Change Financial caps off a strong quarter by hitting milestones

The recent onboarding of a partner bank in the US is one of several pipelines Change Financial will tap into in FY22, as it aims to rapidly grow recurring revenues. Image: Getty

The recent onboarding of a partner bank in the US is one of several pipelines Change Financial will tap into in FY22, as it aims to rapidly grow recurring revenues.

Australian global fintech company, Change Financial (ASX:CCA), has capped off a strong quarter by hitting critical milestones and delivering solid cash receipts and sales revenue.

For the September quarter (Q1 FY22), receipts from customers totalled US$2.8 million (around A$3.7 million), with sales revenue coming it at US$1.9 million (around A$2.5 million).

It was a very productive quarter which saw the company producing early results with its key US partner Axiom Bank, with the onboarding of an established card program as a new client.

“We are pleased to have started the year by delivering key strategic milestones on our roadmap, building on the strong foundations we laid in FY21,” said Change CEO Alastair Wilkie.

“We have grown our global footprint with the signings of Axiom bank, and our first Payments as a Service client in the US.”

Partnership with Axiom

During the quarter, Change announced a three-year partnership with Axiom, one of the fastest growing community banks in the US.

Headquartered in Florida, Axiom Bank provides a wide range of financial products and services that include retail banking, money markets, as well as commercial loans and treasury management services.

As part of the three-year deal, Change aims to onboard potential clients with Axiom as the issuing bank, leveraging Change’s Mastercard registered processor and payments platform, Vertexon.

The deal was a key step towards expanding Change’s reach in the US, and will be a key relationship when onboarding fintechs in the region in the future.

Unlocking growth in the US is a key focus of Change’s FY22 strategy, with the country being a strategic market in driving growth for its recurring revenue base.

“The partnership with Axiom is a key relationship to unlock Change’s growth in the region and will accelerate the adoption of our products by US fintechs,” said Wilkie.

Earlier this month, Change produced early results by winning a contract with a US-based fintech, which will become the first card program to be launched under the Axiom Bank partnership.

Change will begin onboarding the client this quarter (Q2 FY22), with the program launch anticipated in Q3 FY22.

The deal is expected to generate a minimum of US$700,000 (A$1 million) in revenue for Change over an initial three-year term.

Strong sales pipeline

Change has now also completed the roll out of its Phase 2 Customer Ready Platform, allowing the company to offer a next generation integrated payment processing and card management solutions platform.

It’s also well advanced on the development of its PaySim API, a platform that provides banks and fintechs with the ability to integrate and automate their stress and regression testing.

Another product channel with the capacity for revenue generation is through the implementation of a CRM system to track a customer’s business development activities, thus increasing their lead conversion and customer retention rates.

CCA is also set to further accelerate its recurring revenue base over the next quarters after launching its payments platform, Vertexon, earlier this week.

Vertexon is Change’s new Payments as a Service (PaaS) offering, which provides quick-to-market card and payments solutions to banks and fintechs around the world.

The software integrates seamlessly with the clients’ core systems, and is able to deliver both physical and digital card solutions, as well other features such as Buy Now Pay Later (BNPL).

The Vertexon SaaS platform has been launched on Amazon Web Services (AWS) in Sydney, to initially service banks and fintechs across the Oceania region.

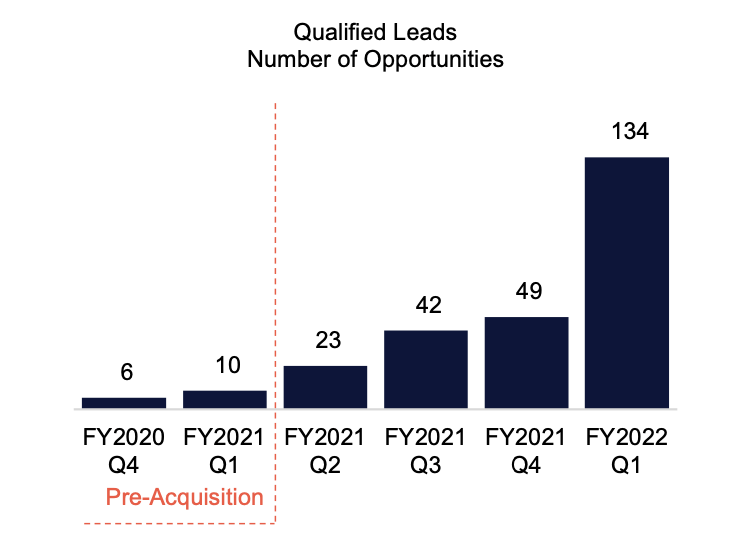

These developments have a resulted in a healthy pipeline for CAA , as outlined below:

Looking ahead

Over the last six months, CCA has hit milestones which resulted in a strong foundation for the company’s growth trajectory ahead.

During the June quarter for example, Change focused on hiring and building a strong sales team, and during the September quarter the company concentrated its efforts on increasing opportunities in the pipeline.

The sales team has already delivered a significant increase in Q1 FY22 compared to Q4 FY21, with opportunities across both the Vertexon and PaySim products.

Leading into Q2 FY22, Change anticipates an increase in new client numbers as opportunities are converted to sales.

To accelerate this growth opportunity, the company appointed a leading global payments executive, Eddie Grobler, to its Board this week.

Grobler is a highly experienced cards and payments specialist and former Mastercard executive of 20 years, who will play a big role in CAA’s global push.

These pipelines and management changes have put the company in a strong position in FY22, as it aims to rapidly increase its annual recurring revenue (ARR) base.

The company’s ARR increased to US$4.6 million (A$6.1 million), and Change expectes this to grow as the pipeline converts into paying contracts.

Change Financial owns a technology that provides the critical infrastructure that connects existing licensed banks with modern API-driven brands such as other fintechs

Its platform currently manages and processes more than 16 million virtual, credit, debit and prepaid cards worldwide, serving 136 clients in 36 countries.

This article was developed in collaboration with Change Financial, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.