ASX tech players have outdone their US counterparts during COVID-19

Getty Images.

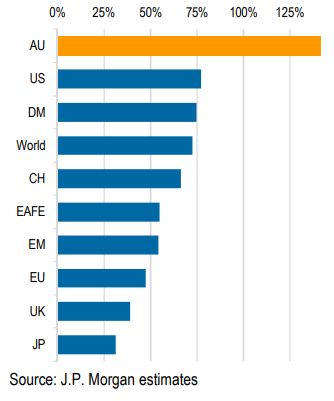

While the ASX’s headline indices are still below pre-COVID lows unlike the American exchanges, our tech sector has performed better than the US during COVID-19.

The MSCI Australia IT sector performance since March 23 is up 142 per cent while the US is up just over 75 per cent.

In fact our tech sector has outperformed all of its global peers.

The average performance of all ASX stocks in the tech sector paints an even rosier picture, with a 190 per cent gain. Forty-seven stocks have more than tripled in value and six have risen over 1,000 per cent.

Ophir Asset Manager co-founder Andrew Mitchell said the Australian tech sector would need to continue its strong performance if it wanted to establish itself as a leader.

“As a wealthy developed economy with a good education system we are going to need to be a leader here to help drive domestic productivity going forward, There’s no reason why we can’t,” he said.

Here are all the ASX tech stocks and their performance since March 23:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Return Since March 24 | Market Cap |

