ASX Tech August Winners: AI glow flickers, but big contract wins in defence steal spotlight

Is AI’s halo fading? Picture via Getty Images

- Earnings fire S&P to fresh highs

- AI halo fades as semis stumble

- ASX tech slides 1.7pc in August

What happened in August?

By the end of August, 98% of S&P 500 companies had reported Q2 earnings, and 81% beat expectations.

That alone was enough to push the S&P 500 marching into record territory, its 20th all-time high this year.

The tech-heavy Nasdaq also closed out August 1.6% higher, its fifth straight monthly gain.

Here’s a bit of fun fact: History says when you hit 20 records by August, you almost always finish the year higher.

Then again, history doesn’t usually have to factor in a White House actively trying to kneecap the central bank.

Trump’s sacking of the Bureau of Labor Statistics chief after a weak payrolls print, and his pot-shots at Jerome Powell turned “Fed independence” into Wall Street’s favourite drinking game.

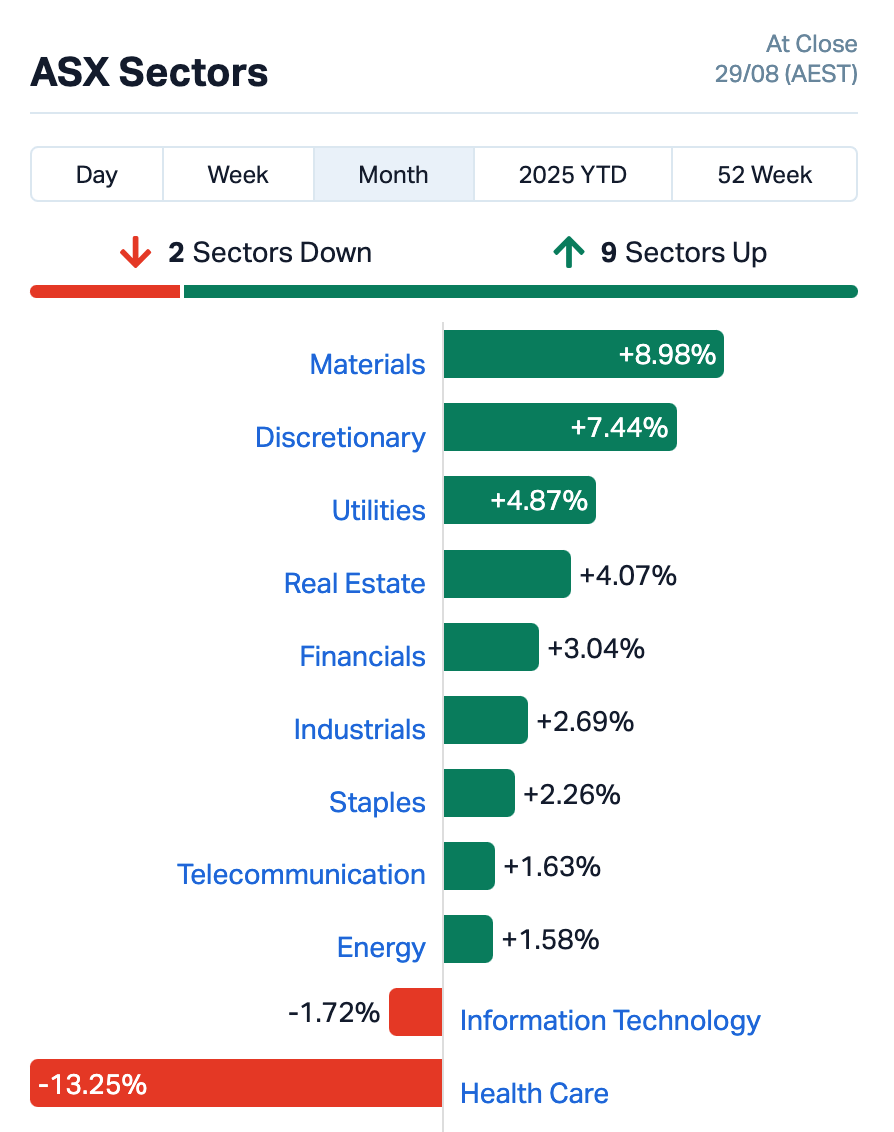

Meanwhile, back home, the ASX tech sector slid 1.72% in August.

Local investors spent the month knee-deep in earnings, where the current scoreboard mattered more than the AI hype.

And the lesson was blunt: if you didn’t deliver, the market didn’t care.

Is AI gloss fading?

The gloss might be fading, and the AI story no longer looks untouchable.

In August, the real bruises showed up in semis.

Nvidia, Wall Street’s AI mascot, slipped 2% for the month despite beating on overall sales and earnings, because its data centre business came up light.

