ASX Tech September Winners: Sector underwater but iSynergy soars as it chases Web3

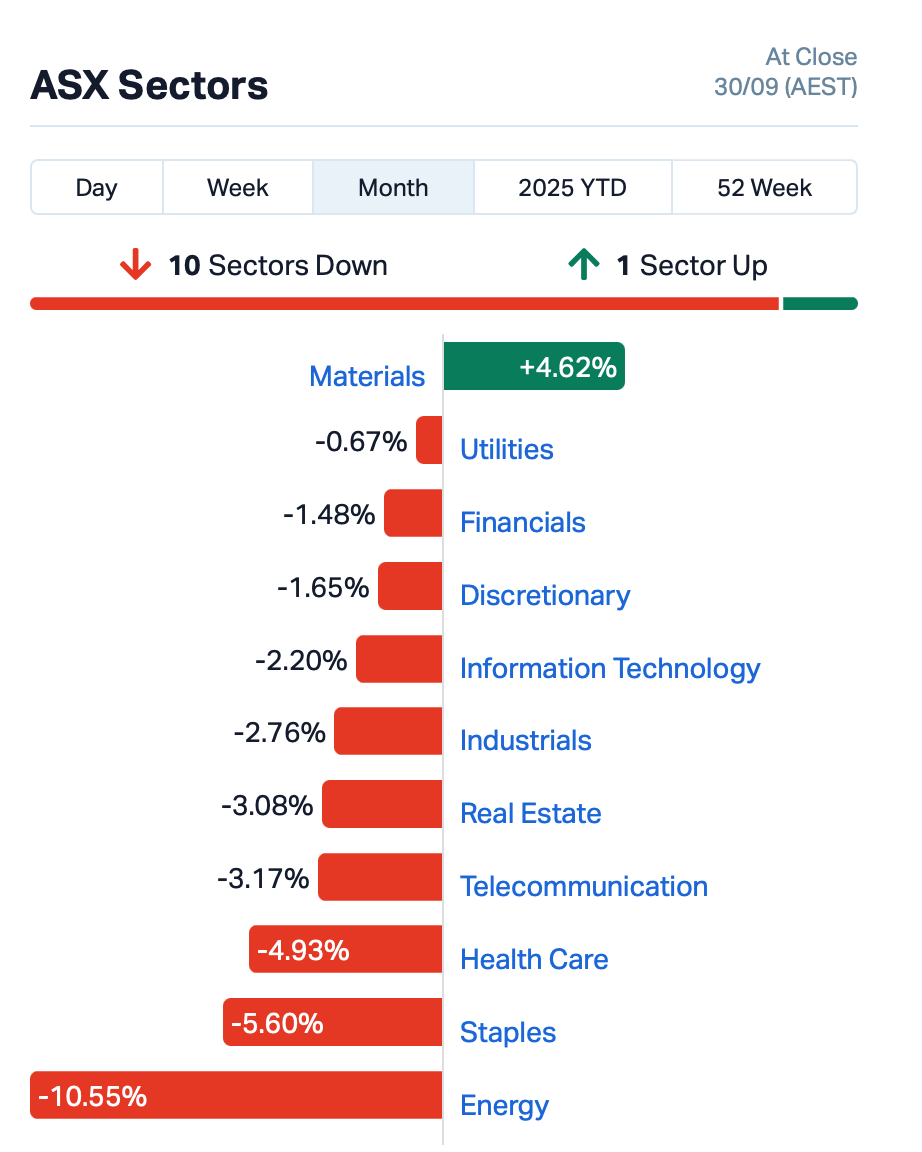

The ASX Tech sector was under water in September. Picture via Getty Images

- Mag 7 drive Wall Street’s best September in years

- ASX tech takes a beating while DroneShield soars

- I Synergy strikes Octagram deal to chase Web3 frontier

Mag 7 carries the load in September

September has historically been the weakest month of the year for global equity markets, but 2025 broke the pattern.

The Nasdaq gained more than 5% and the S&P 500 rose 3.5%, their strongest September runs in over a decade.

That rally was almost entirely carried by the Magnificent 7, and the tone around them was one of relentless momentum rather than earnings conviction.

Nvidia hit successive record highs, its market cap topping US$4.5 trillion, remaining the emblem of AI-driven excess.

Meta found a bid on resilient advertising trends, but it was Tesla that shifted sentiment most as investors took a smaller-than-feared delivery drop as a sign the slump had bottomed.

However, the one common theme was crowding.

Everyone piled into the same seven names. A bespoke ETF tracking the Mag7 rose 17.5% year-to-date by end-September versus the S&P’s 13%.

Winners and losers both plenty in ASX Tech

Back home, the ASX tech space told a different story.

The sector started the month under pressure, dropping nearly 4% in a single session as global bond yields crept higher.