|---|---|---|---|---|

| SZL | SEZZLE INC-CDI | 8.65 | 2010 | 1.64B |

| CRO | CIRRALTO LTD | 0.04 | 1650 | 55.35M |

| 3DP | POINTERRA LTD | 0.42 | 1590 | 271.14M |

| SE1 | SENSERA LTD | 0.06 | 1370 | 19.01M |

| BRN | BRAINCHIP HOLDINGS LTD | 0.53 | 1220 | 733.75M |

| YOJ | YOJEE LTD | 0.22 | 1190 | 177.60M |

| OPY | OPENPAY | 3.68 | 1040 | 396.4M |

| TYM | TYMLEZ GROUP LTD | 0.14 | 976.92 | 37.40M |

| IP1 | INTEGRATED PAYMENT TECHNOLOG | 0.04 | 914.8 | 21.07M |

| IHR | INTELLIHR LTD | 0.28 | 868.69 | 62.92M |

| BUD | BUDDY TECHNOLOGIES LTD | 0.08 | 825 | 192.48M |

| NVX | NOVONIX LTD | 1.6 | 803.16 | 566.24M |

| TNT | TESSERENT LTD | 0.27 | 728.12 | 173.51M |

| APT | AFTERPAY LTD | 84.08 | 635.95 | 23.44B |

| AR9 | ARCHTIS LTD | 0.44 | 633.33 | 70.98M |

| SPT | SPLITIT PAYMENTS LTD | 1.66 | 585.42 | 642.86M |

| MYQ | MYFIZIQ LTD | 0.46 | 538.89 | 52.85M |

| FZO | FAMILY ZONE CYBER SAFETY LTD | 0.47 | 535.14 | 155.11M |

| KTE | K2 ENERGY LTD | 0.03 | 525 | 7.52M |

| WSP | WHISPIR LTD | 4.28 | 483.33 | 436.28M |

| Z1P | ZIP CO | 7.10 | 478 | 3.6B |

| VLT | VAULT INTELLIGENCE LTD | 0.58 | 452.38 | 74.24M |

| DTZ | DOTZ NANO LTD | 0.2 | 400 | 63.55M |

| BLG | BLUGLASS LTD | 0.08 | 341.41 | 84.99M |

| CAT | CATAPULT GROUP INTERNATIONAL | 2.37 | 335.19 | 448.60M |

| NUH | NUHEARA LTD | 0.05 | 333.33 | 72.36M |

| KNO | KNOSYS LTD | 0.12 | 307.41 | 16.37M |

| IAM | INTIGER GROUP LTD | 0 | 300 | 7.74M |

| HYD | HYDRIX LTD | 0.36 | 293.08 | 40.64M |

| LVH | LIVEHIRE LTD | 0.32 | 290.24 | 95.75M |

| 9SP | 9 SPOKES INTERNATIONAL LTD | 0.04 | 290 | 47.41M |

| HTG | HARVEST TECHNOLOGY GROUP LTD | 0.34 | 286.36 | 155.65M |

| 5GN | 5G NETWORKS LTD/AUSTRALIA | 2.18 | 284.21 | 200.59M |

| VR1 | VECTION TECHNOLOGIES LTD | 0.06 | 275 | 50.26M |

| HSC | HSC TECHNOLOGY GROUP LTD | 0.01 | 250 | 23.46M |

| DTC | DAMSTRA HOLDINGS LTD | 1.88 | 245.28 | 255.25M |

| NEA | NEARMAP LTD | 3.11 | 241.76 | 1.41B |

| ST1 | SPIRIT TELECOM LTD | 0.44 | 238.46 | 230.44M |

| TYR | TYRO PAYMENTS LTD | 3.61 | 238.32 | 1.81B |

| OPL | OPYL LTD | 0.22 | 225 | 4.80M |

| WBT | WEEBIT NANO LTD | 0.73 | 222.73 | 74.63M |

| DCC | DIGITALX LTD | 0.04 | 221.43 | 27.54M |

| BTH | BIGTINCAN HOLDINGS LTD | 1.27 | 220 | 482.58M |

| AO1 | ASSETOWL LTD | 0.01 | 217.31 | 4.41M |

| AVA | AVA RISK GROUP LTD | 0.3 | 215.79 | 70.67M |

| ESK | ETHERSTACK PLC-CDI | 0.62 | 210 | 74.99M |

| IOD | IODM LTD | 0.17 | 209.09 | 95.11M |

| SLX | SILEX SYSTEMS LTD | 0.57 | 200 | 101.07M |

| VOR | VORTIV LTD | 0.25 | 200 | 33.47M |

| COS | COSOL LTD | 0.73 | 196 | 94.35M |

| CGL | CITADEL GROUP LTD/THE | 4.34 | 192.41 | 343.96M |

| LNU | LINIUS TECHNOLOGIES LTD | 0.02 | 187.5 | 30.14M |

| CPT | CIPHERPOINT LTD | 0.06 | 181.93 | 5.66M |

| NTO | NITRO SOFTWARE LTD | 2.27 | 176.83 | 432.10M |

| OCL | OBJECTIVE CORPORATION LTD | 12.41 | 169.82 | 1.15B |

| 8CO | 8COMMON LTD | 0.14 | 165.31 | 23.78M |

| EOL | ENERGY ONE LTD | 4.25 | 163.75 | 107.98M |

| ADA | ADACEL TECHNOLOGIES LTD | 0.78 | 163.27 | 59.24M |