When you’re priced for perfection, “good” is just another word for disappointing.

An MIT study didn’t help, landing like a bucket of cold bucket water over the hype.

According to the study, 95% of firms throwing cash at generative AI are seeing no returns.

Turns out you can’t just plug ChatGPT into a spreadsheet and call it transformation.

ASX tech winners in August

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| IFG | Infocusgroup Hldltd | 0.037 | 131% | $10,801,750 |

| ATV | Activeport Group | 0.023 | 114% | $21,546,100 |

| EOS | Electro Optic Sys. | 5.800 | 85% | $1,119,122,174 |

| SP3 | Spectur | 0.022 | 83% | $6,971,803 |

| XRG | Xreality Group Ltd | 0.050 | 72% | $37,177,376 |

| ERD | Eroad Limited | 2.220 | 61% | $416,183,078 |

| OEC | Orbital Corp Limited | 0.220 | 57% | $39,394,395 |

| CDA | Codan Limited | 30.880 | 49% | $5,615,968,133 |

| DTZ | Dotz Nano Ltd | 0.055 | 49% | $32,861,911 |

| SOR | Strategic Elements | 0.043 | 43% | $20,377,660 |

| NVU | Nanoveu Limited | 0.100 | 39% | $93,427,123 |

| CT1 | Constellation Tech | 0.002 | 33% | $2,949,467 |

| DTI | DTI Group Ltd | 0.008 | 33% | $7,176,823 |

| ID8 | Identitii Limited | 0.008 | 33% | $6,224,108 |

| SNS | Sensen Networks Ltd | 0.040 | 33% | $31,721,499 |

| VR1 | Vection Technologies | 0.054 | 32% | $97,571,082 |

| WBT | Weebit Nano Ltd | 2.830 | 30% | $589,940,580 |

| ROC | Rocketboots | 0.120 | 29% | $20,557,602 |

| IFM | Infomedia Ltd | 1.675 | 29% | $633,852,981 |

| SPZ | Smart Parking Ltd | 0.995 | 28% | $408,102,146 |

| JAN | Janison Edu Group | 0.210 | 27% | $54,576,533 |

| OAK | Oakridge | 0.085 | 27% | $2,294,822 |

| EPX | EPX Limited | 0.034 | 26% | $25,519,930 |

| TYR | Tyro Payments | 1.240 | 26% | $655,540,279 |

| ASV | Assetvisonco | 0.046 | 24% | $34,240,632 |

| MX1 | Micro-X Limited | 0.077 | 24% | $51,374,573 |

| 8CO | 8Common Limited | 0.026 | 24% | $5,826,467 |

| ASB | Austal Limited | 7.770 | 23% | $3,272,568,942 |

| DTL | Data#3 Limited | 9.210 | 22% | $1,426,705,747 |

| BLG | Bluglass Limited | 0.011 | 22% | $28,340,684 |

| 1CG | One Click Group Ltd | 0.011 | 22% | $13,005,148 |

| FL1 | First Lithium Ltd | 0.120 | 20% | $9,558,432 |

| ZMM | Zimi Ltd | 0.012 | 20% | $5,880,526 |

| PIL | Peppermint Inv Ltd | 0.003 | 20% | $7,324,230 |

| 360 | Life360 Inc. | 46.500 | 19% | $7,962,282,234 |

| ESK | Etherstack PLC | 0.523 | 19% | $69,342,021 |

| QOR | Qoria Limited | 0.670 | 19% | $893,531,701 |

| DUG | DUG Tech | 1.620 | 17% | $218,145,314 |

| NXT | Nextdc Limited | 16.500 | 15% | $10,566,865,485 |

| PPS | Praemium Limited | 0.800 | 15% | $382,172,139 |

| KYP | Kinatico Ltd | 0.275 | 15% | $118,825,296 |

| RKN | Reckon Limited | 0.590 | 15% | $66,843,951 |

| NOV | Novatti Group Ltd | 0.033 | 14% | $18,479,947 |

| IRE | IRESS Limited | 8.720 | 14% | $1,628,804,213 |

| FCL | Fineos Corp Hold PLC | 3.000 | 13% | $1,015,688,235 |

| MP1 | Megaport Limited | 16.440 | 13% | $2,645,875,498 |

| CGO | CPT Global Limited | 0.070 | 13% | $2,932,816 |

| NXL | Nuix Limited | 2.660 | 13% | $890,188,120 |

| CF1 | Complii Fintech Ltd | 0.028 | 12% | $16,004,185 |

| RUL | Rpmglobal Hldgs Ltd | 3.770 | 12% | $832,151,742 |

| DRO | Droneshield Limited | 3.300 | 11% | $2,886,572,218 |

| GTI | Gratifii | 0.110 | 11% | $42,075,727 |

| OCL | Objective Corp | 20.930 | 11% | $2,000,913,149 |

| PKY | Pathkey.Ai Ltd | 0.024 | 9% | $7,105,977 |

| LVE | Love Group Global | 0.125 | 9% | $5,066,771 |

| NVX | Novonix Limited | 0.570 | 9% | $379,228,775 |

| ACE | Acusensus Limited | 1.040 | 8% | $145,824,496 |

| PPK | PPK Group Limited | 0.525 | 7% | $47,676,561 |

| YOJ | Yojee Limited | 0.425 | 6% | $149,463,367 |

| IRI | Integrated Research | 0.440 | 6% | $78,035,192 |

| EOL | Energy One Limited | 14.140 | 6% | $443,011,616 |

| XF1 | Xref Limited | 0.190 | 6% | $41,817,055 |

