Bitcoin powers to new highs on corporate buying after January correction

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

- Bitcoin’s price has risen 50 per cent from January correction level to $60,000

- ‘Tesla has diversified its own business by investing in Bitcoin on a grand scale’

- Ethereum too hits a new record at $2,300, rising 300 per cent since Christmas

Australian dollar prices for Bitcoin have ascended to new record highs at $59,800 ($US45,965) Wednesday as large US corporations add to buying interest in the market from institutions, high net worth individuals, and retail investors.

Tesla (NASDAQ:TSLA) made world-wide headlines this week when it revealed in a US regulatory filing that it had bought $US1.5bn ($1.9bn) worth of Bitcoin in January.

“Yesterday’s move by Tesla to invest in Bitcoin and start accepting it as payment for its own products really moved the needle,” said Simon Peters, cryptocurrency expert with trading platform eToro.

“Already there is talk of copycat moves from Apple and Google, linking it to their own payment systems.”

Apple (NASDAQ:AAPL) had $US38bn ($49bn) of cash and cash equivalents on its balance sheet at the end of 2020.

Google parent company Alphabet (NASDAQ:GOOG) has $US26.4bn ($34bn) of cash and cash equivalents on its financial statement.

If these companies and other tech giants invested modest amounts of their cash holdings, it could trigger a surge in Bitcoin prices.

The market value of Bitcoin currently stands at $US860bn ($1.1 trillion).

There are price forecasts of Bitcoin reaching up to $US100,000 before the year’s end.

Market expects others to follow Tesla’s lead

Bitcoin prices surged this week after Tesla’s buying spree, as it raised market expectations that other large US companies with excess capital on their balance sheets may buy too.

“The shift to digital consumption is growing. We expect to see others follow in Tesla’s footsteps, with Bitcoin payments increasingly making sense for businesses that conduct nearly all their sales online,” said eToro’s Peters.

Tesla’s decision to invest in Bitcoin and to accept the cryptocurrency as payment has very broad implications for economies, currencies and societies.

“If corporates the size of Tesla, valued at nearly $US1 trillion, believe Bitcoin can be used in this way, and are willing to back its views with action, then others will undoubtedly start to consider it.

“Tesla has diversified its own business by investing in Bitcoin on a grand scale. We believe other companies will also look to hold some Bitcoin as both a diversifier, and as an insurance policy against the devaluation of other currencies,” said Peters.

At the end of December, before its investment in Bitcoin, Tesla had cash holdings of $US19.3bn ($25bn) on its balance sheet, up from $US6.2bn at the end of 2019.

Tesla’s share price was trading at $US850 on Tuesday, up from $US730 per share at the start of 2021.

MicroStrategy was an early investor in Bitcoin

Tesla is not the first major company to invest in cryptocurrency. Several US tech companies pioneered the concept of ploughing their surplus cash into cryptocurrency.

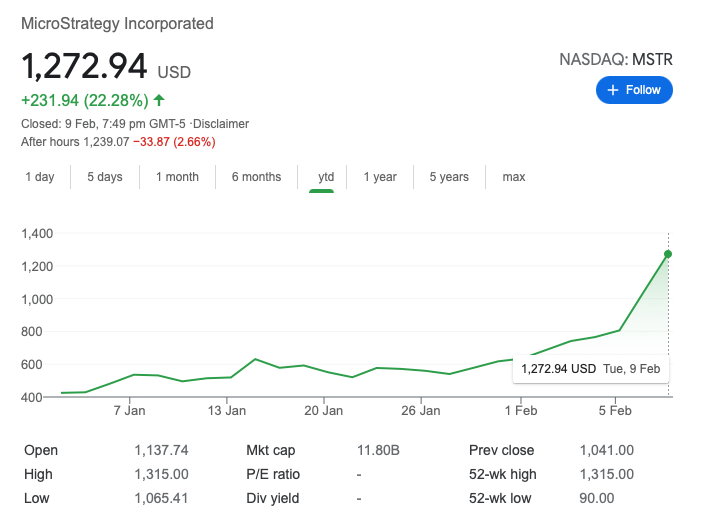

The Michael Saylor-led MicroStrategy (NASDAQ:MSTR), an early investor in Bitcoin, has seen its share price balloon, particularly this week.

MicroStrategy started to buy Bitcoin last August with an initial purchase of 20,000 coins, and has added to its position since to now total around 71,000 coins.

The US tech and cloud computing company has witnessed its share price rise 200 per cent since the start of 2021, rising from US$425 per share to $US1,272, Tuesday.

Saylor explained his thinking behind his company’s investment in Bitcoin, currently valued at $4.26bn. This is equivalent to 30 per cent of MicroStrategy’s market value of $14.3bn.

“In an expansionary monetary environment you want scarce assets. The scarcest asset in the world is Bitcoin,” he told Bloomberg.

The supply of Bitcoins in circulation is limited to 21 million, and to date around 18 million have been issued, leaving around 3 million to enter the market.

This week, Saylor hosted a webinar on his company’s experience of investing in Bitcoin that was attended by senior managers from 1,400 companies.

Series of stunning price moves

Bitcoin has made a stunning series of price moves since breaking out of its $15,000 price ceiling back in October.

The premier cryptocurrency rallied to $25,000 in the lead-up to Christmas, then doubled to $52,000 by early January 2021, going on to slump to $39,450 by the end of last month.

From there, Bitcoin advanced to its current high price this week of close to $60,000, representing a 52 per cent increase from its late-January low.

“The world is moving online more and more and Bitcoin sits at the heart of online transactions, and with this kind of endorsement from a multi-billion dollar company, it’s likely the price will hit $US50,000 by the end of the week,” Peters said.

Several ASX companies provide a gateway to the cryptocurrency market including, DigitalX (ASX:DCC) whose DigitalX Bitcoin Fund tracks the price of the cryptocurrency.

“Investors that are coming to Bitcoin are there for the longer term, and are buying each day or each month to build up their positions,” chief executive, Leigh Travers, told Stockhead.

Ethereum shares in crypto price rally

Other cryptocurrencies have also risen in recent weeks, triggered by a stampede of investors into the sector.

Ethereum, sometimes referred to as the digital equivalent of silver to Bitcoin’s digital gold, has tripled in value since Christmas to $2,325 ($US1,800).

The CME Group has this week launched an Ethereum futures contract, which eToro’s Peters said will increase global recognition of the cryptoasset.

The Ethereum futures contract join’s CME Group’s existing Bitcoin futures contract.

Another cryptocurrency, Cardano, soared around 80 per cent last week hitting $US0.70, and is the third most-traded cryptocurrency on the eToro trading platform.

In March 2020, the asset was priced at $US0.02 and since rolling out its proof of stake network the price has continued to rise.

Cardano has also recently launched its smart contract, which is expected to attract more developers to use the asset moving forward, added Peters.

Meanwhile, research by eToro shows that women are increasingly interested in investing in the cryptocurrency sector.

Participation levels for women in the digital currency market have risen to 15 per cent and 12 per cent for Bitcoin and Ethereum, respectively, from around 11 per cent in early 2020.

“The sector’s broad appeal is, more and more, being reflected by its diversified investor base,” said Peters.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.