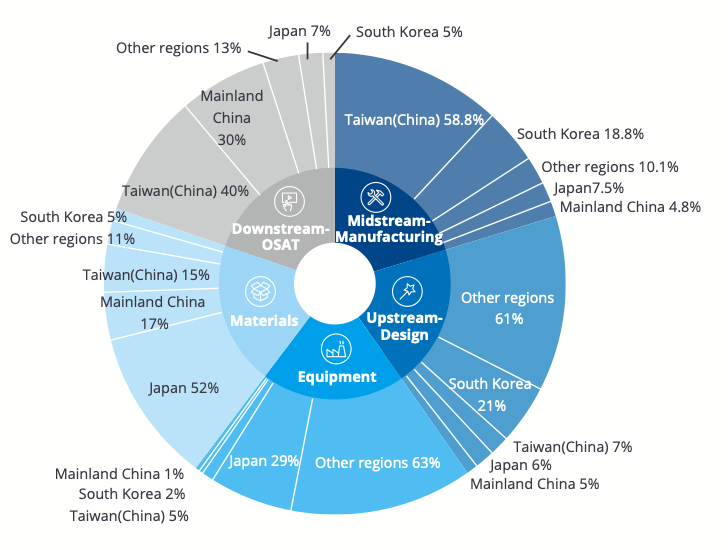

The big four semiconductor regions – South Korea, Japan, Mainland China and Taiwan – already play a leading role in the industry at the upstream, midstream and downstream level.

“A series of black swan events have made the Asia Pacific semiconductor market strategically critical,” Deloitte said.

“We expect that the semiconductor industry in the Asia Pacific will grow its global share to 62% by 2030, and the global market of semiconductors will exceed US$1 trillion.”

Not to mention that emerging AI technologies are expected to create new market opportunities and improve the design and manufacturing – which Deloitte says could potentially contribute over US$1 billion to the annual profits of the global semiconductor companies over the next 10 years.

APAC Governments investing in the billions

Japanese companies account for over half of the global market share in semiconductor materials.

The total volume of chips made in Taiwan is over 50% of the global total – and Taiwan had three integrated circuit (IC) design companies listed in top 10 for revenue in 2020.

South Korea excels in wafer manufacturing, and Mainland China and Taiwan are regarded as the top-tier in the global outsourced semiconductor assembly and test (OSAT) industry.

Deloitte said within the next decade, the South Korean government will invest KRW510 trillion (US$450 billion) with local companies to establish the world’s largest semiconductor industry supply chain.

Japan plans to attract more advanced tech investment from overseas and has set up a fund of JPY200 billion and plans to substantially expand support polices.

China will invest US$30 billion into the semiconductor industry over the next few years and companies in Taiwan plan to invest more than US$107 billion on semiconductors by 2025.

So where could Australia fit in?

Right now, we are more of a bystander.

The Quad alliance with Australia, India, the US and Japan announced last month also launched a semiconductor supply chain initiative, with the aim to map capacity, identify vulnerabilities and bolster supply chain security for semiconductors and their vital components.

This along with NSW’s Semiconductor Sector Services Bureau are steps in the right direction towards establishing Australia as a player in the Asia Pacific and securing a place in the global semiconductor supply chain.

Here are the Aussie semiconductor stocks with news out this week:

Brainchip Holdings (ASX:BRN)

AI player Brainchip nabbed a US patent for its artificial neural network system for improved machine learning, feature pattern extraction and output labelling this week.

It’s just one of five patents the company has secured since 2008 in the field of neuromorphic artificial intelligence.

“This patent is intended to protect the unique ability of the Akida chip to learn in real time, rather than being trained with many samples,” CEO and co-founder Peter van der Made said.

“As the world’s first commercial producer of neuromorphic artificial intelligence chips (Akida1000), we must maintain our lead over our competitors by ensuring our unique and revolutionary technology is protected and secure.”

Archer Materials (ASX:AXE)

The company released its September quarterly this week, and since the quarter ended has finalised the sale of its mineral exploration business to iTech Minerals Ltd.

Archer is now a pure play semiconductor company and is hoping that changing its GICS code to ‘Semiconductors’ will allow it to be admitted to the S&P/ASX All Technology Index

“Our 12CQ quantum computer chip technology development is unique and with the recent grant of the US patent we have plans to expand overseas,” Executive chairman Greg English said.

Sensera (ASX:SE1)

The company’s quarterly was not as impressive, detailing the hit it took when customer NanoDX decided to go with an entirely different design to the company’s MicroElectroMechanical Systems (MEMS).

Quarterly revenue was US$505,000, down from US$633,000 last quarter.

Sensera said this was due to backlog that it could not fulfill for major customer Abiomed due to sensor sensitivity issues, which cut revenue potential in half.

The company expects to make up for some of the lost production over the balance of FY22 and expected it to be a growth quarter – with the aim to develop new business and reduce reliance on Abiomed.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.