| DDR | Dicker Data Limited | 9.130 | 5% | $1,649,717,805 |

| AMO | Ambertech Limited | 0.200 | 5% | $19,080,957 |

| SEN | Senetas Corporation | 0.020 | 5% | $33,120,382 |

| BVS | Bravura Solution Ltd | 2.240 | 5% | $1,004,191,944 |

| TAL | Talius Group Limited | 0.076 | 4% | $21,792,910 |

| CML | Connected Minerals | 0.130 | 4% | $5,376,568 |

| 4DS | 4Ds Memory Limited | 0.028 | 4% | $57,705,164 |

| COS | Cosol Limited | 0.600 | 3% | $109,193,278 |

| BRN | Brainchip Ltd | 0.205 | 3% | $417,327,056 |

| JCS | Jcurve Solutions | 0.046 | 2% | $16,207,798 |

| EML | EML Payments Ltd | 1.130 | 2% | $432,362,568 |

| AR9 | Archtis Limited | 0.160 | 2% | $54,281,118 |

| SMP | Smartpay Holdings | 1.040 | 1% | $251,621,203 |

| RDY | Readytech Holdings | 2.340 | 1% | $289,140,010 |

InFocus Group Holdings (ASX:IFG)

InFocus is spinning up a new arm called InFocus Digital Ventures (IFGDV), designed to push deeper into frontier tech like digital assets, AI and big data.

IFGDV will be the launchpad for projects such as gamifying the Frugl grocery app with rewards, and expanding into iGaming and stablecoin work already on the books.

To back the push, InFocus has locked in a binding but conditional facility of up to $10m from Mythos Group, a digital asset player with serious Asia-Pac reach.

An initial $2.5m will land straight away and be parked in the Monochrome Bitcoin ETF until deployment.

Activeport has had a big few weeks, rolling out two first-of-their-kind network products.

In Singapore, the company launched Asia’s first software-driven NNI Exchange, a platform that lets telcos interconnect and automate virtual circuits using Activeport’s software.

Back home, Activeport has also flicked the switch on Australia’s first private-cloud “superhighway”, offering variable fibre bandwidth to data-centre operators like Equinix and NextDC.

To help fuel the growth, the company has launched a fully underwritten rights issue to raise up to $2.5m at 1 cent a share, with free attaching options.

It’s a lot of moving parts, but the strategy is clear: Activeport is betting on connectivity to capture the surge in AI and cross-border cloud traffic.

Electro Optic Systems (ASX:EOS)

EOS is tightening its grip on the counter-drone market.

In August, the company landed two major wins: first, joining Leidos Australia’s successful bid for the ADF’s $1.3bn Project LAND 156, which will roll out a long-term counter-drone capability.

On top of that, EOS secured the world’s first export order for a 100kW high-power laser weapon system, worth around $125m from a European NATO member.

This laser, designed to take out drone swarms at scale, builds on EOS’s established kinetic systems and marks a step-change in capability.

Production will run through 2025-2028 out of Singapore.

XRG has had a big August, locking in a $2.1m Industry Growth Program grant to fast-track the AI roadmap for its Operator XR tactical training platform.

The funding will double manufacturing capacity at its Sydney HQ, and secure the global certifications needed to win larger defence and government contracts.

On top of that, XRG’s US subsidiary landed its largest deal yet, a contract worth up to $5.7m with the Texas Department of Public Safety.

The order covers OP-2 VR training systems, software licences, implementation and up to five years of support, with delivery slated for Q2 FY26.

Eroad has thrown its weight behind the New Zealand Government’s plan to shift all 3.5 million light vehicles onto electronic Road User Charging (eRUC) by 2027.

Already collecting over $900m a year in eRUC from heavy fleets, the company reckons its GPS-based platform is tailor-made to handle the scale-up.

The timing is sharp.

Just weeks after the policy call, Eroad named Ciara McGuigan as its new CFO, bringing experience from telco and media heavyweights.

