Bailador’s strong governance framework contributes to shareholder value

Pic: Getty Images

Bailador takes a deep dive into the governance aspect of its Environmental, Social and Governance (ESG) framework.

Tech-focused growth capital fund Bailador (ASX:BTI) has long believed there is a clear and positive relationship between delivering long-term shareholder value and high-quality corporate governance.

Corporate governance means the systems by which organisations are controlled, operate, and are held to account – and modern ESG thinking takes a more stakeholder-centric approach to doing business than in the past.

Bailador’s governance framework needs to be fit for purpose to ensure the company operates in the best interests of shareholders, as well as founders and their businesses, fellow investors, its investment team and the Australian technology ecosystem.

A manager and an independent board

Bailador doesn’t employ staff the way operating businesses do, instead appointing a manager in Bailador Investment Management to manage the investments the company makes.

The Bailador board has clearly delineated the role of the Manager and the Manager reports to the Board on its performance.

Bailador CFO and Company Secretary, Helen Foley, said “We are clear and transparent in our fees and report our performance to shareholders after all fees paid to the Manager,”.

Bailador’s board consists of co-founders David Kirk and Paul Wilson, along with three independent directors – Andrew Bullock, Jolanta Masojada and Brodie Arnhold – who bring a breadth of experience to their roles.

The company reviews the skills the board requires regularly and conducts regular performance evaluations as well.

A rigorous investment process

The Bailador Investment Management investment committee runs a multi-staged investment process that incorporates thorough due diligence of potential investments.

The investment committee sees a lot of investments and the vast majority of those do not make the cut.

“We are critically assessing potential investments for market opportunity, demonstrated scalability, culture fit, valuation, returns and of course risk,” Foley says.

“We commit to solid structured work on the investments we turn down, incorporating our learnings into making better investment decisions.”

A robust valuation process

“All businesses in the current portfolio are valued at either a mark to the ASX market price (for our publicly listed investments ASX:SDR and ASX:STG), the latest price set by a third-party transaction (InstantScripts, Rezdy and Mosh) or by a valuation determined by Bailador based on its knowledge of the business and comparative pricing they observe in the market (Access Telehealth, Nosto and Brosa),” the company says.

“Our valuations are constantly reviewed by our investment team and a formal thorough valuation report is prepared every six months for the board,” Foley adds.

Sometimes this includes external commissioned work on certain sectors or businesses and auditors review BTI’s valuations and have their own non-audit valuations experts review the company’s valuations.

“In June each year, we also have an independent valuation prepared,” Foley adds. “And our highly qualified board reviews all of this information, probes for more information and makes valuation determinations.”

Bailador’s aim is to be conservative and proactive with its valuations, continuing to watch market conditions closely to ensure its portfolio reflects fair value for shareholders.

“It is no coincidence and a testament to our commitment to good governance, that in a challenging technology market, our three businesses with internally determined valuations (Access Telehealth, Nosto and Brosa) are all valuations that have been written down by us in the last six months,” Foley says.

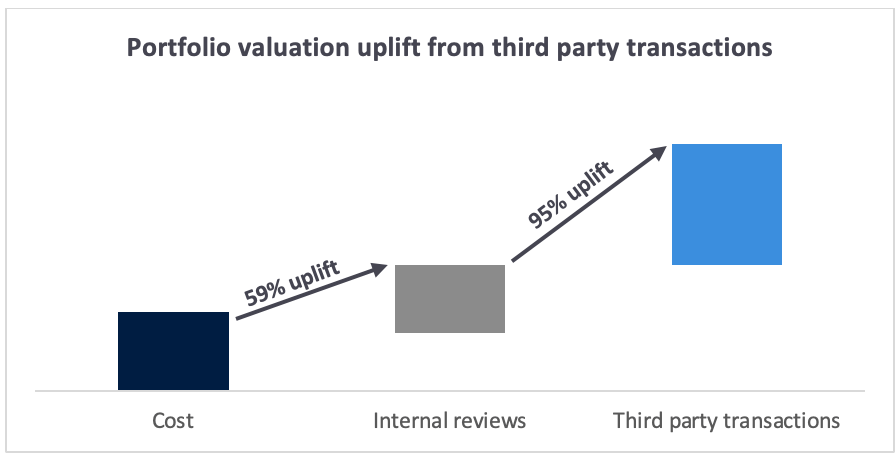

Proof is in the portfolio valuation uplift

Since Bailador’s public listing in 2014, businesses in the portfolio have completed 30 third party transactions (that’s either raising capital, IPOs, or business sales).

One hundred per cent of those third party transactions have been at or above the valuation Bailador was holding the business in its portfolio.

“This gives us empirical evidence that our governance processes are working,” Foley says.

This article was developed in collaboration with Bailador Technology Investments Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.