ASX Tech July Winners: A strong month as AI fever takes hold; iSynergy rockets 1,000pc

IS3 goes stratospheric on its AI ambitions. Picture via Getty Images

- Wall Street tech rockets on earnings and stimulus

- ASX tech shines as inflation cools and rate hopes rise

- IS3 explodes 1000% on AI cloud ambitions

What happened globally in July?

After months of tweet-storms and tariff theatrics, July finally served up something investors hadn’t tasted in a while … clarity.

Both the Nasdaq and S&P 500 hit fresh all-time highs during the month, riding a wave of solid earnings and the sense that maybe Washington was done setting things on fire.

US growth stocks outpaced value 2-to-1, and nearly 80% of S&P 500 companies beat earnings expectations, according to figures from JPMorgan.

Trump’s new trade deals – first with Vietnam, then Japan and the EU – dialled down the tension.

Tariffs are still chunky (15-20%), but investors would rather deal with known pain than flinch at every tweet.

Then there was the real sugar hit: Trump’s ‘One Big Beautiful Bill Act’ finally got the green light in July, promising another round of fiscal stimulus.

On the quarterly reporting front, the Magnificent Seven’s earnings surged 21.6% year-on-year while the rest of the market huffed along at just 4%.

Alphabet and Apple lit the match, and Nvidia rode the rocket to new highs.

But Tesla dropped more than 8% after Elon muttered something about “difficult times” ahead.

ASX tech stocks had strong month

Then we pan back to the local stage, where the ASX 200 clocked a tidy 2.36% gain for July, its fourth straight winning month.

With inflation cooling to 2.1% for the June quarter, punters started betting the RBA might soon loosen the screws.

Rate cut hopes always put a bit more spring in the market’s step.

