ASX Tech June Winners: Technology still on top so far this year

Tech is still power surging this year. Pic via Getty Images

- ASX tech rises 1.47% in June, extending its YTD gains to almost 28%

- US tech stocks outperform in June as investor enthusiasm around AI remains

- Schrole Group and K2Fly surge in June after both announcing takeovers

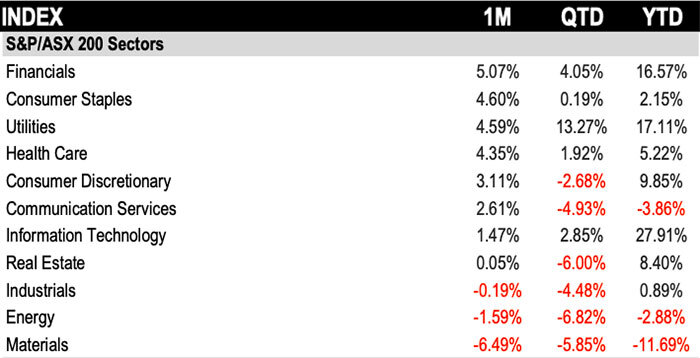

After some strong monthly gains in 2024 the S&P/ASX 200 Information Technology sector rose just 1.47% in June, but extended its YTD gain to ~28% to remain the top performer for 2024 YTD.

The US Nasdaq Composite index, the bellwether for the global tech sector, which rallied by more than 44% in 2023, surged 5.96% in June and is up ~20% YTD.

While inflation in May spiked in Australia, it slowed to its lowest annual rate in more than three years in the US. According to the Australian Bureau of Statistics, the monthly CPI indicator hit 4% for May, much higher than April’s 3.6%, and above the 3.8% the market had forecast.

But in the US, the core personal consumption expenditures price index, which excludes the more volatile food and energy prices, and is the US Federal Reserve’s preferred inflation measure rose just 0.1% in May and 2.6% from the prior year.

Headline PCE, which includes food and energy, was flat on the month and up 2.6% on an annual basis, also in line with expectations.

Global X investment strategist Billy Leung told Stockhead the ASX tech sector in June was rattled by the latest higher-than-expected inflation data.

“Growth sectors, including technology, are expected to be influenced by the anticipated interest rate hikes,” he said.

“Higher interest rates can impact growth companies, which generally perform better in low-interest-rate environments.”

Leung explained that US tech stocks in June outperformed on back of continued investor enthusiasm around artificial intelligence (AI).

“The AI investment theme is expanding significantly into the semiconductor space, particularly with new advancements such as high bandwidth memory (HBM),” he said, adding:

“Companies such as Taiwan-listed TSMC and US-listed Micron will benefit from this trend.

“Tight supply and high demand for HBM are expected to be a key highlight over the next 12 months, driven by its critical role in AI data centres and next-gen technology adoption.”

Leung also noted that chip maker Nvidia had a volatile June, rising to become the world’s largest and most valuable company with a market cap at US$3 trillion on the back of positive news before falling again.

“It reached over-brought levels so it was more of a technical sell-off so the fundamentals are still very strong for Nvidia.

“The company is transitioning from being perceived as a hardware-focused business to a software-oriented one, which is expected to enhance its profit margins and overall profitability.”

The investment expert added that the US tech sector may also be impacted by the upcoming presidential elections and possibility of Donald Trump being re-elected again and imposing tariffs.

The top ASX tech winners in June 2024

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| SCL | Schrole Group Ltd | 0.46 | 156% | $16,539,322 |