The overall mood locally seems to be one of selective buying.

Investors backed companies tied to structural themes like defence or sticky SaaS models, while the rest of the sector remained hostage to rates and liquidity.

DroneShield (ASX:DRO) was one standout, surging more than 50% in September and finishing as the best performer on the ASX 200, driven by escalating global defence demand.

ASX tech leaders in September

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.027 | 200% | $45,127,292 |

| SIS | Simble Solutions | 0.007 | 75% | $7,618,312 |

| SNS | Sensen Networks Ltd | 0.07 | 75% | $55,967,168 |

| EOS | Electro Optic Sys. | 10.12 | 74% | $1,971,970,452 |

| DUG | DUG Tech | 2.72 | 68% | $368,979,358 |

| DTZ | Dotz Nano Ltd | 0.09 | 64% | $55,846,546 |

| AT1 | Atomo Diagnostics | 0.03 | 58% | $24,305,258 |

| SLX | Silex Systems | 6.525 | 57% | $1,819,149,587 |

| OLL | Openlearning | 0.022 | 57% | $10,621,775 |

| DRO | Droneshield Limited | 4.99 | 51% | $4,076,189,860 |

| LNU | Linius Tech Limited | 0.0015 | 50% | $13,179,029 |

| ATV | Activeportgroupltd | 0.034 | 48% | $34,269,127 |

| HYD | Hydrix Limited | 0.023 | 44% | $6,273,683 |

| 8CO | 8Common Limited | 0.037 | 42% | $8,291,511 |

| CML | Connected Minerals | 0.18 | 38% | $8,478,433 |

| ID8 | Identitii Limited | 0.011 | 38% | $9,053,149 |

| SOR | Strategic Elements | 0.059 | 37% | $27,960,045 |

| SEN | Senetas Corporation | 0.027 | 35% | $44,712,515 |

| CT1 | Constellation Tech | 0.002 | 33% | $2,949,467 |

| AJX | Alexium Int Group | 0.008 | 33% | $12,873,043 |

| XPN | Xpon Technologies | 0.012 | 33% | $5,884,276 |

| SP3 | Specturltd | 0.029 | 32% | $9,190,104 |

| BVS | Bravura Solution Ltd | 2.88 | 29% | $1,134,198,937 |

| VR1 | Vection Technologies | 0.068 | 26% | $118,550,510 |

| FBR | FBR Ltd | 0.005 | 25% | $32,375,888 |

| W2V | Way2Vatltd | 0.01 | 25% | $19,142,854 |

| EOL | Energy One Limited | 17.48 | 24% | $553,605,095 |

| HTG | Harvest Tech Grp Ltd | 0.021 | 24% | $19,035,319 |

| RUL | Rpmglobal Hldgs Ltd | 4.64 | 23% | $1,022,779,227 |

| XRG | Xreality Group Ltd | 0.06 | 20% | $43,233,660 |

| DXN | DXN Limited | 0.062 | 19% | $18,519,626 |

| TAL | Talius Group Limited | 0.09 | 18% | $25,807,393 |

| PHX | Pharmx Technologies | 0.135 | 17% | $80,798,417 |

| DWG | Dataworks Group | 0.07 | 17% | $7,155,683 |

| KYP | Kinatico Ltd | 0.32 | 16% | $138,269,435 |

| NOV | Novatti Group Ltd | 0.038 | 15% | $20,804,955 |

| ACE | Acusensus Limited | 1.195 | 15% | $165,520,601 |

| EPX | EPX Limited | 0.039 | 15% | $29,272,861 |

| 360 | Life360 Inc. | 52.91 | 14% | $9,074,216,866 |

| OEC | Orbital Corp Limited | 0.25 | 14% | $44,766,358 |

| 5GN | 5G Networks Limited | 0.145 | 12% | $42,904,874 |

| WBT | Weebit Nano Ltd | 3.15 | 11% | $663,731,619 |

| CAT | Catapult Sports Ltd | 6.9 | 11% | $1,951,803,389 |

| FLX | Felix Group | 0.22 | 10% | $51,103,669 |

| CYB | Aucyber Limited | 0.078 | 10% | $16,282,315 |

| NXL | Nuix Limited | 2.92 | 10% | $980,545,561 |

| OAK | Oakridge | 0.093 | 9% | $2,510,805 |

| RKN | Reckon Limited | 0.645 | 9% | $72,508,692 |

| CCR | Credit Clear | 0.265 | 8% | $112,531,890 |

| RKT | Rocketdna Ltd. | 0.014 | 8% | $12,817,325 |

| DDR | Dicker Data Limited | 9.8 | 7% | $1,773,201,390 |

| ELS | Elsight Ltd | 1.79 | 6% | $365,927,053 |

| SKO | Serko | 2.34 | 6% | $291,564,351 |

| QOR | Qoria Limited | 0.7075 | 6% | $966,881,318 |

| MX1 | Micro-X Limited | 0.081 | 5% | $54,093,501 |

| JAN | Janison Edu Group | 0.22 | 5% | $57,175,415 |

| SMN | Structural Monitor. | 0.48 | 4% | $72,570,373 |

| PKY | Pathkey.Ai Ltd | 0.025 | 4% | $7,568,726 |

| LVE | Love Group Global | 0.13 | 4% | $5,269,442 |