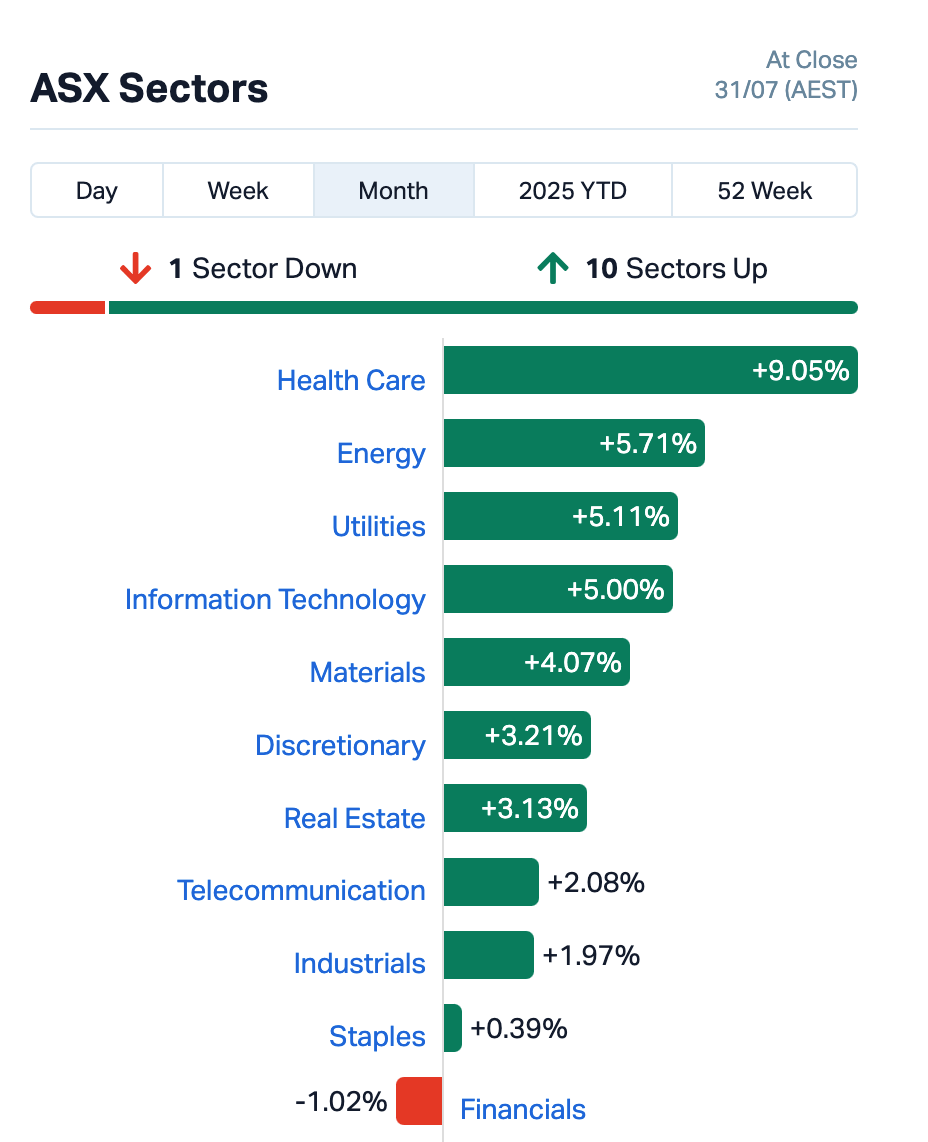

Among the 11 sectors, healthcare stole the spotlight.

After months stuck in the recovery ward, health ripped back with a near 9% gain, making it July’s best performer.

That finally gave investors a reason to stop writing “under review” next to their CSL notes.

Tech also stacked on a 5% gain for the month, thanks to a mix of AI optimism and real earnings momentum.

But some analysts reckon this market is still on a short rope.

Profits have been falling for three years straight but valuations are still sitting up around 19x forward earnings.

And the only thing keeping investors from bolting to cash are growth sectors like tech and biotech.