| HWH | HOUSTON WE HAVE LTD | 0.04 | 162.5 | 10.99M |

| SBW | SHEKEL BRAINWEIGH LTD | 0.19 | 160 | 27.11M |

| CCG | COMMSCHOICE GROUP LTD | 0.1 | 156.1 | 20.10M |

| ADS | ADSLOT LTD. | 0.02 | 155.56 | 42.41M |

| EVS | ENVIROSUITE LTD | 0.2 | 153.09 | 210.06M |

| SIS | SIMBLE SOLUTIONS LTD | 0.03 | 150 | 6.05M |

| K2F | K2FLY LTD | 0.38 | 150 | 34.65M |

| FGO | FLAMINGO AI LTD | 0 | 150 | 2.80M |

| 360 | LIFE360 INC-CDI | 4.15 | 145.45 | 623.55M |

| EPD | EMPIRED LTD | 0.5 | 145.24 | 82.54M |

| NOV | NOVATTI GROUP LTD | 0.23 | 144.68 | 52.00M |

| UBN | URBANISE.COM LTD | 0.07 | 142.86 | 50.68M |

| PPS | PRAEMIUM LTD | 0.51 | 142.86 | 208.43M |

| CDA | CODAN LTD | 10.91 | 140.3 | 1.97B |

| DUB | DUBBER CORP LTD | 1.23 | 139.22 | 253.66M |

| EML | EML PAYMENTS LTD | 3.23 | 139.1 | 1.15B |

| AMO | AMBERTECH LTD | 0.1 | 138.1 | 7.65M |

| FSG | FIELD SOLUTIONS HOLDINGS LTD | 0.05 | 135 | 24.93M |

| OTW | OVER THE WIRE HOLDINGS LTD | 4.27 | 132.07 | 220.55M |

| MP1 | MEGAPORT LTD | 17.03 | 131.99 | 2.66B |

| GSW | GETSWIFT LTD | 0.68 | 130.51 | 146.42M |

| NVU | NANOVEU LTD | 0.07 | 130 | 9.51M |

| MAQ | MACQUARIE TELECOM GROUP LTD | 46.5 | 129.06 | 992.31M |

| BID | BIDENERGY LTD | 1 | 127.78 | 134.48M |

| ELS | ELSIGHT LTD | 0.59 | 125.93 | 65.28M |

| SLC | SUPERLOOP LTD | 1.16 | 122.55 | 415.26M |

| CXZ | CONNEXION TELEMATICS LTD | 0.02 | 122.22 | 17.26M |

| DXN | DXN LTD | 0.03 | 121.15 | 26.39M |

| DTL | DATA#3 LTD | 6.37 | 119.05 | 991.60M |

| VN8 | VONEX LTD | 0.14 | 116.67 | 24.15M |

| MSL | MSL SOLUTIONS LTD. | 0.06 | 116.67 | 20.95M |

| CCA | CHANGE FINANCIAL LTD | 0.11 | 116.07 | 29.79M |

| RKN | RECKON LTD | 0.83 | 115.53 | 94.03M |

| WTC | WISETECH GLOBAL LTD | 28.83 | 114.78 | 9.51B |

| DSE | DROPSUITE LTD | 0.07 | 112.12 | 39.34M |

| NNT | 99 TECHNOLOGY LTD | 0.09 | 108.89 | 109.01M |

| FCL | FINEOS CORP HOLDINGS PLC-CDI | 5.42 | 104.14 | 1.60B |

| KYK | KYCKR LTD | 0.08 | 102.7 | 25.79M |

| MNW | MINT PAYMENTS LTD | 0.01 | 100 | 15.88M |

| TDY | THEDOCYARD LTD | 0.19 | 100 | 27.82M |

| SKF | SKYFII LTD | 0.18 | 100 | 62.34M |

| CL1 | CLASS LTD | 1.84 | 96.28 | 231.43M |

| IXU | IXUP LTD | 0.05 | 95.56 | 19.61M |

| RXP | RXP SERVICES LTD | 0.41 | 95.24 | 66.05M |

| SCL | SCHROLE GROUP LTD | 0.02 | 90 | 27.99M |

| PRO | PROPHECY INTERNATIONAL HLDGS | 0.57 | 88.33 | 36.19M |

| APX | APPEN LTD | 34.56 | 87.51 | 4.17B |

| MOQ | MOQ LTD | 0.15 | 87.5 | 26.62M |

| CNW | CIRRUS NETWORKS HOLDINGS LTD | 0.03 | 87.5 | 26.50M |

| RDY | READYTECH HOLDINGS LTD | 1.9 | 87.06 | 150.41M |

| AD8 | AUDINATE GROUP LTD | 5.28 | 84.81 | 397.82M |

| CV1 | CV CHECK LTD | 0.13 | 81.13 | 28.05M |

| RUL | RPMGLOBAL HOLDINGS LTD | 1.16 | 78.46 | 263.59M |

| IRI | INTEGRATED RESEARCH LTD | 4.06 | 77.77 | 711.79M |

| LVT | LIVETILES LTD | 0.23 | 76.92 | 207.51M |

| DDR | DICKER DATA LTD | 7.7 | 76.48 | 1.31B |

| UNL | UNITED NETWORKS LTD | 0.04 | 76 | 17.26M |

| MOB | MOBILICOM LTD/AUSTRALIA | 0.09 | 75.51 | 22.18M |

