Blockchain and crypto stocks are taking a breather – but will they come back?

Pic: Thinkhubstudio / iStock / Getty Images Plus via Getty Images

The blockchain/crypto run has finished — at least for the time being — among 22 of 24 related ASX stocks monitored by Stockhead.

After a huge run from early December to early January, shares prices have started to plateau as crypto currencies have fallen, boards have failed to deliver on promises, and blockchain hopes for other companies have not panned out.

Two have missed the hype entirely — iCandy (ASX:ICI) and Manalto (ASX:MLT) — which were both suspended from trade before the excitement began in November and are yet to rejoin the market.

Kyckr (ASX:KYK) and Sportshero (ASX:SHO) are both managing to convince investors to push their stock higher without relying on the hype to drive share price rises.

Momentum for crypto stocks is dissipating

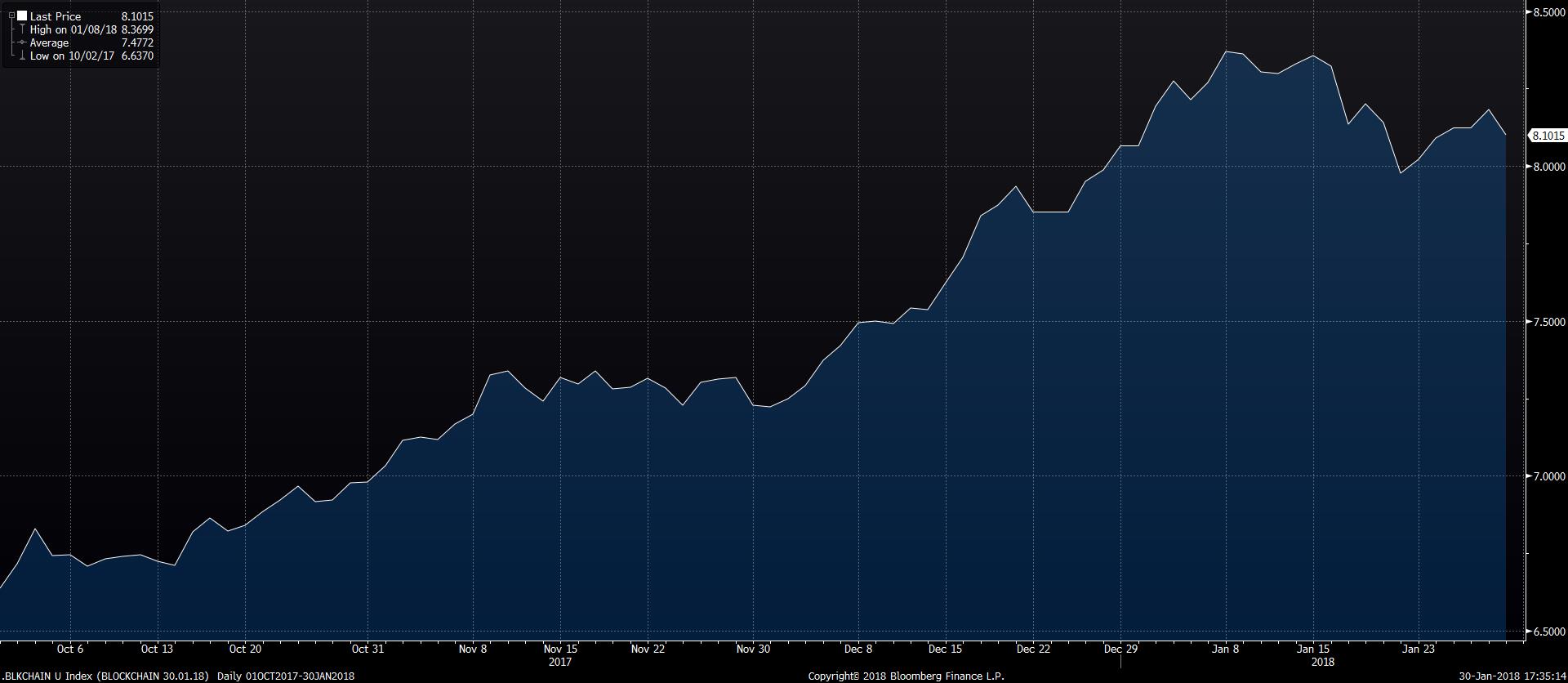

Crypto and blockchain-related stocks rose quickly last year alongside an extraordinary surge in the value in cryptocurrencies.

Bitcoin began to rise in the middle of 2017 but took off in November, dragging up other cryptocurrencies and companies involved in the sector.

Bitcoin peaked at $US19,343.04 ($23,941) on December 16 and Ethereum at $US1391.76 ($1722) on January 14, a delay that matched a shift from bitcoin to other currencies as settlement times lengthened.

Cyan Asset Management’s Dean Fergie says momentum for crypto and blockchain stocks is now dissipating rapidly.

