Cashed up Bailador is looking for opportunities in recovering tech sector

BTI has more than $100 million to spend on new investments. Pic via Getty Images.

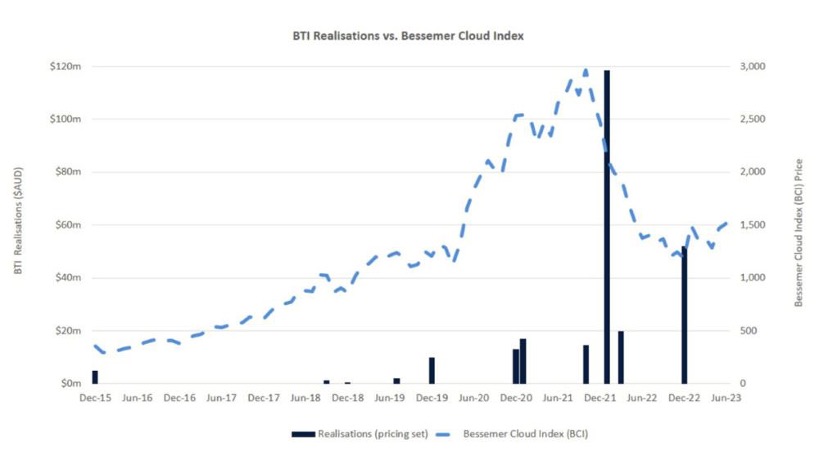

Having made hay while the sun shines with more than $200 million in cash from realisations, Bailador Technology Investments is on the lookout for new high growth opportunities.

Bailador Technology Investments (ASX:BTI) believes the time is right to start deploying its vast capital for new opportunities in a rebounding tech sector to deliver more value for shareholders.

BTI co-founder and managing partner Paul Wilson says the tech sector has had its challenges over the past year with valuations coming off and some reasonably high-profile failures of companies.

Wilson credits the tech-focused growth capital fund’s strong performance during this time to a disciplined approach to new investments.

“We specialise in information technology and have done for a number of years and see hundreds of opportunities a year,” he says.

“It was not difficult for us to see that valuations had gotten high and that felt unsustainable. So as we saw that developing we were careful about retaining our discipline on new investments.

“On the other side of the coin we capitalised by realising a number of our positions and we’ve generated over $200 million in cash over the last couple of years. “

He says BTI has been waiting for the right time to deploy capital and those opportunities are now starting to emerge.

“There are some quality businesses with more realistic valuations, and I think that has left us in a great position with over $100 million cash in the bank and a strong pipeline of deals,” he says.

BTI Realisation vs. Bessemer Cloud Index. Pic: Supplied (BTI)

What BTI is looking for in a tech company

Wilson says tech companies with a great product were able to survive during the tech bear market to come out the other side.

He says key metrics BTI looks for include if the business can demonstrate it can win and retain customers and whether they recommend the product to their peers.

He says a second element is whether the tech product or service is critical to the customer and “not just a nice to have” which can be cut during tough times.

“Bailador invests in businesses at the expansion stage rather than early-stage ventures so we like to see that the business is producing repeatable, strong unit economics,” he says.

Wilson says BTI looks for businesses that show they can acquire customers, onboard, and keep them for good margins at a reasonable cost.

He says sensible cost structures are vital and over the past few years there have been examples of companies excited about opportunities for growth.

“Not everything will go right so you need a buffer to make mistakes or for things to take longer,” he says.

He says raising a level of capital appropriate for the business and its stage of development is also important.

“Again, not assuming perfect execution, but allowing for a buffer for things to go wrong. That way if there is a bit of a downturn or difficult environment you’re not panicking.”

Real businesses with solid unit economics

Wilson says BTI’s portfolio includes businesses with solid unit economics and strong potential to expand the customer base and revenue streams.

“It’s not our approach to invest in something that might be a good idea,” he says.

Wilson says Digital healthcare platform InstantScripts is a great example of a company BTI invested in, which has proven exceptionally popular with consumers and been a solid investment.

He says the digital prescription platform and telehealth consultation business provided $52 million in cash proceeds to Bailador at a 64% per annum return.

“It’s a service that really resonated, helped people, and the health system and it had a solid management team that didn’t try to just go hell for leather with growth,” Wilson says.

He says it’s one of the reasons why Wesfarmers (ASX:WES) in June announced it was buying InstantScripts in a $135 million deal.

Wilson says another example is Rezdy, which provides online booking software for tour and activity operators.

“Once again it’s starting with a great product that really helps tour and activity operators find customers and generate revenue,” he says.

“They’ve had a disciplined approach to new international markets and are strong in the US now.

“We have just combined that business with another at a 47% uplift in valuation and that deal included a substantial capital injection from a US private equity group so it’s well set up for success.”

Wilson says in the health sphere again is Access Telehealth, which enables people to access specialist medical care via a video platform.

“Importantly, it brings together a first-rate community of specialists onto that platform and is performing very strongly,” he says.

Good value in private tech companies

Wilson says the public markets have become much less expensive for tech, while the private markets have been slower to respond with valuations staying up for longer.

“But we are now seeing better value in private tech companies than we were previously so quality businesses that are not so expensive,” he says.

“For a period, there were a number of non-traditional players investing in private companies in the tech sector.

“Often they thought they were investing in pre-IPO but in reality, a lot of those businesses were not really that advanced and when the stock exchange shut to new listings it became apparent many weren’t really self-sustaining.”

Wilson says a number of those investors have exited the space, sold up or stopped making new investments, which has two impacts.

He says there’s less intense competition for new investments, so prices are coming back to reasonable levels.

“For those looking to exit the space completely, and sell positions, they’re often doing that at reduced prices so we can pick up those positions,” he says.

“We have over $100 million in cash available for investment and we’re very happy with our position to take advantage of the current market.”

Wilson says there is no shortage of continued technological innovation, and development of solutions, so opportunities are always emerging.

This article was developed in collaboration with Bailador Technology Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.