Australia’s carbon emissions keep going up despite spate of clean energy projects

Pic: Getty

Australia’s carbon emissions have risen for the third year in a row despite a rush of renewable energy projects — including a growing number of ASX-listed ventures (see below).

Emissions increased 0.8 per cent in the December quarter according to government’s National Greenhouse Accounts. They’re up 1.5 per cent compared to the same quarter in 2016.

Higher liquified natural gas production and exports was the main reason, the report said. LNG production grew 41.4 per cent in 2017 and was expected to grow another 18.1 per cent this year.

That’s despite so many new renewable energy projects that the Clean Energy Regulator says the 2020 Renewable Energy Target has effectively been met, thanks to wind and solar projects built or in planning.

Australia now has 6553MW of existing or planned renewable energy. The RET target is 6400MW.

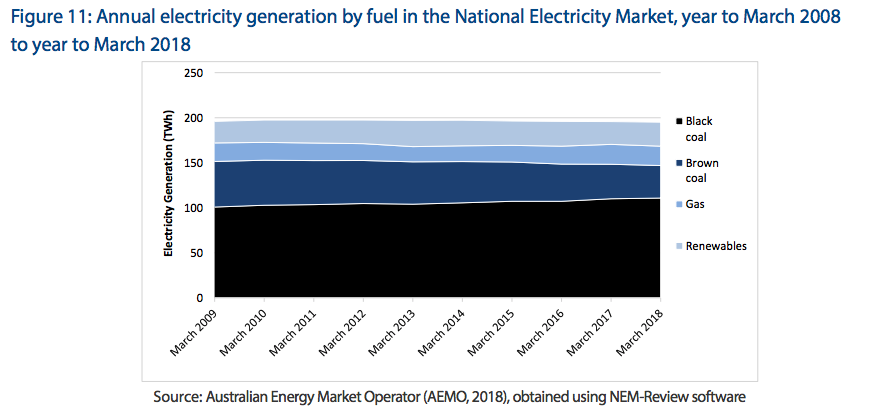

The electricity sector was the only sector to post a decrease in emissions — of 3.1 per cent — which the government put down to decreased demand and a reduction in power from brown coal.

Australia’s energy market has seen a spate of renewable energy projects, some of which remain private and some of which have hit the ASX.

Increasingly, companies are looking to buy power via Power Purchase Agreements directly from the generator rather than through a retailer.

That is backstopping projects like ReNu Energy’s (ASX:RNE) small scale solar and bioenergy deployments at places like shopping centres and schools.

In January, Bloomberg New Energy Finance said Australian corporations signed agreements for 400MW of power in 2017 as “expensive wholesale power and the availability of renewable energy certificates have increased the economic incentive for locking into relatively cheap renewable electricity prices long-term”.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The clean energy regultor says another 1454MW of projects are likely to lift off before the end of 2018.

Genex Energy (ASX:GNX) which is building the Kidston 50MW solar and, eventually, 270MW solar and 2750MW pumped hydro, is one such company.

Tilt Renewables (ASX:TLT), which saw over a quarter of its register sold to a Kiwi power company on Monday, is another.

It has 386MW of generating wind power in Australia plus another 3001MW of wind, solar and hydro projects either in the works or proposed. That doesn’t include its New Zealand assets.

Carnegie Clean Energy (ASX:CCE), now that it has branched away from just wave power, is selling itself as a battery and solar installer (while keeping the wave tech running on the side).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.