Blockchain technology, which provides an encrypted, public ledger of transactions, is best known as the basis of digital cryptocurrencies such as bitcoin.

“There’s only a very narrow segment of the population that are prepared to buy something that doesn’t tangbily exist,” Mr Fergie told Stockhead.

“You’ve had a sector that’s gone from almost nothing to become very valuable. You’ve had a lot of investors who’ve made a lot of money very very quickly.”

(See table below).

| ASX code | Name | Change Dec 1 - Jan 30 | Price (Dec 1) | Price (Jan 30) | Market Cap |

|---|---|---|---|---|---|

| YOJ | Yojee | 0.51 | 17.5c | 26.5c | 194594400 |

| DCC | DigitalX | 0.42 | 21.5c | 30.5c | 152447488 |

| LNU | Linius Technologies | 2.02 | 4.8c | 14.5c | 120165976 |

| CCA | Change Financial | 0.56 | 7.2c | $1.12 | 84165408 |

| MBM | Mobecom | -0.24 | 44.5c | 34c | 59418316 |

| SHO | Sportshero | 1.75 | 7.1c | 19.5c | 47451620 |

| NOV | Novatti | -0.08 | 38c | 35c | 47370008 |

| FFG | Fatfish Internet Group | 0.32 | 6.2c | 8.2c | 39677696 |

| GTG | Genetic Technologies | 0.72 | 0.9c | 1.55c | 38964524 |

| KYK | Kyckr | 1.03 | 15c | 30.5c | 36072604 |

| FGF | First Growth Funds | 1.23 | 1.3c | 2.9c | 31134432 |

| BPG | Byte Power Group | 0.29 | 0.7c | 0.9c | 27585630 |

| TSN | Transaction Solutions International | 0.91 | 1.1c | 1.2c | 25512158 |

| CHP | Chapmans | 0.55 | 1.1c | 1.7c | 22100002 |

| OOK | Ookami | 1.12 | 4.2c | 8.9c | 21722938 |

| RFN | Reffind | 0.16 | 3.2c | 37c | 19589000 |

| PIL | Peppermint Innovation | 0.36 | 1.4c | 1.9c | 18518982 |

| ZYB | Zyber Holdings | 0.88 | 1.2c | 2.25c | 14257729 |

| S3R | Serpentine Technologies | 0.67 | 0.6c | 1c | 6244339.5 |

| SCL | Alchemia | 0.18 | 1.1c | 1.3c | 4221407 |

| TB8 | Tianmei Beverage Group | -0.15 | 13.5c | 11.5c | |

| AB1 | Animoca Brands | 5.25 | 1.2c | 7.5c | 32560000 |

Without hype driving the sector, companies with only a tenuous relationship to blockchain are beginning to feel the pinch in their shares.

Zyber shareholders (ASX:ZYB) discovered this last week when the director who led the shell company’s push towards a crypto deal resigned from the board.

It fell 61 per cent from a five-year high of 4.6c in early January to 1.8c days later.

Stocks with a revenue-generating business around cryptocurrencies or blockchain include:

- DigitalX (ASX:DCC) which advises people who wish to get involved with the sector

- Kycker to a degree as it has a product that incorporates blockchain software

- Ookami (ASX:OOK) after buying a piece of democratised data site Brontech

- Reffind (ASX:RFN) after finalising an investment in global loyalty play Loyyal on Monday

- Yojee (ASX:YOJ) which is about to release its blockchain backend software for its logistics offering.

Most of the others are either “businesses grasping at crypto straws to gain market favour”, as Mr Fergie puts it, or are still in the process of building their blockchain or cryptocurrency product.

Fatfish Internet Group (ASX:FFG) CEO Kin Wai Lau says his new investee is testing the cryptocurrency mining equipment and they will start mining “soon”. It was supposed to be up and running last week, according to the original announcement.

Change Financial (ASX:CCA) is backing IvyKoin, a new cryptocurrency being launched in Australia.

Serpentine (ASX:S3R) is awaiting $4.4 million in payment for the sales of majority of its business from the man who vended it into an Australian shell and then took it back out and turned it into a blockchain business.

And Genetic Technologies (ASX:GTG) may be set to become a blockchain-backed medical data company, after the directors resisting a board coup quit on Tuesday.

First Growth Funds (ASX:FGF) is another step closer to closing a $3.45 million investment in itself by Blockchain Global.

And Tianmei (ASX:TB8) wants to let people track the water in their water bottles using blockchain.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The next crypto market is…

The market for Initial Coin Offers (ICOs) however is booming.

ICOBench lists eight ICOs based out of Australia that are closing in the next two months and 1675 in total, and that’s not an exhaustive list.

CoinDesk’s ICO funding tracker shows that global investments in coin offerings began to leap in May 2017, with cumulative investment touching $3.8 billion by November.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.