ASX Tech March Winners: Sector up 55% YTD as Aussie retail investors still love ‘Magnificent 7’

Pic: Getty Images

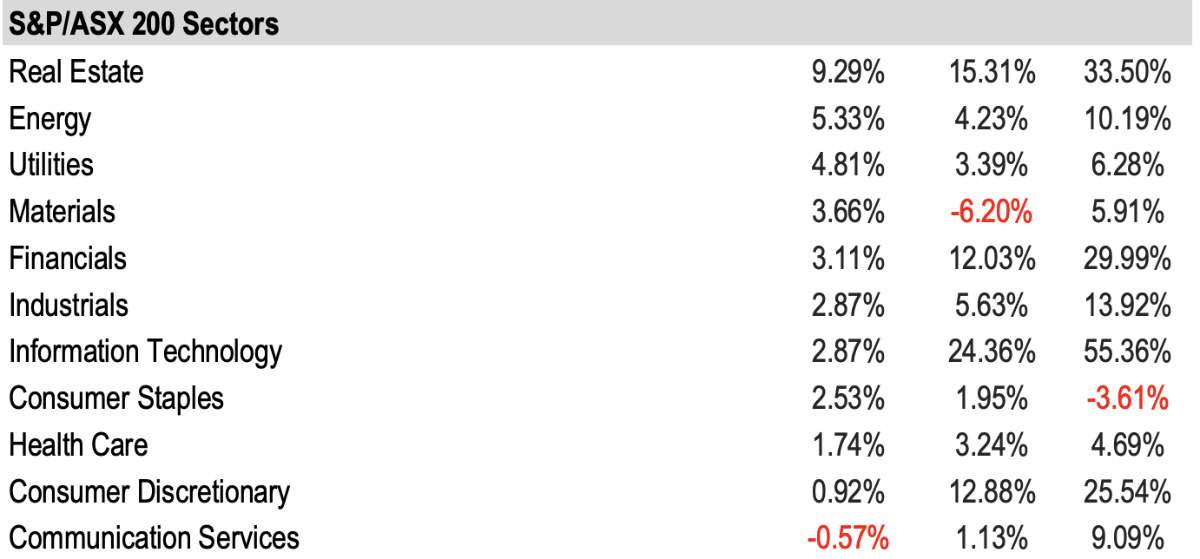

- ASX tech sector up 2.87% in March, outpacing broader markets YTD with a 24.36% rise

- eToro data shows one in five Aussie retail investors intend to up investment in ‘Magnificient 7’ in 2024

- Restaurant tech company TASK Group announces it will be bought out by NASDAQ-listed PAR Technology Corporation

After soaring 19.48% to be the top performer of the bourse’s 11 sectors in February the S&P/ASX 200 Info Tech (ASX:XIJ) index continued to rise in March but at a lesser pace, up 2.87%.

Tech remains the top performer of all 11 sectors on the ASX this year and is up more than 55% YTD as investor interest remains around artificial intelligence (AI).

The US NASDAQ Composite index, the bellwether for the global tech sector which rallied by more than 44% in 2023, rose 1.8% in March and is up 9.3% YTD with markets shaking off ongoing concerns over inflation and the US Fed Reserve’s future rate trajectory.

And it seems Aussies still love the ‘Magnificent 7’ big tech stocks in 2024. According to data from eToro’s latest Retail Investor Beat (RIB), one in five retail Australian investors intends to increase their investments in the ‘Magnificent 7’ including Amazon, Apple, Microsoft, Meta, Tesla, Nvidia, and Alphabet this year.

Among the 1,000 Australian retail investors surveyed, 7% expressed plans to sell some of their holdings in the Magnificent 7 in 2024 to secure profits.

Additionally, 10% stated their intention to decrease the amount of new capital they invest in these companies in the coming months, while the majority (42%) don’t plan any changes to their allocation.

The RIB findings come after a prosperous 14 months for the seven companies, with their collective share price witnessing a 90% surge since January 2023.

Regarding sector preferences for 2024, Aussie retail investors showed a preference for tech (15%), followed by financial services (12%).

The proportion of investors holding AI-related stocks remains stable, slightly declining from 20% to 19% in the first quarter of 2024, indicating that the Magnificent 7 continue to be seen as valuable investments for Aussie retail investors.

Here are the top ASX Tech Winners for March 2024

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| TSK | Task Group Holdings | 0.8 | 105% | $281,490,508.21 |

