BNPL or Crypto? Which investment has made Australians poorer in 2022?

BNPL or crypto? Which has made Aussie investors poorer? Picture Getty Image

- BNPL and cryptos have been the two worst investments for Aussies in 2022

- Stockhead reaches out to Opal Capital’s Omkar Joshi to ask his views on the BNPL market

- And which BNPL stocks have risen or fallen in June?

It’s been a wild ride for Aussie investors this year, with many asset prices declining, some even falling off the cliff.

If you had invested in a diversified portfolio of Aussie blue chips, your year-to-date return would be close to minus 11%, mirroring the return on the ASX 200.

If you had skewed your investment towards Tech (XIJ), your portfolio would be down by 38%, while a Mining (XMJ)-heavy portfolio would set you back only 5%.

Of all asset categories however, two that have stood out as the worst performers this year are cryptocurrencies, and the buy-now-pay-later (BNPL) sectors.

The BNPL segment has practically nosedived in the last 12 months, leaving most investors with just cents in every dollar invested.

In total, the BNPL sector has shrunk by roughly $40 billion in market cap this year, dragged down mostly by sector leader Block Inc (ASX:SQ2).

Losses in cryptocurrencies, meanwhile, have also taken big chunk out of the Aussie investor’s portfolio.

Bitcoin has lost almost 60% of its value this year, and is now hovering around US$20k from its all-time high of US$69k in November.

According to available data, the global cryptocurrency market valuation has dropped by roughly $1 trillion in 2022, with almost all leading coins trading at less than half their all-time highs.

Aussies are neck deep in cryptos

Although some of the crypto price action could be attributed to the recent failures of Terra and Celsius, most experts believe the current purge is all about picking out the weeds from the grasses.

“What you see now with this selloff, this drawdown, is just a lot of excess in the space that needed to be cut,” Tyrone Ross, CEO and co-founder of Turnqey Labs, told CNBC.

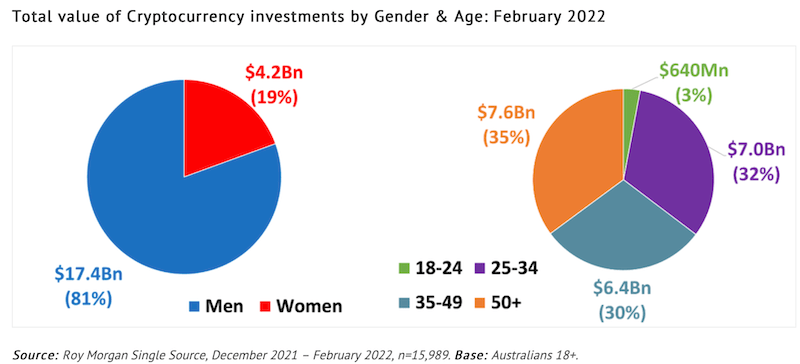

It’s little consolation for the 1 million Australians aged 18+ who Roy Morgan Research says own at least one cryptocurrency, with an average holding of $20,000.

Aussies mostly trade in Bitcoin and Ethereum, but also in niche names such as Ripple, Cardano, Dogecoin, Shiba Inu, Solana, Binance Coin, Litecoin, Cronos, and Polygon.

In total, $21 billion was held by Aussie crypto traders as of February this year.

Assuming 50% of that wealth has been lost since February, that would amount to around $10.5 billion.

That sounds terrible – but nearly four times more has been lost on BNPL stocks.

In the past, experts and investors have touted Bitcoin as an inflation hedge, because of its limited supply of 21 million coins. But its collapse this year just when inflation is surging has probably done enough to debunk that theory.

‘A disaster waiting to happen’

For the BNPL sector, it’s an understatement to say that it’s had a tough year. Some BNPL stocks have gone from market darlings to losing all of their market value in the space of just 12 months.

Zip and Sezzle are two BNPL stocks that have lost more than 90% of their value in the last year.

On Wednesday, the sector was under pressure again with Zip slipping another 4% and touching a six-year low of 44c. Zip’s takeover target, Sezzle, also slumped by 4% to its all-time low of 25c.

So what’s gone wrong, and is the huge collapse in BNPL stocks on the ASX justified?

“I think it’s very justified,” says Omkar Joshi, portfolio manager at Opal Capital, who spoke to Stockhead.

“I’d argue that the share price action [in BNPL stocks] we saw for the last two years during the Covid boom was probably unjustified.

“So we’re just seeing a reversion back to where things always should have been,” said Joshi.

He explained that the BNPL business model only works in a good economy, or when there’s lots of government stimulus.