| DXN | DXN Limited | 0.064 | 88% | $12,942,255 |

| K2F | K2Fly Ltd | 0.185 | 85% | $33,646,894 |

| DRO | Droneshield Limited | 1.72 | 79% | $1,250,582,640 |

| XRG | Xreality Group Ltd | 0.055 | 49% | $29,316,385 |

| RCL | Readcloud | 0.083 | 43% | $11,842,565 |

| FND | Findi Limited | 4.7 | 42% | $232,293,812 |

| 1CG | One Click Group Ltd | 0.011 | 38% | $7,031,788 |

| OPL | Opyl Limited | 0.025 | 32% | $4,267,866 |

| BDT | Birddog | 0.077 | 31% | $14,478,082 |

| CF1 | Complii Fintech Ltd | 0.022 | 29% | $11,358,410 |

| ASV | Asset Vision Co | 0.018 | 29% | $13,065,058 |

| IRI | Integrated Research | 0.93 | 27% | $152,782,550 |

| NVQ | Noviqtech Limited | 0.038 | 27% | $5,720,697 |

| XPN | Xpon Technologies | 0.016 | 23% | $5,479,064 |

| PHX | Pharmx Technologies | 0.038 | 23% | $20,947,738 |

| ELS | Elsight Ltd | 0.455 | 21% | $66,562,767 |

| CAT | Catapult Grp Int Ltd | 1.89 | 20% | $507,854,002 |

| PPS | Praemium Limited | 0.505 | 20% | $241,249,908 |

| EIQ | Echoiq Ltd | 0.18 | 20% | $88,712,972 |

Schrole Group (ASX:SCL) surged 156% in June after announcing a takeover bid from TES Aus Global Pty Limited to acquire 100% of the Edtech for 48.52 cent/share, representing a 203% premium to the closing price of 16 cents/share on June 14, 2024. SCL targets teachers and educational organisations, combining recruitment, background checks, onboarding, relief teacher management, and professional development.

Data centre firm DXN (ASX:DXN) soared 88% for the month after providing a promising trading update, including that unaudited revenue for FY24 is expected to exceed $10m, materially higher than FY23 revenue of $6.6m. DXN says the revenue growth has been driven by the deployment of new modular data centres across multiple clients.

Resource governance software solutions provider K2Fly (ASX:K2F) rose 85% in June after also announcing it had entered a takeover deal with Argyle Bidco Pty Ltd, a wholly-owned subsidiary of tech-focused investment firm Accel-KKR.

Under the deal Argyle will acquire 100% of K2F shares by way of a scheme of arrangement at 19 cents/share represents a 90% premium to its share price on June 20 of 10 cents/share.

DroneShield (ASX:DRO) spiked 79% for the month after receiving an order of $4.7m from a new non-government Swiss international customer, to provide multiple vehicle-based counterdrone-drone (C-UxS) systems.

DRO says the vehicle-based solution will offer a rapidly deployable C-UxS platform, that can be operated in both static and on-the-move (OTM) missions for convoy and mobile VIP protection.

ASX tech laggards in June, 2024

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.004 | -69% | $1,882,486 |

| ADS | Adslot Ltd. | 0.001 | -50% | $3,749,672 |

| FGL | Frugl Group Limited | 0.05 | -50% | $5,759,397 |

| ZMM | Zimi Ltd | 0.011 | -45% | $1,356,829 |

| FCT | Firstwave Cloud Tech | 0.012 | -40% | $22,230,252 |

| LVH | Livehire Limited | 0.011 | -39% | $4,435,175 |

| ICE | Icetana Limited | 0.018 | -33% | $4,234,055 |

| CGO | CPT Global Limited | 0.089 | -32% | $3,728,865 |

| W2V | Way2Vat | 0.009 | -31% | $8,739,811 |

| BEO | Beonic Ltd | 0.021 | -28% | $9,763,384 |

| BTH | Bigtincan Holdings | 0.1 | -28% | $71,659,782 |

| SOR | Strategic Elements | 0.043 | -28% | $18,324,271 |

| RWL | Rubicon Water | 0.33 | -27% | $55,228,511 |

| ATV | Active Port Group | 0.048 | -26% | $17,168,842 |

| LNU | Linius Tech Limited | 0.0015 | -25% | $8,320,111 |

| AXE | Archer Materials | 0.335 | -23% | $84,099,514 |

| SBW | Shekel Brainweigh | 0.04 | -23% | $8,853,001 |

| VR1 | Vection Technologies | 0.018 | -22% | $21,405,190 |

| DCC | Digitalx Limited | 0.041 | -21% | $36,388,969 |

| BRN | Brainchip Ltd | 0.22 | -20% | $417,588,304 |

| GTI | Gratifii | 0.008 | -20% | $14,048,381 |

| ID8 | Identitii Limited | 0.008 | -20% | $3,481,904 |

| WHK | Whitehawk Limited | 0.012 | -20% | $5,549,715 |

| HCL | Highcom Ltd | 0.12 | -20% | $12,835,334 |

| MP1 | Megaport Limited | 11.22 | -20% | $1,842,234,390 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.