ASX tech winners in July

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.011 | 1000% | 18,769,299 |

| CT1 | Constellation Tech | 0.002 | 100% | 2,949,467 |

| NVQ | Noviqtech Limited | 0.042 | 83% | 10,564,535 |

| NVU | Nanoveu Limited | 0.069 | 68% | 63,433,796 |

| DRO | Droneshield Limited | 3.750 | 64% | 3,279,820,703 |

| AI1 | Adisyn Ltd | 0.070 | 59% | 50,688,792 |

| NOV | Novatti Group Ltd | 0.030 | 58% | 16,799,952 |

| ATV | Activeportgroupltd | 0.014 | 56% | 9,617,679 |

| OEC | Orbital Corp Limited | 0.145 | 53% | 23,893,059 |

| LIS | Lisenergylimited | 0.160 | 52% | 102,432,037 |

| WBT | Weebit Nano Ltd | 2.420 | 49% | 504,472,157 |

| BEO | Beonic Ltd | 0.300 | 43% | 21,258,302 |

| OLL | Openlearning | 0.017 | 42% | 8,205,469 |

| AXE | Archer Materials | 0.290 | 35% | 73,905,634 |

| FL1 | First Lithium Ltd | 0.100 | 33% | 7,965,360 |

| HYD | Hydrix Limited | 0.017 | 31% | 4,637,070 |

| ICE | Icetana Limited | 0.072 | 29% | 38,291,466 |

| AT1 | Atomo Diagnostics | 0.018 | 29% | 14,177,803 |

| SMN | Structural Monitor. | 0.530 | 28% | 81,834,675 |

| SP3 | Specturltd | 0.015 | 25% | 4,753,502 |

| ZMM | Zimi Ltd | 0.010 | 25% | 4,900,438 |

| 360 | Life360 Inc. | 40.160 | 25% | 6,827,390,399 |

| 8CO | 8Common Limited | 0.021 | 24% | 4,705,993 |

| KYP | Kinatico Ltd | 0.240 | 23% | 103,702,076 |

| 1CG | One Click Group Ltd | 0.011 | 22% | 13,005,148 |

| FLX | Felix Group | 0.220 | 22% | 45,190,339 |

| X2M | X2M Connect Limited | 0.019 | 21% | 8,266,080 |

| QOR | Qoria Limited | 0.600 | 21% | 800,177,642 |

| HSN | Hansen Technologies | 6.010 | 21% | 1,226,308,647 |

| DTI | DTI Group Ltd | 0.006 | 20% | 5,382,617 |

| ID8 | Identitii Limited | 0.006 | 20% | 4,668,081 |

| ODA | Orcoda Limited | 0.078 | 20% | 14,626,109 |

| ROC | Rocketboots | 0.097 | 20% | 16,617,395 |

| AMO | Ambertech Limited | 0.185 | 19% | 17,649,885 |

| FCL | Fineos Corp Hold PLC | 2.760 | 18% | 934,351,756 |

| NVX | Novonix Limited | 0.450 | 18% | 286,775,115 |

| PHX | Pharmx Technologies | 0.110 | 18% | 65,835,747 |

| JCS | Jcurve Solutions | 0.046 | 18% | 15,195,798 |

| XYZ | Block Inc | 120.940 | 18% | 5,466,116,351 |

| HCL | Highcom Ltd | 0.365 | 18% | 37,479,175 |

| EPX | EPX Limited | 0.027 | 17% | 17,811,282 |

| DCC | Digitalx Limited | 0.088 | 17% | 129,806,213 |

| JAN | Janison Edu Group | 0.170 | 17% | 44,181,003 |

| CYB | Aucyber Limited | 0.080 | 16% | 16,699,810 |

| RUL | Rpmglobal Hldgs Ltd | 3.370 | 16% | 743,859,780 |

| CAT | Catapult Grp Int Ltd | 6.630 | 13% | 1,880,880,300 |

| EOS | Electro Optic Sys. | 3.210 | 13% | 619,376,238 |

| RKN | Reckon Limited | 0.535 | 13% | 60,612,735 |

| CML | Connected Minerals | 0.140 | 12% | 5,790,150 |

| SEN | Senetas Corporation | 0.019 | 12% | 31,464,363 |

| TAL | Talius Group Limited | 0.068 | 11% | 19,498,919 |

| BLG | Bluglass Limited | 0.010 | 11% | 25,764,258 |

| DUB | Dubber Corp Ltd | 0.020 | 11% | 52,500,599 |

| EXT | Excite Technology | 0.010 | 11% | 20,726,419 |

| PPS | Praemium Limited | 0.705 | 10% | 336,789,198 |

| RCL | Readcloud | 0.110 | 10% | 16,898,174 |

| IFM | Infomedia Ltd | 1.300 | 10% | 491,945,597 |

| XF1 | Xref Limited | 0.170 | 10% | 37,415,260 |

| ERD | Eroad Limited | 1.420 | 10% | 266,207,194 |

| WTC | Wisetech Global Ltd | 119.380 | 9% | 39,947,292,069 |

| RKT | Rocketdna Ltd. | 0.012 | 9% | 10,986,279 |

| RWL | Rubicon Water | 0.190 | 9% | 45,732,069 |

| TYR | Tyro Payments | 0.955 | 9% | 504,871,747 |

| CCR | Credit Clear | 0.255 | 9% | 108,285,404 |

| IKE | Ikegps Group Ltd | 0.910 | 8% | 167,050,840 |

| NXL | Nuix Limited | 2.370 | 8% | 783,837,994 |

| DDR | Dicker Data Limited | 8.720 | 8% | 1,575,634,092 |

| SPX | Spenda Limited | 0.008 | 7% | 34,614,116 |

| ATA | Atturralimited | 0.855 | 7% | 324,036,918 |

| GTI | Gratifii | 0.099 | 6% | 37,599,343 |

| FCT | Firstwave Cloud Tech | 0.017 | 6% | 29,129,818 |

| HTG | Harvest Tech Grp Ltd | 0.017 | 6% | 15,453,311 |

| EVS | Envirosuite Ltd | 0.088 | 6% | 127,774,253 |

