Bulletproof boss sells stake to help takeover bidder sneak up on Board

Bulletproof founder Anthony Woodward sold out to Macquarie Telecom. Pic: Getty

Cloud-provider Bulletproof Group’s founder enabled a takeover offer for the embattled business by selling his entire stake.

Anthony Woodward, CEO and cofounder of Bulletproof (ASX:BPF), sold his 16.11 per cent interest to Macquarie Telecom (ASX: MAQ) via a call option which was unveiled on Tuesday night.

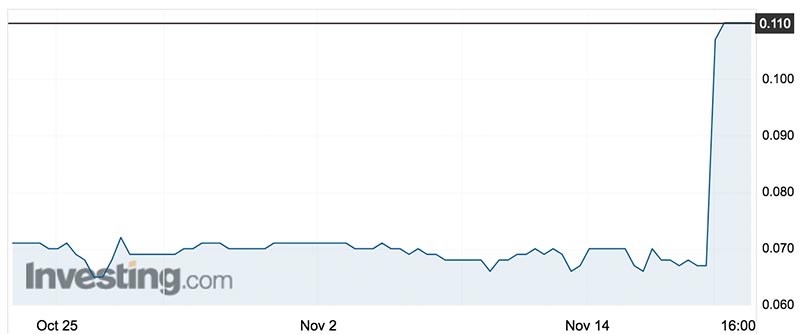

Macquarie is offering 11c a share in cash in the off-market bid, valuing Bulletproof at about $17.9 million. Bulletproof’s share price jumped 64 per cent on Wednesday to match the offer price.

Macquarie Telecom chief and founder David Tudehope says his company was approached by Craig Farrow, a director of Bulletproof, about five months ago to take over the company.

Bulletproof plunged into the red last year, reporting a loss of $6.1 million — a drop of 442.4 per cent compared to the year before.

Mr Tudehope said he did due diligence and decided to “stay in touch” rather than make an offer at the time.

Last week Macquarie was given a briefing on Bulletproof and realised it was becoming financially unstable.

“We went to Anthony and asked ‘what price do you think is fair value for your shares?’ We agreed on 11c,” he told Stockhead, adding this was the basis for the offer to other shareholders as well.

Bulletproof chief financial officer Paula Kensington says the board was not aware that Mr Woodward had placed his shareholding under a call option with Macquarie.

But, “given the share price — we’re trading at 7c — there’s been a lot of activity circling for some time,” Ms Kensington told Stockhead.

Mr Woodward did not respond to requests for comment.

Ms Kensington, who joined Bulletproof in April, says the business has undergone a restructure and “it’s all up from here”.

‘Take no action’

The board is recommending investors take no action yet.

“Bulletproof has established an independent subcommittee of the board, which comprises all of the directors of Bulletproof other than Mr Woodward… to evaluate the offer and manage potential, or actual, conflicts of interest,” the company told shareholders.

“If the offer proceeds, [Bulletproof] intends to appoint an independent expert to assess the offer.”

The offer will go ahead if Macquarie receives 90 per cent acceptances and there are no major changes in the business.

Mr Tudehope told investors the company’s earnings had deteriorated in the last 18 months.

“There is a strong strategic fit with Macquarie. The combination will enable Macquarie and Bulletproof customers to access a full set of cloud options of colocation, private cloud and public cloud,” he said.

Bulletproof is also the subject of a lawsuit in New Zealand by Cloud House, which it bought in 2016 and promised earn-out payments based on revenue and profit hurdles.

The suit alleges decisions by Bulletproof management were the reason why these hurdles weren’t met, and that the Australian business mislead Could House over its capabilities and access to managed services.

Bulletproof says the claim is without merit and is vigorously defend the proceedings, lodging a defence in August.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.