| ERD | Eroad Limited | 2.29 | 3% | $429,305,968 |

| IKE | Ikegps Group Ltd | 0.83 | 3% | $160,848,254 |

| IRE | IRESS Limited | 8.85 | 1% | $1,647,483,161 |

| AD8 | Audinate Group Ltd | 4.77 | 1% | $405,999,055 |

| NXT | Nextdc Limited | 16.62 | 1% | $10,835,840,243 |

| IFM | Infomedia Ltd | 1.685 | 1% | $635,745,079 |

IS3 surged after striking a one-year strategic partnership with Malaysia’s Octagram Investment to push deeper into Web3 and immersive tech.

The deal, which began on 23 September, will see the two co-develop AI-driven marketing tools, blockchain-based rewards systems, and cross-platform gaming solutions across engines like Unity, Unreal, Steam and Meta.

Each side keeps its own IP and brands, with a limited licence to use the other’s trademarks during the partnership. The agreement is non-exclusive.

IS3 says the tie-up is strategically significant, opening doors into AI, VR and blockchain applications in gaming and entertainment.

SIS rose after landing a $760k, three-year deal with UK forecourt operator Ascona to roll out its SimbleSense energy intelligence platform across 60+ sites.

Installations began in April and are due to finish by December, giving Ascona real-time tools to track energy use, identify inefficiencies and cut costs as part of its net-zero push.

The win is a key validation of Simble’s UK growth strategy.

Separately, Simble confirmed it has sold its entire Bittensor (TAO) holding for ~$190k, crystallising a ~$10k loss, and will no longer pursue digital assets.

Proceeds will be directed to working capital.

SNS, which provides AI-powered “Live Awareness” solutions for cities and enterprises, has booked $2m in new contracts across Singapore, the US and Australia for FY26.

The wins cover AI compliance systems for Singapore Transit, digital kerbside and mobile enforcement in Philadelphia and West Palm Beach, plus new and expanded deployments with local councils and major fuel retailers to combat theft and map assets.

The company also cleared $1.5m in receivables from Montreal, and says its stronger balance sheet leaves it well placed to scale as adoption of its AI platform grows.

Electro Optic Systems (ASX:EOS)

EOS expects 2025 revenue of $115–125m from existing contracts, with a chance of up to another $25m if new orders land in time for delivery this year.

Revenue is heavily weighted to the second half as EOS continues manufacturing and pursues advanced opportunities.

This includes the $100m Land 400-3 program in Australia, a $20m European RWS (remote weapons system) deal and a $50m counter-drone contract in North America.

The company’s contract backlog has grown to ~$299m, up $163m since December 2024, supported by wins in Europe, NATO and Australia.

While some deals have slipped into Q4 or 2026, EOS says its pipeline remains strong.

DUG Technology (ASX:DUG) has received the first purchase order from PETRONAS for cloud-based supercomputing (HPCaaS) and software-as-a-service (SaaS), worth US$14.9m for year one.

The order covers compute and storage capacity, access to DUG Insight geophysical software, and support from dedicated geophysicists.

The deal lifts the expected three-year contract value to at least US$43.3m, almost double the US$23.8m originally flagged.

ASX tech laggards in September

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| 4DS | 4DS Memory Limited | 0.0085 | -70% | $18,548,088 |

| SPX | Spenda Limited | 0.004 | -43% | $18,460,862 |

| IFG | Infocusgroup Hldltd | 0.023 | -38% | $10,067,353 |

| PRO | Prophecy Internation | 0.22 | -36% | $16,225,645 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | $6,179,560 |