| NVQ | Noviqtech Limited | 0.006 | 100% | $7,436,536.48 |

| 360 | Life360 Inc | 13.09 | 68% | $2,638,371,931.20 |

| ASV | Asset Vision Co | 0.02 | 67% | $14,516,731.30 |

| AXE | Archer Materials | 0.57 | 58% | $146,537,032.48 |

| EXT | Excite Technology | 0.012 | 50% | $15,950,900.78 |

| ADS | Adslot Ltd. | 0.003 | 50% | $9,673,486.64 |

| EXT | Excite Technology | 0.012 | 50% | $15,950,900.78 |

| EML | EML Payments Ltd | 1.23 | 46% | $476,147,622.76 |

| FND | Findi Limited | 2.87 | 44% | $135,667,394.38 |

| SEN | Senetas Corporation | 0.021 | 35% | $29,854,383.94 |

| LNU | Linius Tech Limited | 0.002 | 33% | $10,393,481.43 |

| 1CG | One Click Group Ltd | 0.009 | 29% | $5,505,430.58 |

| PRO | Prophecy Internation | 0.77 | 28% | $54,851,320.83 |

| EPX | Ept Global Limited | 0.028 | 27% | $16,456,838.92 |

| OEC | Orbital Corp Limited | 0.14 | 27% | $20,447,968.10 |

| VGL | Vista Group Int Ltd | 1.81 | 27% | $435,868,412.49 |

| DCC | Digitalx Limited | 0.069 | 25% | $60,615,894.08 |

| EIQ | Echoiq Ltd | 0.15 | 25% | $66,845,840.76 |

| 5GN | 5G Networks Limited | 0.175 | 25% | $58,198,708.99 |

Restaurant tech company TASK Group (ASX:TSK) topped the tech winners chart after announcing it would be bought out by PAR Technology Corporation (NYSE:PAR) with TSK shareholders able to choose between cash and PAR shares.

The cash deal is worth 81c per TSK share – a 107% premium to the 30-day average price. TSK says PAR is a leading global restaurant technology company and provider of unified commerce servicing more than 70,000 enterprise restaurants in 110 countries.

Life360 (ASX:360) announced its CY23 results in March showing the family safety services and location tech company had met or exceeded all its targets. Consolidated revenue rose 33% to $305 million in line with guidance of US$300-$310m, while core subscription revenue of $200m was up 52% YoY.

360 says it’s committed to a pathway to profitability and delivered positive adjusted EBITDA of $20.6m, ahead of guidance of $12-$16m and positive operating cash flow of $7.5 m, a $64.6m improvement versus CY22.

The company says its expects to achieve sustainably positive EBITDA by H1 CY25. 360 has also announce the creation of a new advertising revenue stream in CY24 alongside the Australian launch of the full subscription service in the Q2 (April -June) of CY24.

Archer Materials (ASX:AXE) announced it had designed a miniaturised version of its Biochip graphene field effect transistor (“gFET”) chip.

“The Archer Biochip contains a sensing region of which the gFET is the core component. Each gFET chip contains multiple gFETs, each of which is a transistor, which acts as a sensor,” the company says.

AXE says it’s miniaturised the total chip size by redesigning the layout of the circuits creating these gFET transistors.

In March the company also announced it had built a single chip integrated pulsed electron spin resonance (p-ESR) microsystem, with its research partner École Polytechnique Fédérale de Lausanne (EPFL) in Switzerland.

“Archer and EPFL intend to use the p-ESR microsystem to perform complex measurements involving the potential electron spin manipulation of Archer’s 12CQ quantum materials,” the company says.

Here are the biggest ASX Tech Losers for March 2024

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| GTI | Gratifii | 0.005 | -38% | $6,846,113.32 |

| IXU | Ixup Limited | 0.015 | -37% | $16,313,033.88 |

| W2V | Way2Vatl | 0.018 | -33% | $12,702,590.62 |

| BTH | Bigtincan Hldgs Ltd | 0.155 | -33% | $92,437,963.50 |

| 8CO | 8Common Limited | 0.036 | -32% | $8,067,416.51 |

| XPN | Xpon Technologies | 0.019 | -30% | $5,768,555.21 |

| CT1 | Constellation Tech | 0.0015 | -25% | $2,212,100.55 |

| OPL | Opyl Limited | 0.026 | -24% | $3,720,836.04 |

| ACE | Acusensus Limited | 0.6 | -21% | $73,943,985.38 |

| LVH | Livehire Limited | 0.032 | -21% | $10,622,859.99 |

| PPK | PPK Group Limited | 0.505 | -20% | $45,983,985.90 |

| SOV | Sovereign Cloud Holdings | 0.03 | -20% | $26,095,693.70 |

| X2M | X2M Connect Limited | 0.042 | -19% | $10,597,099.80 |

| AVA | AVA Risk Group Ltd | 0.135 | -18% | $40,981,778.56 |

| SNS | Sensen Networks Ltd | 0.023 | -18% | $16,242,985.77 |

| ESK | Etherstack PLC | 0.245 | -16% | $33,656,685.51 |

| ID8 | Identitii Limited | 0.011 | -15% | $4,302,380.14 |

| 3DP | Pointerra Limited | 0.041 | -15% | $29,074,223.44 |

| WBT | Weebit Nano Ltd | 3.35 | -15% | $629,271,243.76 |

Enterprise loyalty and rewards company Gratifii (ASX:GTI) announced it had raised $1.6 million through the issue of 320 million fully paid ordinary shares at an issue price of $0.005/share to new and existing sophisticated and institutional investors, as well as company directors.

GTI says funds from the placement will be used toward additional capital technology development, inventory and working capital.

The company also announced in March it had inked two new agreements with Aussie payments company subsidiary EML Payment Solutions, a wholly-owned subsidiary of EML Payments (ASX:EML)

GTI says the deal will deliver prepaid debit cards to GTI’s Australian clients and extend the range of rewards available to EML’s clients.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.