ASX Tech Stocks: Silex wants its uranium enrichment tech in the US, Aussie stocks caught in NASDAQ riptide

Pic: Westend61 / Westend61 via Getty Images

- US tech stocks feel the heat from the Fed’s tightening policy and market reset

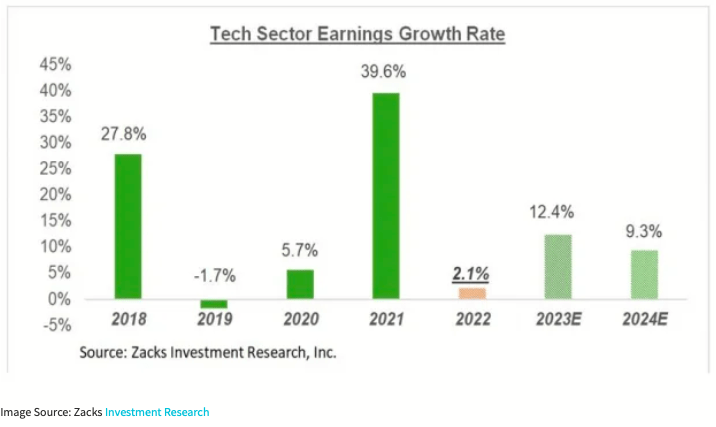

- A positive Q4 and a rebound in earnings growth could be on the cards next year

- Silex Systems could potentially deploy its uranium laser enrichment tech in the US

Technology stocks have been bearing the brunt of the ongoing market reset in response to the Fed’s tightening policy in the US.

Mainly because the bulk of most tech stocks’ profitability is somewhere in the future, which has left them vulnerable to rising interest rates.

The technology-focused Nasdaq Composite declined 0.7% yesterday, and Facebook Meta dropped 2pc on Sheryl Sandberg stepping down as COO.

Chief growth officer (which is apparently not a made-up title) Javier Olivan is replacing her, but Reuters flagged that he’s a products man and that Sandberg is taking her financial credibility – something Meta still needs – with her.

Ouch.

But it’s not all doom and gloom, the sector looks set for a positive Q4, with a rebound in earnings growth predicted from next year onwards.

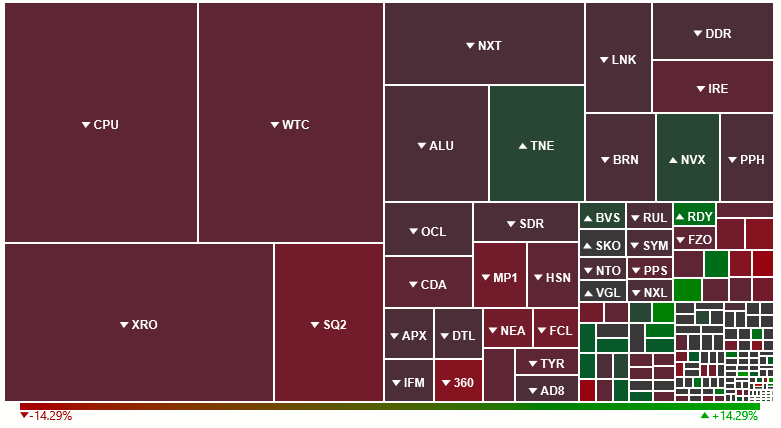

ASX tech stocks

On our side of the pond, tech stocks are catching some of the headwinds in the US, with a lot of red in the water today.

Who’s got news out today?

Silex Systems (ASX:SLX) says the exclusive licensee of its cool laser technology for uranium enrichment – Global Laser Enrichment (GLE) – has signed a letter of intent with Constellation Energy Generation to assess areas of cooperation in the nuclear fuel supply chain.

Basically, the plan is to look at deploying the tech in the US and diversifying US domestic uranium, conversion and enrichment capabilities and capacity.

It could be kind of a big deal for Silex, since Constellation is the largest producer of carbon-free energy in the US and owns, or has a major interest in, 23 nuclear power units across the US northeast.

CEO and MD Michael Goldsworthy says the possible acceleration of GLE’s commercialisation activities is in response to global nuclear fuel supply chain risks exacerbated by the Russian invasion of Ukraine.

“The US currently relies on significant imports of its nuclear fuel and is actively considering a number of initiatives to rebuild its domestic nuclear fuel supply industry to become more self-sufficient,” he said.

“This LOI signals the beginning of an important process for GLE in its effort to build key industry and commercial relationships and position itself to become a diversified US-based supplier of nuclear fuel.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.