Boss stumps up $3m to keep G Medical funded for a few more months

Pic: Yuichiro Chino / Moment via Getty Images

An earlier version of this article stated that “a $65.7 million deal in July last year to distribute the Prizma case in China seems to have disappeared”.

Stockhead accepts this is not the case and apologises for the error.

The boss of health monitor maker G Medical Innovations has stumped up a $3 million loan to give the company an extra few months of funding.

President and chief Yacov Geva has given G Medical (ASX:GMV) a $US3 million to provide working capital.

It’s due to be repaid by April next year and at 10 per cent interest was a better deal than commercial lenders could do, the company said.

G Medical makes devices to digitally monitor patient health. It’s ‘Prizma’ medical phone case turns a smartphone into a clinical-grade mobile medical monitor to measure vital signs such as ECG, respiration, oxygen saturation, heart rate, temperature and stress analysis.

G Medical last year announced contracts with three distributors for the Prizma device — SilverLake, MEDTL and First Channel — but it’s waiting for the contracts to get underway.

The Silverlake deal for China and the MEDTL deal for Cyprus are relying on regulatory approvals in China for manufacturing.

In March they said this approval was expected by the end of June.

The First Channel deal for India and Taiwan is reliant on that company finding appropriate partners. It has yet to do this, despite the deal being signed in November last year.

A deal to distribute the Prizma case in China “remains on track with Prizma stock that will be fulfilled as local manufacturing in China commences and purchase orders are placed”, a company spokesperson said.

“Our ongoing work with the CFDA in this regard has been included in updates to the ASX,” the spokesperson said.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The First Channel and MEDTL contracts aren’t expected to deliver the cumulative $10.6 million first year revenue that G Medical said the contract laid down, in fiscal 2018.

The Silverlake deal did not specify a dollar figure.

As a result, G Medical’s $7.7 million cash buffer at the end of March may not leave enough wiggle room for a burn rate of $5.6 million this quarter.

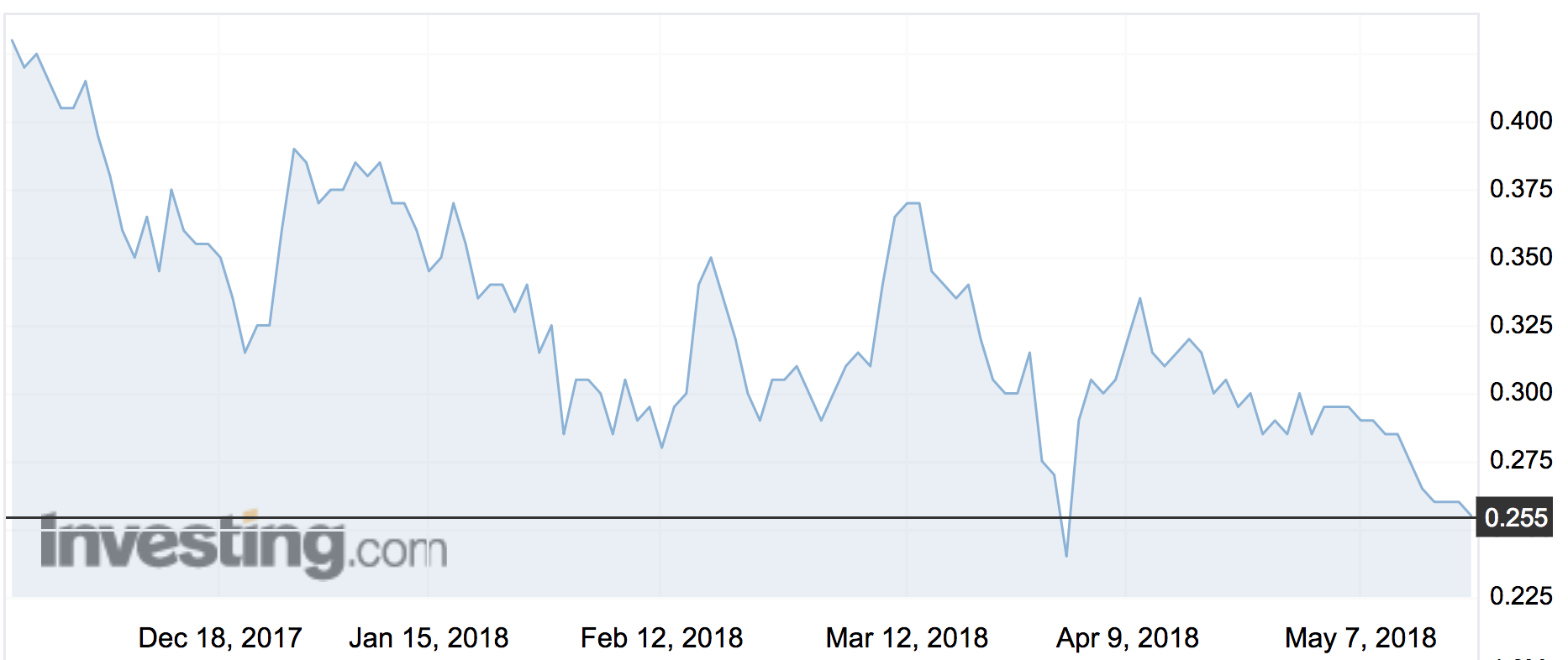

G Medical shares opened flat at 25.5c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.