Bitcoin 2020: It’s still not the heady days of 2017, but crypto markets are off to a solid start

(Getty Images)

It’s now been more than two years since crypto’s hype phase peaked in December 2017, when Bitcoin prices topped out above $US19,000 ($27,562).

The “crypto winter” that followed was accompanied by a sharp decline in retail investor interest and increased regulatory scrutiny, particularly around initial coin offerings. Eventually, BTC prices bottomed out below $US3,500 in February 2019 before some notable rallies last year.

And during the intervening period, opinions around valuation have remained split as the sector chips away to establish itself as a legitimate alternative asset class.

In developed market jurisdictions, questions have centred largely around how to define what crypto assets actually are (commodities or securities), and how they will interact with the existing financial system and the regulations that govern it.

2020 is only 16 days old but during that time there’ve been a few interesting developments in the space.

And they’ve been accompanied by another round of capital inflows; BTC is up from $US7,700 on Saturday to a high of $US8,800, with even stronger performances among some established alt-coins.

Insto interest?

One notable event this week was the launch of an options contract on Bitcoin futures by the CME Group.

As one of the largest derivative exchange platforms in the world, CME definitely falls within the realm of traditional finance and the regulation that comes with it.

It also provides another channel for capital flows from institutional and sophisticated investors to move into crypto, which has long been flagged as a key value proposition among crypto optimists.

Trading in CME Bitcoin options kicked off on Monday with reported volume of more than $US2m. It will compete for market share with Bakkt, another digital asset trading platform owned by the Intercontinental Exchange (parent company of the New York Stock Exchange).

Analysts from JP Morgan wrote last week that they’d observed an increase in open-interest options contracts ahead of the launch, in anticipation of a potential pickup in activity.

The regulated BTC options market is still in its early days, although it’s not the first time a trading exchange has attempted to establish a platform for trading crypto derivatives.

Back in December 2017, Chicago-based Cboe Exchange launched a Bitcoin futures product during the height of the crypto boom. But by March 2019 Cboe announced it would not be adding any more BTC futures contracts, and the last active trade expired in June.

While CME’s entry marks another step forward in the institutional space, it’s still more of a baby step. What many view as the holy grail — a Bitcoin-based exchange traded fund (ETF) — remains off limits in developed markets.

US regulators have consistently rejected multiple attempts to establish a BTC ETF, citing concerns about market manipulation.

Type of assets

One reason that Bitcoin can be used legally as a base asset for derivative products is because the US Commodity Futures Trading Commission (CFTC) has satisfied itself that BTC is a commodity (a tradable good), as opposed to a security (e.g. stocks and bonds).

Another established crypto, Ripple, has also risen strongly to start the year, but the CFTC says it’s still “unclear” whether Ripple is a commodity or security.

Most crypto assets in western markets are still classified as securities from a regulatory standpoint. And that means western-domiciled crypto exchanges aren’t qualified to host them on their trading platforms.

As a result, most crypto trading volume is still carried out on exchanges which operate outside developed-market jurisdictions, such as Binance (Malta) and BitMex (Seychelles). Binance has a US division, but it’s more restricted in the trading pairs it can offer.

Use of money

Running adjacent to the interest around crypto assets are developments around new forms of money better suited to facilitating cross-border payments within an integrated global economy.

And there are still plenty of questions about how digital money for the internet age will coexist with the regulations that underpin the global financial system.

A good example of that is Libra – the stable-coin concept backed by a basket of traditional fiat currencies that forms Facebook’s own attempt at creating a borderless digital payment mechanism.

The Libra Association published a second roadmap just before Christmas, after the first iteration failed when a number of global payments companies dropped out of the project.

Last week, the RBA noted that it was still considering the merits of stablecoins and a central bank-backed digital currency, as part of a submission to the Senate Select Committee on fintech and regtech.com

The bank said its current view of existing cryptos such as Bitcoin is that they “do not provide the usual functions of money, which explains why they have not become widely used in Australia as a means of payment”.

It said it’s continuing to monitor regulatory developments around stablecoin concepts such as Libra, while maintaining that the case for an adjacent central bank-backed digital currency “has not been established”.

Despite all that, this week’s rally is evidence that the crypto markets still offer the volatility – both up and down – that appeals to traders with a higher risk profile.

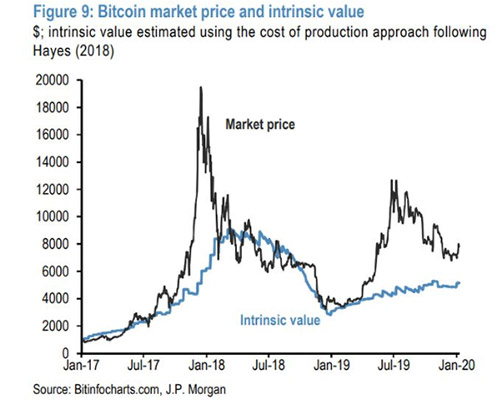

So, what’s Bitcoin actually worth? The JP Morgan analysts maintain a commodity-based model of intrinsic value, based on the computing power required to mine new coins and total electricity costs.

And at these prices, they estimate that Bitcoin still has some “downside risk” based on its current cost of production:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.