Bright spark Vivid lights up investors with strongest growth to date

Pic: nespix / iStock / Getty Images Plus via Getty Images

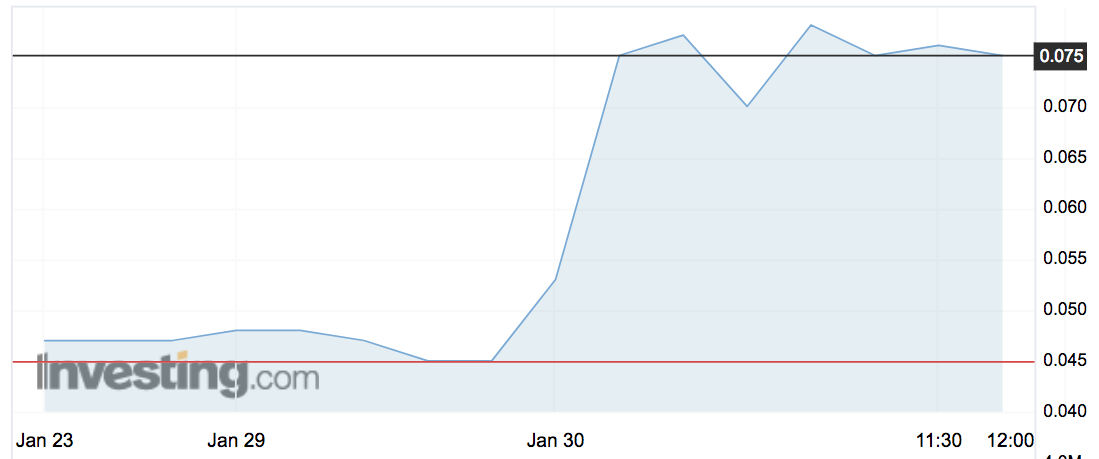

‘Internet of Lights’ play Vivid Technology says its last quarter was its strongest growth to date and the market couldn’t be more excited – shares in the company trading up as much as 75 per cent before lunch.

Vivid Technologies (ASX:VIV) was trading at 7.5c at midday, up 66 per cent.

It is all down to an increase in customer receipts for their ‘Lighting-as-a-Service’ lighting management solutions, up 182 per cent compared to the previous corresponding period, at $4.8 million.

Vivid says it has over 732,000 sq m of client area under light installed as at the end of the year – of which they manage and report usage to improve energy efficiency.

It says the strong results were due to converting new and repeat customers in the retail property, health and facilities management sectors.

“Leveraging our KlarityTM data analytics capability, which currently collates over 3.3 million data points annually from each intelligent lighting node installed, together with our core IoT communications platform KloudKonnectTM, we provide unparalleled insight to help customers optimise their energy and operational efficiency capabilities,” Vivid told the market.

And they aren’t ruling out further integration with ‘Internet of Things’ (IoT) solutions in the future.

“Our business is at an exciting stage, with the Q2 cash flow reflecting the execution of our planned strategy… We look forward to updating our shareholders over the rest of this year as we continue to expand our innovative technology and business models locally and overseas,” managing director Samuel Marks said.

As well as their lighting subsidiary, the company also supports CO2-to-fuel tech NewCO2Fuels, an Israeli start-up working within renewable energy.

The company had $3.9 million left in the bank at the end of the quarter, with expect outgoings of $4.1 million for the current period.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.