“It’s not a sector that works when the economy is tough,” he said.

Joshi argues that BNPLs don’t have the capital like a bank to absorb bad debts, and they don’t have the security like a bank would in a mortgage.

BNPLs also conduct limited credit checks on who’s using their products, which is compounding to the problem of potential bad debts we’re seeing right now.

“So you’ve effectively got an unsecured lender with no capital and minimal credit checks. That’s a disaster waiting to happen.”

According to Joshi, the rising rate cycle that we’re in now will also make it harder for companies like BNPLs who rely heavily on raising capital.

“So that’s why I think what’s happening now [to BNPLs] is actually warranted, it actually makes a lot of sense,” he said.

BNPL winners and losers in June

How many BNPL stocks on the ASX were down by double digit percentages in June?

All of them.

| Code | Name | Price | % 1-Month | % 6- Months | % 12- Months | Market cap |

|---|---|---|---|---|---|---|

| FFG | Fatfish Group | 0.025 | -14% | -50% | -63% | $23,830,987 |

| SQ2 | Block | 94.79 | -19% | 0% | 0% | $4,156,578,728 |

| NOV | Novatti Group Ltd | 0.16 | -29% | -47% | -76% | $55,324,091 |

| CI1 | Credit Intelligence | 0.099 | -18% | -59% | -71% | $8,013,702 |

| LFS | Latitude Group | 1.245 | -30% | -35% | -45% | $1,292,884,615 |

| IOU | Ioupay Limited | 0.044 | -46% | -73% | -81% | $24,930,543 |

| SZL | Sezzle Inc. | 0.255 | -51% | -92% | -97% | $54,218,228 |

| SPT | Splitit | 0.125 | -58% | -47% | -78% | $61,245,208 |

| DOU | Douugh Limited | 0.015 | -35% | -78% | -85% | $8,922,814 |

| OPY | Openpay Group | 0.145 | -38% | -81% | -90% | $23,741,901 |

| LBY | Laybuy Group | 0.04 | -43% | -84% | -93% | $10,192,768 |

| ZIP | ZIP Co Ltd | 0.45 | -47% | -90% | -94% | $326,769,629 |

| HUM | Humm Group Limited | 0.44 | -40% | -51% | -55% | $222,870,743 |

| PYR | Payright Limited | 0.07 | -59% | -65% | -85% | $5,474,995 |

Block’s inconsistent bottom-line growth performance has contributed to its sluggish share price performance.

The company reported a 43% decrease in net income for FY20, followed by a 22% decrease for FY21.

For FY22, Block has announced to the market that it expects a 48.5% decrease in earnings, and just a 1% increase in revenues.

But it also predicted that it will bounce back in FY23, estimating a 92% earnings growth and a 21% revenue growth.

Its BNPL arm Afterpay meanwhile, reported a net loss of $345 million for the six months to 31 December amid a surge in write-offs. The loss compared miserably to the $79.2 million net loss it reported in the pcp.

Zip’s latest half year results showed that its revenue surged by 89% year on year (YoY) to $302 million, on the back of record transaction volumes of $4.5 billion.

Its customer numbers also increased to 9.9m, up by 74% YoY.

So why has its share price collapsed by 90% this year?

First, its credit losses have worsened, ballooning to $204 million and reaching 2.6% of its total transaction volume. This was above its target rate of 2%.

In addition, as of December 2021, its total borrowings stood at $2.4bn, compared to net assets of only $1.2bn.

Zip’s acquisition target, Sezzle, has also crumbled by 90% this year.

The company earned a total income of US$115m in FY21, and followed that up with a solid Q1 of US$27.6m.

But just like its peers, Sezzle is facing several headwinds, with some experts predicting that it won’t be able to raise more funds except in the “most distressed terms”.

Zip valued Sezzle at $491 million when it announced the acquisition back in February.

Humm’s share price plunge of 44% in June was mainly the result of its board members quitting en masse.

Five of Humm’s six board members resigned after Latitude Group (ASX:LFS) walked away from buying Humm’s BNPL business.

Latitude had earlier offered to pay $335 million in a bid that would have kickstarted its push into the BNPL sector.

Humm’s board members quit after saying they could not work with major shareholder Andrew Abercrombie, who opposed the sale vigorously by calling it a “garage sale”.

Payright was the worst of the bunch this month, down by almost 60%.

The company’s performance has actually been solid. In the last quarter it reported gross receivables of $97 million, up 59% on the pcp.

But just like its competitors, the company’s bad debt has risen steadily – from 1.64% in March 2021 to 1.84% in March this year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.