| SP3 | SPECTUR LTD | 0.07 | 73.17 | 7.52M |

| DWS | DWS LTD | 0.94 | 70.91 | 123.92M |

| VOC | VOCUS GROUP LTD | 3.36 | 70.62 | 2.05B |

| 4DS | 4DS MEMORY LTD | 0.05 | 67.86 | 61.56M |

| WCG | WEBCENTRAL GRP LTD | 0.12 | 64.18 | 13.43M |

| SNS | SENSEN NETWORKS LTD | 0.09 | 63.64 | 40.55M |

| XRO | XERO LTD | 99.91 | 63.26 | 14.70B |

| ISD | ISENTIA GROUP LTD | 0.19 | 60.87 | 37.00M |

| UWL | UNITI GROUP LTD | 1.49 | 60.71 | 764.61M |

| NXT | NEXTDC LTD | 11.92 | 59.95 | 5.53B |

| JCS | JCURVE SOLUTIONS LTD | 0.03 | 57.14 | 10.82M |

| CPU | COMPUTERSHARE LTD | 13.24 | 54.81 | 7.08B |

| CT1 | CONSTELLATION TECHNOLOGIES L | 0.03 | 52.94 | 35.19M |

| COO | CORUM GROUP LTD | 0.05 | 51.43 | 21.34M |

| FCT | FIRSTWAVE CLOUD TECHNOLOGY L | 0.12 | 46.94 | 77.72M |

| LNK | LINK ADMINISTRATION HOLDINGS | 4.08 | 44.3 | 2.18B |

| SPZ | SMART PARKING LTD | 0.1 | 42.86 | 35.92M |

| SF1 | STEMIFY LTD | 0.02 | 42.86 | 3.14M |

| FTC | FINTECH CHAIN LTD | 0.09 | 42.62 | 56.62M |

| ALU | ALTIUM LTD | 36.29 | 41.8 | 4.78B |

| NET | NETLINKZ LTD | 0.07 | 41.3 | 137.14M |

| JXT | JAXSTA LTD | 0.03 | 40.91 | 7.66M |

| ELO | ELMO SOFTWARE LTD | 5.7 | 39.76 | 490.84M |

| HSN | HANSEN TECHNOLOGIES LTD | 3.94 | 39.31 | 788.31M |

| TZL | TZ LTD | 0.05 | 37.5 | 5.04M |

| OPC | OPTICOMM LTD | 5.1 | 37.47 | 530.78M |

| BIQ | BUILDINGIQ INC-CDI | 0.01 | 35.71 | 3.55M |

| CWL | CONSOLIDATED FINANCIAL HOLDI | 0.12 | 35.29 | 14.59M |

| HTA | HUTCHISON TELECOMM (AUST) | 0.14 | 35 | 1.83B |

| AV1 | ADVERITAS LTD | 0.11 | 33.33 | 32.04M |

| RHP | RHIPE LTD | 1.97 | 31.42 | 313.40M |

| JAN | JANISON EDUCATION GROUP LTD | 0.36 | 30.91 | 75.48M |

| DTI | DTI GROUP LTD | 0.03 | 30 | 8.71M |

| RCW | RIGHTCROWD LTD | 0.25 | 28.95 | 54.27M |

| ID8 | IDENTITII LTD | 0.23 | 28.77 | 25.62M |

| SEN | SENETAS CORP LTD | 0.05 | 28.57 | 58.44M |

| PYG | PAYGROUP LTD | 0.65 | 27.45 | 45.97M |

| PVS | PIVOTAL SYSTEMS CORP INC-CDI | 1.14 | 27.22 | 130.54M |

| OLL | OPENLEARNING LTD | 0.31 | 26.09 | 40.99M |

| XF1 | XREF LTD | 0.16 | 26 | 28.51M |

| BCC | BEAM COMMUNICATIONS HOLDINGS | 0.22 | 25.71 | 11.63M |

| LVE | LOVE GROUP GLOBAL LTD | 0.05 | 25 | 2.03M |

| IFM | INFOMEDIA LTD | 1.66 | 24.65 | 619.73M |

| MNF | MNF GROUP LTD | 5.02 | 24.57 | 423.24M |

| TCN | TECHNICHE LTD | 0.04 | 22.58 | 8.01M |

| CIO | CONNECTED IO LTD | 0.02 | 20 | 5.95M |

| RDF | REDFLEX HOLDINGS LTD | 0.4 | 19.7 | 59.87M |

| IRE | IRESS LTD | 10.68 | 14.95 | 2.06B |

| SMX | SECURITY MATTERS LTD | 0.37 | 14.06 | 47.11M |

| BVS | BRAVURA SOLUTIONS LTD | 3.72 | 12.69 | 919.31M |

| RCL | READCLOUD LTD | 0.36 | 10.77 | 35.81M |

| LME | LIMEADE INC-CDI | 1.54 | 10 | 378.31M |

| APV | APPSVILLAGE AUSTRALIA LTD | 0.11 | 10 | 10.87M |

| NOR | NORWOOD SYSTEMS LTD | 0.03 | 8 | 6.69M |

| TNE | TECHNOLOGY ONE LTD | 7.86 | 7.8 | 2.51B |

| BCT | BLUECHIIP LTD | 0.06 | 7.41 | 34.40M |

| DTS | DRAGONTAIL SYSTEMS LTD | 0.09 | 5.81 | 25.97M |

| WJA | WAMEJA LTD | 0.1 | 5.56 | 115.03M |

| HIL | HILLS LTD | 0.15 | 3.45 | 34.80M |