| CPU | Computershare Ltd | 42.150 | 6% | 24,379,015,001 |

| BRN | Brainchip Ltd | 0.205 | 5% | 415,277,056 |

| NOR | Norwood Systems Ltd. | 0.021 | 5% | 10,834,480 |

| OAK | Oakridge | 0.067 | 5% | 1,808,860 |

| WHK | Whitehawk Limited | 0.012 | 5% | 8,525,483 |

| ASB | Austal Limited | 6.560 | 4% | 2,762,941,089 |

| MP1 | Megaport Limited | 15.060 | 4% | 2,423,776,460 |

| CDA | Codan Limited | 20.950 | 4% | 3,803,909,140 |

| CF1 | Complii Fintech Ltd | 0.025 | 4% | 14,289,450 |

| BCC | Beam Communications | 0.130 | 4% | 11,234,850 |

| CXZ | Connexion Mobility | 0.026 | 4% | 20,832,933 |

| UBN | Urbanise.Com Ltd | 0.870 | 4% | 68,417,589 |

| SNS | Sensen Networks Ltd | 0.030 | 3% | 23,791,124 |

| CGO | CPT Global Limited | 0.062 | 3% | 2,597,637 |

| XRG | Xreality Group Ltd | 0.032 | 3% | 23,793,521 |

| KNO | Knosys Limited | 0.036 | 3% | 7,780,993 |

| VR1 | Vection Technologies | 0.038 | 3% | 67,200,032 |

| EIQ | Echoiq Ltd | 0.225 | 2% | 145,167,235 |

| SLX | Silex Systems | 4.250 | 1% | 1,011,949,327 |

| XRO | Xero Ltd | 180.990 | 1% | 29,932,420,128 |

IS3 shares soared 1000% in July after it inked a non-binding MoU with Nasdaq-listed Treasure Global (TGL) to explore a $600,000 deal for AI chips and cloud infrastructure in Malaysia.

The plan is to buy advanced GPUs over 12 months and potentially co-develop regional AI data centres.

While the MoU isn’t binding and no money’s changed hands yet, it marks IS3’s first serious step into AI infrastructure, aligning with its broader goal to scale up digital capabilities and regional reach.

The share price surge caught the ASX’s attention, prompting a speeding ticket.

IS3 responded by confirming it had been in early talks, which had now been formalised in the MoU, but stressed the discussions were “substantially incomplete” and didn’t justify the share price spike.

Still, the market clearly saw something it liked in IS3’s AI ambitions, and ran with it.

NoviqTech fired the starter’s pistol on its quantum push in July.

The company launched a new subsidiary called Quantum Intelligence to bring quantum computing, AI and blockchain to mainstream enterprise.

It’s kicking off with a September beta of two subscription-based tools: QI Provenance for tamper-proof digital trust and QI AI for blockchain-backed decision-making.

Later this year, NVQ rolls out the full Quantum Intelligence Platform, powered by NVIDIA CUDA-Q, promising up to 10x performance for heavy workloads like logistics, finance and cryptography.

To back it, NVQ has locked in a $1.25m placement at 3.6c a share and secured long-term global rights to the QI software from Singapore-based Morphotech.

The licence is non-exclusive and royalty-free until NVQ hits profitability.

In July, Nanoveu took a major leap from simulation to silicon, kicking off synthesis of its ultra-efficient 16nm ECS-DoT chip in partnership with Cairo’s Centre of Nanoelectronics.

The chip is designed for smart edge devices, from wearables to autonomous systems.

Alongside it, Nanoveu launched a modular AIoT kit to fast-track prototyping across sectors like healthcare and logistics, and opened early access for developers.

To fuel the rollout, the company raised $2 million from high-net-worth backers at 5.5c a share, giving it the runway to finish chip production and scale commercial testing.

With phase 2 drone trials now underway, Nanoveu is putting ECS-DoT through its paces in real-world environments.

The aim is to validate its energy efficiency after earlier simulations showed a 33% boost in drone flight endurance.

DroneShield had a bumper July, with major announcements sending its share price flying.

First up, it secured a $5 million slice of a $16.9m Australian Defence Force contract under LAND156, supplying handheld gear to knock out rogue drones.

Then came the big swing. DroneShield committed $13m to triple its Sydney production space and expand R&D, as it ramps up to meet booming global demand.

The upgrade pushes total annual manufacturing capacity to $2.4 billion by end-2026.

