Bailador bets on its portfolio gains to drive shareholder growth

BTI is upbeat about the capital appreciation potential of its portfolio companies. Pic: Getty Images.

- Bailador believes capital appreciation of portfolio companies will drive future investment growth for shareholders

- Tech-focused capital fund has franking credits for more than six years at the June 2024 dividend rate

- The company has settled $20m cash realisation of a portion of its investment in SiteMinder while retaining 82% holding

Special Report: Tech-centric capital fund Bailador Technology Investments believes capital appreciation of its investment portfolio will continue to be the primary driver of future investment growth for shareholders.

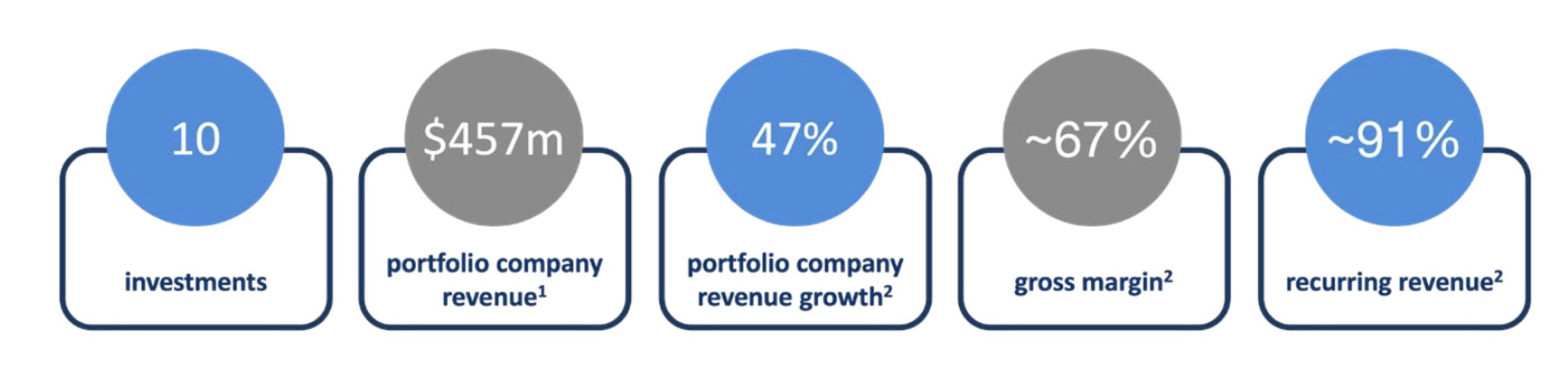

Bailador Technology Investments (ASX:BTI) co-founders David Kirk and Paul Wilson said in their October report that the fund’s portfolio of mostly private companies have combined $457m in revenue growing at 47% YoY with solid margins and a very high percentage of sticky, recurring revenue.

“These are the types of characteristics we aim to drive as our portfolio businesses grow, and that attract premium valuations when we look to realise our investments,” the founders said.

Source: BTI

Source: BTI

Franking credits for more than six years

The founders said private portfolio investment returns were lumpy by nature and unlike listed shares, may go many months without a change in valuation.

To complement capital growth, BTI’s dividend policy is designed to smooth returns and improve reliability of returns for investors, while also releasing valuable franking credits.

“Bailador is well capitalised ($43m in net cash at time of writing) and has franking credits for over six years at the June 2024 dividend rate.

“For shareholders who wish to focus solely on their capital return, the company has a DRP to allow dividend reinvestment.”

BTI’s stated policy is to continue to pay regular on-going dividends of 4% of net tangible assets (NTA) per annum (pre-tax).

Shareholders receive an interim dividend of 2% of NTA following December results and a final dividend of 2% of NTA following June results.

“As NTA per share grows, the cents per share paid as a dividend also grows,” the founders said.

“When the BTI share price is below NTA per share, the dividend yield is even higher than 4%, and franking credits take that effective yield higher still.”

Source: BTI

Compelling investment case

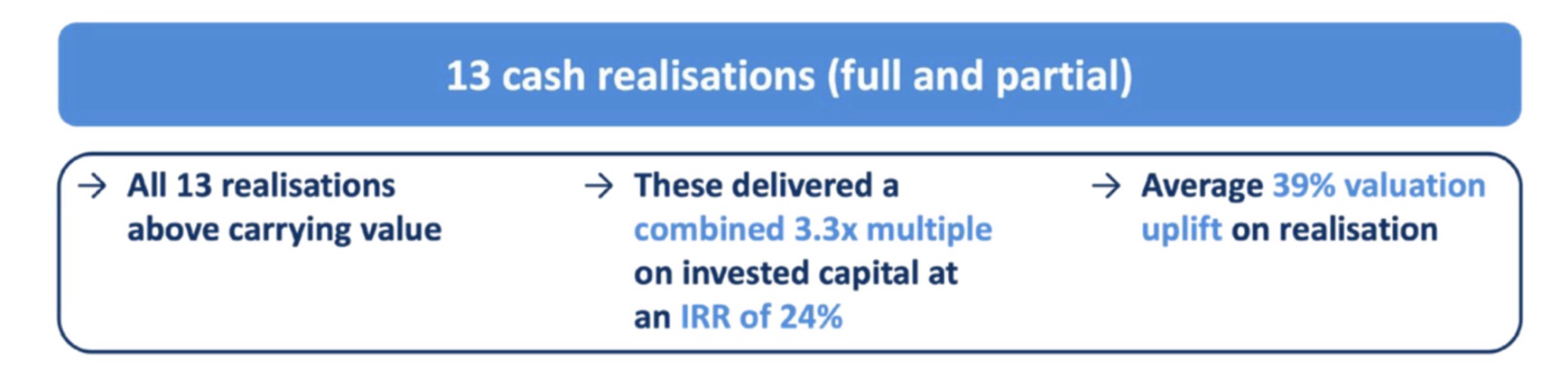

The founders said BTI had a well-established track record of conservative valuations – with every cash realisation completed above its carrying value.

“Despite this track record suggesting shares could well trade at a premium to NTA, the current BTI share price implies a discount to the NTA level of our high-quality portfolio,” they noted.

The founders added there was an opportunity to access high-growth private companies retail investors do not usually have access to, at a marked discount.

“Combined with a consistent, fully franked high dividend yield, we believe this represents a compelling investment opportunity,” they said.

Source: BTI

Cash realisation in SiteMinder

On November 1 BTI settled a $20m cash realisation of a small portion of its investment in hotel bookings platform SiteMinder (ASX:SDR) while retaining 82% of its holding.

The fund first bought into SDR in 2012 with an initial $5m investment and was instrumental in its listing on ASX in 2021.

“We maintain high conviction in the positive prospects for SiteMinder, and Paul Wilson remains a board director of SiteMinder,” the founders said.

“This cash realisation allows a rebalancing of the portfolio, with cash available to be deployed in new high growth investments.”

Deploying capital to new and existing companies

BTI has meanwhile been deploying capital to new and existing companies.

The fund recently made a $10m follow-on investment to its initial $20m investment in cloud-based financial advice and investment management software platform DASH Technology Group, to fund a new acquisition.

It also made a $3m follow-on investment in SaaS platform Rosterfy, which enables not-for-profit organisations, government bodies and mass-scale sports and events to recruit, screen, train and schedule their volunteer communities.

The company also invested $20m in telehealth platform Updoc and $7.7m in fitness studio management software platform Hapana.

BTI’s NTA per share (pre-tax) at close of October 2024 was $1.83, up slightly from $1.79 at the end of September 2024.

This article was developed in collaboration with Bailador Technology Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.