| PFM | Platformo Ltd | 0.036 | -32% | $3,416,699 |

| 1TT | Thrive Tribe Tech | 0.003 | -30% | $1,649,964 |

| FCT | Firstwave Cloud Tech | 0.012 | -29% | $20,562,224 |

| PPK | PPK Group Limited | 0.38 | -28% | $34,508,749 |

| BCC | Beam Communications | 0.093 | -26% | $8,037,239 |

| DTI | DTI Group Ltd | 0.006 | -25% | $5,382,617 |

| RWL | Rubicon Water | 0.14 | -24% | $33,697,314 |

| AI1 | Adisyn Ltd | 0.054 | -24% | $41,275,159 |

| ESK | Etherstack PLC | 0.4 | -23% | $53,124,801 |

| FL1 | First Lithium Ltd | 0.105 | -22% | $11,410,728 |

| EXT | Excite Technology | 0.007 | -22% | $14,508,494 |

| NVX | Novonix Limited | 0.445 | -22% | $307,801,534 |

| EIQ | Echoiq Ltd | 0.17 | -19% | $110,123,911 |

| 1CG | One Click Group Ltd | 0.009 | -18% | $10,640,575 |

| ZMM | Zimi Ltd | 0.01 | -17% | $7,360,438 |

| DUB | Dubber Corp Ltd | 0.018 | -14% | $47,250,539 |

| IRI | Integrated Research | 0.38 | -14% | $68,624,885 |

| LIS | Lisenergylimited | 0.14 | -13% | $92,829,033 |

| NVQ | Noviqtech Limited | 0.029 | -12% | $7,302,617 |

| WTC | Wisetech Global Ltd | 89.5 | -12% | $30,326,074,487 |

| EML | EML Payments Ltd | 1 | -12% | $383,597,965 |

| XYZ | Block Inc | 109 | -11% | $4,907,922,018 |

| TYR | Tyro Payments | 1.1 | -11% | $592,100,897 |

| XF1 | Xref Limited | 0.17 | -11% | $37,415,260 |

| DCC | Digitalx Limited | 0.061 | -10% | $90,813,909 |

| AMO | Ambertech Limited | 0.18 | -10% | $17,172,861 |

| FND | Findi Limited | 3.37 | -10% | $207,652,103 |

| SPA | Spacetalk Ltd | 0.145 | -9% | $10,644,839 |

| RDY | Readytech Holdings | 2.13 | -9% | $268,134,112 |

| ASV | Assetvisonco | 0.042 | -9% | $31,441,686 |

| FCL | Fineos Corp Hold PLC | 2.75 | -8% | $951,361,313 |

| ROC | Rocketboots | 0.11 | -8% | $18,844,469 |

| 3DP | Pointerra Limited | 0.046 | -8% | $38,643,686 |

| HCL | Highcom Ltd | 0.29 | -8% | $30,804,802 |

| RCL | Readcloud | 0.088 | -7% | $13,518,539 |

| X2M | X2M Connect Limited | 0.013 | -7% | $13,287,777 |

| TZL | TZ Limited | 0.044 | -6% | $12,437,220 |

| AR9 | Archtis Limited | 0.15 | -6% | $68,972,829 |

| VNL | Vinyl Group Ltd | 0.092 | -6% | $127,063,939 |

| KNO | Knosys Limited | 0.031 | -6% | $6,700,300 |

| AVA | AVA Risk Group Ltd | 0.078 | -6% | $22,679,728 |

| ATA | Atturralimited | 0.75 | -6% | $282,250,398 |

| CPU | Computershare Ltd | 36.2 | -5% | $20,989,666,770 |

| UBN | Urbanise.Com Ltd | 0.74 | -5% | $58,234,489 |

| PPS | Praemium Limited | 0.76 | -5% | $363,063,532 |

| CDA | Codan Limited | 29.45 | -5% | $5,368,632,749 |

| TNE | Technology One | 38.15 | -5% | $12,590,594,087 |

| GTI | Gratifii | 0.105 | -5% | $40,163,194 |

| OCL | Objective Corp | 19.98 | -5% | $1,911,511,495 |

| XRO | Xero Ltd | 156.77 | -4% | $26,047,605,780 |

| MP1 | Megaport Limited | 15.81 | -4% | $2,551,765,242 |

| CXZ | Connexion Mobility | 0.026 | -4% | $21,017,463 |

| AXE | Archer Materials | 0.265 | -4% | $66,260,223 |

| GTK | Gentrack Group Ltd | 8.91 | -3% | $955,493,218 |

| ODA | Orcoda Limited | 0.073 | -3% | $13,688,537 |

| SPZ | Smart Parking Ltd | 0.97 | -3% | $393,746,795 |

| BRN | Brainchip Ltd | 0.2 | -2% | $407,148,347 |

| VIG | Victor Group Hldgs | 0.041 | -2% | $30,752,488 |

| JCS | Jcurve Solutions | 0.045 | -2% | $15,855,455 |

| BEO | Beonic Ltd | 0.24 | -2% | $16,222,933 |

| VGL | Vista Group Int Ltd | 2.62 | -2% | $625,746,078 |

| HSN | Hansen Technologies | 5.85 | -2% | $1,198,379,959 |

| YOJ | Yojee Limited | 0.42 | -1% | $151,221,760 |

| NVU | Nanoveu Limited | 0.099 | -1% | $96,679,502 |

| SMP | Smartpay Holdings | 1.03 | -1% | $247,992,051 |

| DTL | Data#3 Limited | 9.16 | -1% | $1,423,614,580 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.