ASX tech losers in August

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.005 | -53% | $703,659 |

| FBR | FBR Ltd | 0.004 | -33% | $23,665,031 |

| PFM | Platformo Ltd | 0.053 | -30% | $5,030,140 |

| DCC | Digitalx Limited | 0.068 | -26% | $100,304,801 |

| DWG | Dataworks Group | 0.060 | -25% | $6,133,443 |

| AD8 | Audinate Group Ltd | 4.720 | -25% | $397,575,838 |

| BEO | Beonic Ltd | 0.245 | -23% | $17,360,947 |

| SKO | Serko | 2.200 | -19% | $274,120,330 |

| XPN | Xpon Technologies | 0.009 | -18% | $3,728,279 |

| VGL | Vista Group Int Ltd | 2.650 | -18% | $632,911,110 |

| OLL | Openlearning | 0.014 | -18% | $6,759,312 |

| SMN | Structural Monitor. | 0.460 | -17% | $71,026,322 |

| IOD | Iodm Limited | 0.100 | -17% | $61,656,419 |

| PRO | Prophecy Internation | 0.345 | -16% | $25,444,762 |

| WTC | Wisetech Global Ltd | 101.790 | -15% | $34,061,273,745 |

| IKE | Ikegps Group Ltd | 0.805 | -14% | $156,003,427 |

| VIG | Victor Group Hldgs | 0.042 | -14% | $27,393,520 |

| NOR | Norwood Systems Ltd. | 0.018 | -14% | $9,286,697 |

| 3DP | Pointerra Limited | 0.050 | -14% | $40,253,840 |

| HCL | Highcom Ltd | 0.315 | -14% | $32,345,042 |

| RCL | Readcloud | 0.095 | -14% | $14,593,877 |

| BDT | Birddog | 0.060 | -13% | $4,463,011 |

| EIQ | Echoiq Ltd | 0.210 | -13% | $136,035,419 |

| CYB | Aucyber Limited | 0.071 | -12% | $14,821,081 |

| DXN | DXN Limited | 0.053 | -12% | $15,831,293 |

| UBN | Urbanise.Com Ltd | 0.780 | -11% | $61,339,907 |

| ICE | Icetana Limited | 0.071 | -11% | $37,759,640 |

| SIS | Simble Solutions | 0.004 | -11% | $4,329,321 |

| KNO | Knosys Limited | 0.033 | -11% | $7,132,577 |

| HTG | Harvest Tech Grp Ltd | 0.017 | -11% | $15,453,311 |

| EXT | Excite Technology | 0.009 | -10% | $18,653,777 |

| SLX | Silex Systems | 4.150 | -9% | $1,126,472,091 |

| CCR | Credit Clear | 0.245 | -9% | $104,038,917 |

| FLX | Felix Group | 0.200 | -9% | $45,991,217 |

| XRO | Xero Ltd | 163.590 | -9% | $27,054,779,870 |

| LIS | Lisenergylimited | 0.160 | -9% | $102,432,037 |

| CPU | Computershare Ltd | 38.170 | -8% | $22,077,034,462 |

| NVQ | Noviqtech Limited | 0.033 | -8% | $9,268,706 |

| RWL | Rubicon Water | 0.185 | -8% | $44,528,593 |

| GTK | Gentrack Group Ltd | 9.170 | -7% | $987,809,786 |

| VNL | Vinyl Group Ltd | 0.098 | -7% | $131,963,410 |

| AI1 | Adisyn Ltd | 0.071 | -7% | $51,412,917 |

| CAT | Catapult Sports Ltd | 6.230 | -6% | $1,767,403,359 |

| FND | Findi Limited | 3.740 | -5% | $231,136,567 |

| DUB | Dubber Corp Ltd | 0.021 | -5% | $55,125,629 |

| PHX | Pharmx Technologies | 0.115 | -4% | $68,828,281 |

| BCC | Beam Communications | 0.130 | -4% | $11,234,850 |

| CXZ | Connexion Mobility | 0.026 | -4% | $20,832,933 |

| 5GN | 5G Networks Limited | 0.130 | -4% | $38,719,429 |

| AXE | Archer Materials | 0.275 | -4% | $70,082,929 |

| SPA | Spacetalk Ltd | 0.140 | -3% | $10,235,775 |

| ATA | Atturralimited | 0.795 | -2% | $300,359,763 |

| TZL | TZ Limited | 0.047 | -2% | $13,188,863 |

| ODA | Orcoda Limited | 0.075 | -1% | $14,063,566 |

| XYZ | Block Inc | 123.000 | -1% | $5,289,618,075 |

| ELS | Elsight Ltd | 1.690 | -1% | $369,119,089 |

| TNE | Technology One | 39.970 | -1% | $13,084,920,584 |

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.