| FGL | FRUGL GROUP LTD | 0.03 | 0 | 2.67M |

| XPE | XPED LTD | 0.002 | 0 | 1.79M |

| SYT | SYNTONIC LTD | 0.001 | 0 | 6.94M |

| RFN | REFFIND LTD | 0.002 | 0 | 2.49M |

| ICE | ICETANA LTD | 0.13 | -3.85 | 17.13M |

| TLS | TELSTRA CORP LTD | 2.92 | -5.75 | 34.49B |

| SMN | STRUCTURAL MONITORING-CDI | 0.47 | -8.49 | 57.97M |

| CGO | CPT GLOBAL LIMITED | 0.19 | -11.63 | 7.27M |

| FRX | FLEXIROAM LTD | 0.02 | -21.84 | 6.92M |

| TGO | TRIMANTIUM GROWTHOPS LTD | 0.06 | -24.05 | 9.12M |

| IS3 | I SYNERGY GROUP LIMITED | 0.08 | -25 | 13.75M |

| CLT | CELLNET GROUP LTD | 0.04 | -25.88 | 9.26M |

| CAG | CAPE RANGE LTD | 0.25 | -26.47 | 23.73M |

| ODA | ORCODA LTD | 0.1 | -28.57 | 11.60M |

| QFY | QUANTIFY TECHNOLOGY HOLDINGS | 0.001 | -50 | 2.01M |

Buy now, pay later sector is a standout

Much of the hype in the tech sector has been about buy now, pay later (BNPL) stocks. It has been a spectacular few months for the sector with the ‘worst’ performer FlexiGroup (ASX:FXL), which is up ‘only’ 190 per cent.

Leading the charge of BNPL stocks and all tech stocks is Minneapolis-based Sezzle (ASX:SZL), which is up over 2,000 per cent. Openpay (ASX:OPY) is close behind, notching up a gain of over 1,000 per cent.

The sector has seen solid growth in 2020 in Australia among individual consumers and new sectors too. Additionally, some companies, particularly Zip Co (ASX:Z1P) and Afterpay (ASX:APT), have expanded into overseas markets.

The other top performing sectors

But BNPL stocks aren’t the only winners. There are several other tech stocks that have had a solid few months and are in fast growing sectors.

Internet of Things (IoT) tracking tech company Sensera (ASX:SE1) is another company sitting on a 1,000 per cent gain.

It witnessed solid revenue growth in recent months and won a major contract with US tech firm Triton Systems to utilise its technology.

Geospatial analytics company Pointerra (ASX:3DP) has been a late bloomer but hasn’t stopped advancing since Bevan Slattery invested $2.5m into the company.

Fintech stocks have seen good times too, particularly stocks in the payments space.

Cirralto (ASX:CRO) took out the silver medal among all tech stocks, having sky rocketed in recent weeks as it has grown its point of sale payment systems.

The sector’s other top performers include 9Spokes (ASX:9SP), up 290 per cent, and Integrated Paymant Technologies (ASX:IP1), which is up 915 per cent.

Cybersecurity is another sector that’s been a winner, particularly since the Morrison government’s increase in spending to boost to its cybersecurity capabilities and unveiling of a national cybersecurity strategy.

Leading the charge in this space is Tesserent (ASX:TNT), which is up over 700 per cent since late March off the back of earnings growth and acquisitions.

Other winners include Family Zone Cyber (ASX:FZO) — up over 500 per cent, and Vortiv (ASX:VOR) which has tripled.

At Stockhead, we tell it like it is. While Cirralto and Vortiv are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.