Change Financial finds strong demand for $11.4m capital raising to fund marquee acquisition

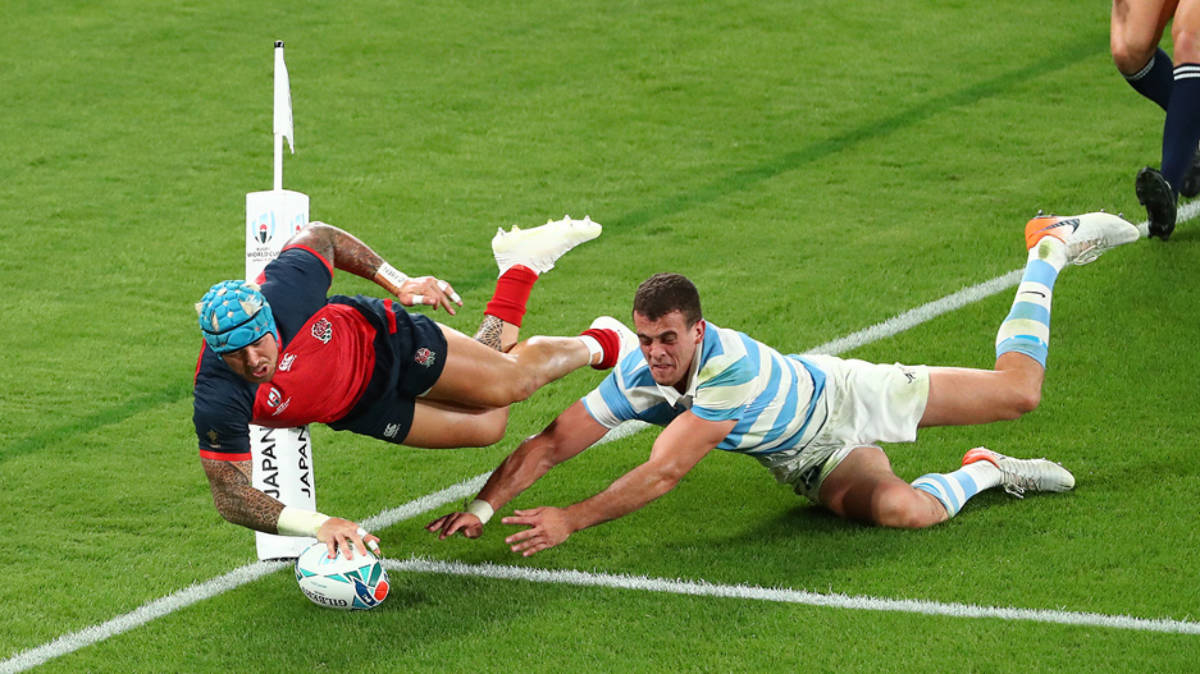

Game changing play - The $7.8m deal gives Change Financial (ASX:CCA) control of a mature payments business with annual revenues in excess of $US11m (~$15m). Image: GettyImages

Special Report: The company has executed a binding agreement to acquire the Australian and New Zealand assets of Wirecard for $7.8m.

Fintech company Change Financial (ASX:CCA) has moved quickly to complete a strategic acquisition, snapping up the regional assets of payments company Wirecard in a $7.8m deal.

The acquisition gives CCA control of a mature, standalone payments business with annual revenues of more than $US11m (~$15m), representing an enterprise value (EV)/Revenue multiple of just 0.5x.

The acquiree company generates recurring income from three core products; card issuance, compliance and mobile payments.

The regional divisions serve a blue-chip client base which includes global banks and the big 4 banks in Australia, and derives almost two thirds ($US6.7m) of its annual revenues from recurring income streams.

Game-changer

Speaking with Stockhead, Change Financial chairman Ben Harrison said that while the financial metrics are compelling, the key value-add comes from the opportunity to integrate its technology offering into Changes’ leading payments and card issuing platform.

“Their code base and our code base are built on the same technology, and we can leverage off the products and feature sets they’ve already built out,” he said.

“In that sense it really is an opportunity to supercharge our growth — not only into US (CCA’s core market) but also globally.”

“What I mean by that is they have a feature set in their technology platform that we had in our roadmap to build out over a two-to-three-year journey. But this acquisition accelerates that buildout almost immediately.”

“So although we’re getting access to revenues on a cheap acquisition multiple, the real game changer is the ability to accelerate our growth path to become a global banking-as-a-service (BaaS) platform.”

Tech reach

In the domestic market, Wirecard’s customers also include the major Australian grocery chains, fintechs and other leading digital brands. Globally, its reach spans more than 120 companies across 35 countries.

The platform also has partnerships with major payments providers such as Mastercard, Visa and American Express.

Strategically, the deal provides Change Financial with an opportunity to “increase its addressable market in US by 10x with the addition of debt and credit card processing”, the company said.

Operationally, Change will dedicate resources to onboarding at least 10 US customers onto the platform over the next 12 months.

Value for money

To finance the deal, Change completed a heavily oversubscribed share placement for $6.4m, via the issue of 67.4m new shares at 9.5c.

Boutique alternative asset management firm, Altor Capital, where Harrison is also chief investment officer, backed the raise with a cornerstone investment.

The Sydney-based division of global investment firm Canaccord Genuity was also brought on as joint lead manager of the placement.

Change also announced a separate, fully-underwritten $4.9m rights issue to existing shareholders, who will be eligible to acquire two shares for every 11 they currently own.

The sale process was run by administrators McGrath Nicol, after Wirecard’s parent company was placed into administration.

The placement was “inundated with interest, with plenty of positive feedback and a book that was many times oversubscribed — all the usual terms of a successful capital raise”, Harrison said.

Along with its offer price, Harrison said an important element of Change’s bid was that it’s a fintech company itself, with a head office in the Asia-Pacific.

“I believe the administrator was looking to find a buyer that was growth orientated, nimble and innovative and could align with the Wirecard staff.”

With the acquisition of an established company at a multiple well below market rates, Change aims to position itself as an important and global player in the fintech landscape, amid the broader tailwinds that are developing behind the sector.

This article was developed in collaboration with Change Financial, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.