Delisted ASX Animoca Brands is now at centre of the NFT boom – and here’s why it’s worth taking seriously

Pic: Yuichiro Chino / Moment via Getty Images

An Aussie company delisted from the ASX last year has been at the heart of the global craze for non-fungible tokens (NFT) – and says that NFTs are just going to get bigger and bigger.

Animoca Brands was kicked off the local bourse on 9 March 2020 in part because of its “involvement in cryptocurrency-related activities” – activities that are now proving wildly successful.

Animoca’s Sandbox token, used in its The Sandbox virtual world game, has a valuation of $US1.8 billion, while its Revv token for use in a motorsports game has a market cap of $US86 million.

Animoca Brands co-founder and chairman Yat Siu told Stockhead from Hong Kong recently that the company always knew NFTs were going to be huge and was an early investor in NBA Top Shot and Cryptokitties creator Dapper Labs as well as blockchain-based virtual reality world Decentraland and NFT trading sites the Worldwide Asset eXchange (WAX) and Opensea.

“Last year, we were among the top five blockchain game companies in the world, according to Blockchain Gamer, and I would say that at this point we are amongst the top three NFT players, not just because of the breadth of our portfolio, but also because of our involvement in various projects that we both launched and invested in,” Siu said.

“I mean, we’ve done probably over 35 deals now in the NFT space.”

NFTs are selling for millions

Unless you’ve been hiding under a rock the past few months, you’ll have heard of the explosion of interest in NFTs, with digital NFT art selling for $US69 million and basketball NFT-based video highlights changing hands for six figures.

Siu says he wasn’t surprised by their soaring popularity.

“High conviction always,” he said. “The reason why we have high conviction is because NFTs, to us, don’t just represent that it’s a non-fungible token, they represent property rights.

“It’s essentially the digital equivalent of owning your land title or deed in a digital world, if you will, and basically giving true digital ownership for the very first time for people online.”

The internet has until now represented abundance, with distributed knowledge freely available, Siu said. While that’s wonderful, it makes it difficult to prove ownership of assets. Anything that is to have value needs to be held by a middleman, such as PayPal or Citibank.

“So that means means you’re actually in their control, as it were, to some extent,” Siu said.

Serfs in a digital age

Gatekeepers such as music platforms end up abusing the trust of music creators, while users of giant platforms such as Facebook contribute free content to the site, making it more powerful, while receiving nothing in return.

“We’re basically the serfs in the digital world, and the overlords are the big game studios, and Facebook, and Amazon, and the consequence is that we’re human farms, farms of data, and we don’t get paid for it.

“I have this image of the Matrix, but instead of being farmed for energy, we’re farmed for our knowledge and our know-how, and info, but we really get nothing for it,” Siu said, pointing to how Facebook recently briefly cut off news content in Australia in a dispute over payments.

NFTs are an answer to a pressing problem, Siu says: How to protect your property rights in a digital world. They provide data sets that you own yourself, but are useable for other people.

The gaming NFTs that Animoca have created have sold for hundreds of thousands of dollars, and can be transferred freely between users. People can even take out loans against their digital cars and other NFTs.

“We really believe that is the beginning of content being the platform,” Siu says.

“Meaning that the content itself becomes the medium in which people want to use and adapt it because you own it, and therefore new services arise because of ownership,” Siu says.

It’s a hard to concept to understand at first, because people are so used to the idea that digital content is worthless, Siu says.

“It’s like we’ve been renting for all of our lives – and when someone comes over and says you can own it, you say, ‘What’s ownership? That’s so strange.’”

Animoca’s projects

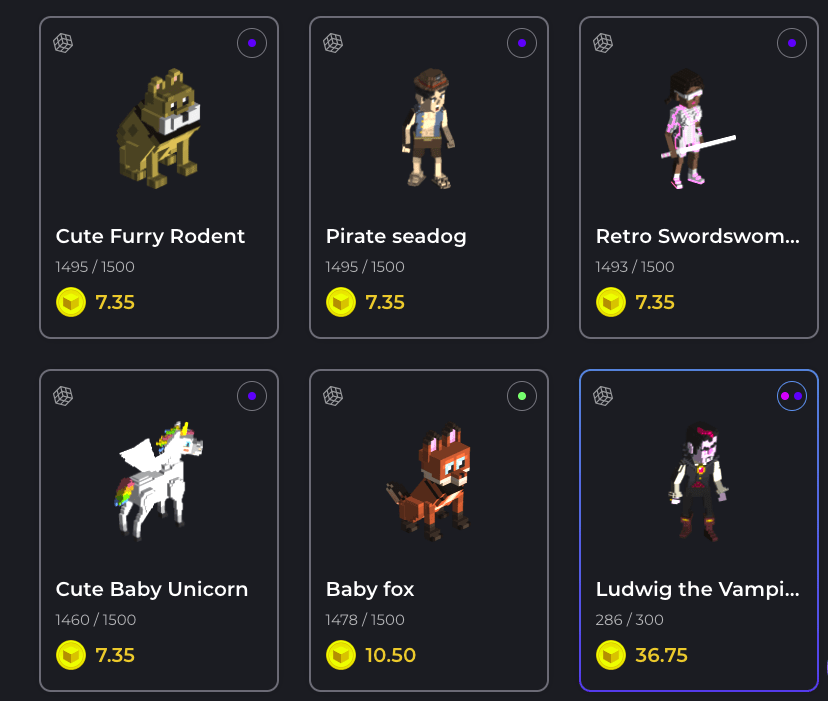

Yesterday Animoca’s Sandbox game released a beta version of its NFT marketplace, where users can buy various characters and entities for the game.

For example there was a cute baby unicorn selling for 7.35 Sand tokens, or about $7.86.

“Cute Baby Unicorn is adorable and full of joy, this creature brings joy to everyone it meets,” the description says.

There are 107 NFTs available from over 46 artists, and more will be added gradually, Animoca says. Eventually the marketplace will be open to everyone.

(If that doesn’t sound exciting to you – well, think about it this way: what if your 14-year-old could sell off their Minecraft creations for money?)

Playing #Minecraft is cool but getting paid while playing is way cooler, isn’t that right?! #TheSandbox brings you its Metaverse where you can play and earn $SAND at the same time!

Join us now!https://t.co/gYv2HMrDvm

— The Sandbox (@TheSandboxGame) August 20, 2020

Siu also points to a charity auction that Animoca’s F1 Delta Time game held early last year to raise money for Australian bushfire victims.

A virtual racing car, with marking inspired by Aboriginal Australian art, was auctioned off for 50.2 Ethereum (or about $8,000) a year ago.

The car was sold again two weeks ago for 1.2 million REVV tokens – or about $430,000. And because of the way the smart contract was set up, resales generate transaction fees – in this case, $31,800, which Animoca will donate to a bushfire charity.

A demonstration of the potential of #NFTs in March 2020 @F1DeltaTime auctioned this apex car for 50.22 eth (approx. A$7,900) for @cryptofalliance, a year later the transaction fee alone is A$31,800 in $REVV on the secondary sale which will be donated to a related #charity. https://t.co/6vM4P2gX7x

— Yat Siu (@ysiu) March 22, 2021

Just the beginning

Siu estimates that last year just 150,000 people worldwide owned NFTs; today maybe 600,000 or 700,000 people do.

But there are hundreds of millions of gamers around the world who would prefer play games where they own their digital swords and other assets, Siu says.

“Non fungible tokens, in our view, we’re still in the beginning,” he says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.