Bailador remains bullish on its largest holding SiteMinder one year after its IPO

Take a deep dive into Bailador’s thinking behind its largest holding, SiteMinder with co-founder BTI Paul Wilson. Pic via Getty Images.

Bailador takes a deep dive into how its largest holding SiteMinder has been travelling one year on since the so-called tech unicorn listed on the ASX.

Tech-focused growth capital fund Bailador Technology Investments (ASX:BTI) largest holding in its portfolio is open hotel commerce platform SiteMinder (ASX:SDR).

SDR was one of Australia’s so-called “tech unicorns” being worth over $1 billion at a private valuation.

The company went to IPO on November 8, 2021 with a valuation of $1.36 billion. It not only held its ground but gained on that by nearly 50% in its first two trading days.

BTI co-founder and managing director Paul Wilson, who also sits on the board of SDR, said the company first invested when it was a private company with revenue of $5m.

“From our original $5m investment, we have realised $30m cash to date, and hold approximately $52m of shares listed on the ASX,” he said.

Leading open hotel commerce platform

SDR the world’s leading open hotel commerce platform, ranked among technology pioneers for opening every hotel’s access to online commerce.

Wilson said it’s this central role that has earned SDR the trust of tens of thousands of hotels across 150 countries, to sell, market, manage and grow their business.

Headquartered in Sydney, SDR has offices in Bangkok, Berlin, Dallas, Galway, London, and Manilla.

Key Stats include:

- 35k Subscription properties

- $145m Annual Recurring Revenue (ARR)

- 8% ARR Growth Rate (year on year, constant currency)

- $806m Market Capitalisation (8/11/22)

- $109m Available Liquidity (including undrawn debt)

Wilson said SDR has delivered on the product, go-to-market, and financial initiatives outlined during the IPO in November 2021.

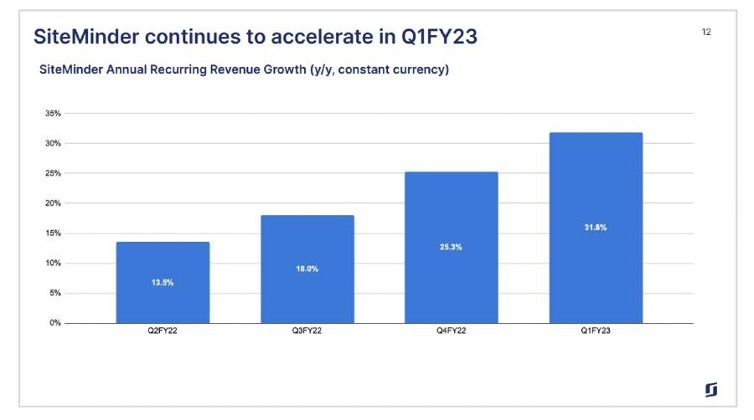

“One of the most resilient businesses in the world travel industry through covid-19 travel restrictions, SiteMinder is not just growing, but growth is accelerating,” he said.

SDR has substantially increased its rate of growth for each of the last four quarters, to be growing at over 30% pa currently.

Reliable, growing revenue model

SDR has historically been a predominantly subscription revenue-based business.

“With its subscriber base of 35k hotels, the business produces reliable, predictable, growing subscription revenue and this is expected to continue,” he said.

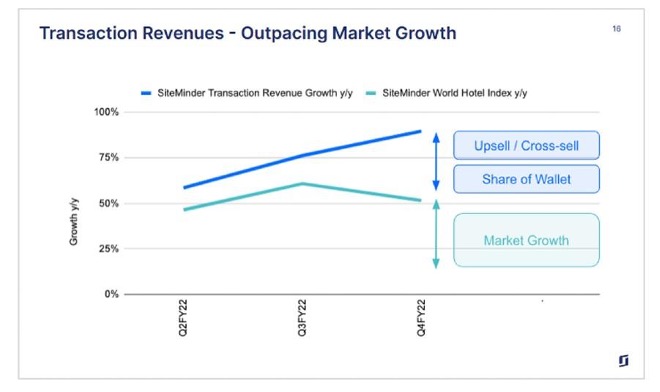

Wilson said in addition, SDR is achieving significant growth in transaction revenue.

“Currently a smaller portion of overall SiteMinder revenue, transaction revenue is driven by the transaction products, such as demand management and payments, adopted by a hotel, as well as travel activity,” he said.

The travel market has bounced back strongly, and SDR transaction revenue growth of 86% (year on year Q2 FY22 constant currency) has outpaced that market growth significantly.

“Transaction revenue for SiteMinder is typically an add-on product taken up by existing subscription customers,” Wilson said.

“This has the benefit of allowing faster growth than the overall travel market, as shown above, but also allows strong operating margins.

“The opportunity from up-sell, cross-sell, and share of wallet is significant.”

Large total addressable market

Underpinning the strong growth prospects for SDR is a very large total addressable market (TAM) of 1 million hotels.

Much of the TAMs are independent hotels, SDR’s core market, whose uptake of modern technology solutions still has a long way to go.

Wilson said the SDR management team, as led by managing director Sankar Narayan, is well credentialed to take advantage of the huge opportunities ahead, with Pat O’Sullivan chairing an experienced board of directors.

The recent appointment of US based Dean Stroecker, co-founder of software giant Alteryx (NYSE:AYX), further strengthens the board’s experience of scaling a software business globally.

The current SDR share price at $3.06 is below its IPO price high of $7.01, with a reduction broadly in line with the overall market this year.

“Bailador has an in-depth understanding of the SiteMinder business, and we are confident that the business will continue to execute and thrive,” Wilson said.

“We are comfortable having SiteMinder as a key element of the BTI portfolio.”

This article was developed in collaboration with Bailador Technology Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.