This was backed by fresh wins including a $61.6m European deal and an $11.7m R&D contract with a Five Eyes defence department, its fourth with the same customer.

DroneShield is scaling fast and gearing up for serious global defence action.

Adisyn has installed and commissioned its new Atomic Layer Deposition (ALD) system at its Israeli research site, marking a big step forward in its graphene R&D push.

The upgraded Beneq TFS 200 machine gives Adisyn the firepower to deposit ultra-thin graphene layers with greater speed, precision and control.

This is crucial for developing low-temperature graphene solutions aimed at next-gen semiconductor interconnects.

The system will run in tandem with a second unit already operating at Tel Aviv University, allowing Adisyn to accelerate validation across different substrates and conditions.

The dual ALD setup sets the stage for Adisyn to fast-track its graphene roadmap and move closer to real-world chip integration.

ASX tech losers in July

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.010 | -50% | 1,015,864 |

| VIG | Victor Group Hldgs | 0.049 | -36% | 31,959,107 |

| AR9 | Archtis Limited | 0.155 | -33% | 52,584,833 |

| XPN | Xpon Technologies | 0.007 | -22% | 2,899,773 |

| OPL | Opyl Limited | 0.023 | -21% | 5,652,671 |

| AD8 | Audinate Group Ltd | 6.150 | -18% | 518,027,839 |

| GTK | Gentrack Group Ltd | 9.750 | -15% | 1,050,288,486 |

| DXN | DXN Limited | 0.061 | -15% | 18,220,922 |

| AVA | AVA Risk Group Ltd | 0.085 | -15% | 24,690,122 |

| AJX | Alexium Int Group | 0.006 | -14% | 9,518,572 |

| VNL | Vinyl Group Ltd | 0.099 | -14% | 133,309,975 |

| COS | Cosol Limited | 0.583 | -13% | 106,008,474 |

| FND | Findi Limited | 3.710 | -13% | 229,282,530 |

| EOL | Energy One Limited | 13.200 | -12% | 413,561,056 |

| TZL | TZ Limited | 0.048 | -11% | 13,469,477 |

| SKO | Serko | 2.620 | -11% | 326,452,393 |

| SPZ | Smart Parking Ltd | 0.800 | -10% | 328,122,329 |

| ESK | Etherstack PLC | 0.450 | -8% | 59,675,401 |

| 3DP | Pointerra Limited | 0.046 | -8% | 37,033,533 |

| PRO | Prophecy Internation | 0.400 | -7% | 29,499,574 |

| SPA | Spacetalk Ltd | 0.150 | -6% | 10,966,902 |

| PFM | Platformo Ltd | 0.076 | -5% | 7,213,031 |

| YOJ | Yojee Limited | 0.380 | -4% | 132,577,872 |

| 5GN | 5G Networks Limited | 0.135 | -4% | 40,208,638 |

| DWG | Dataworks Group | 0.084 | -3% | 8,586,820 |

| EML | EML Payments Ltd | 1.125 | -3% | 430,449,460 |

| BVS | Bravura Solution Ltd | 2.150 | -3% | 963,961,104 |

| SOR | Strategic Elements | 0.031 | -3% | 14,690,871 |

| ASV | Assetvisonco | 0.037 | -3% | 27,541,378 |

| SMP | Smartpay Holdings | 1.015 | -2% | 245,572,616 |

| ACE | Acusensus Limited | 0.930 | -2% | 130,400,752 |

| DUG | DUG Tech | 1.340 | -1% | 180,441,185 |

| ELS | Elsight Ltd | 1.750 | -1% | 379,811,826 |

| RDY | Readytech Holdings | 2.270 | -1% | 280,490,523 |

| DTL | Data#3 Limited | 7.540 | -1% | 1,168,008,831 |

| IRE | IRESS Limited | 7.940 | -1% | 1,483,108,424 |

| VGL | Vista Group Int Ltd | 3.230 | -1% | 771,435,051 |

| OCL | Objective Corp | 19.050 | -1% | 1,821,184,686 |

At Stockhead we tell it like it is. While Adisyn is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.