As world embraces travel again, Jayride eyes cash flow positive FY24

Passenger trips booked rose by 97% on the Jayride platform in FY23 Pic: Getty Images.

- Jayride on track to be cash flow positive in FY24 after strong growth in FY23

- Travel resurgence, growth in Asia and Europe boosts revenue by 99% to record in FY23

- Search now on for new CEO as co-founder and MD Rod Bishop looks to new venture

Jayride is flying high after doubling in scale in FY23 driven by strong growth in passenger trips and revenues booked in Europe and Asia.

Airport transfers marketplace Jayride (ASX:JAY) says growth in Europe and Asia along with a suite of major initiatives launched in FY23 has it in a strong position to become cash flow positive in FY24.

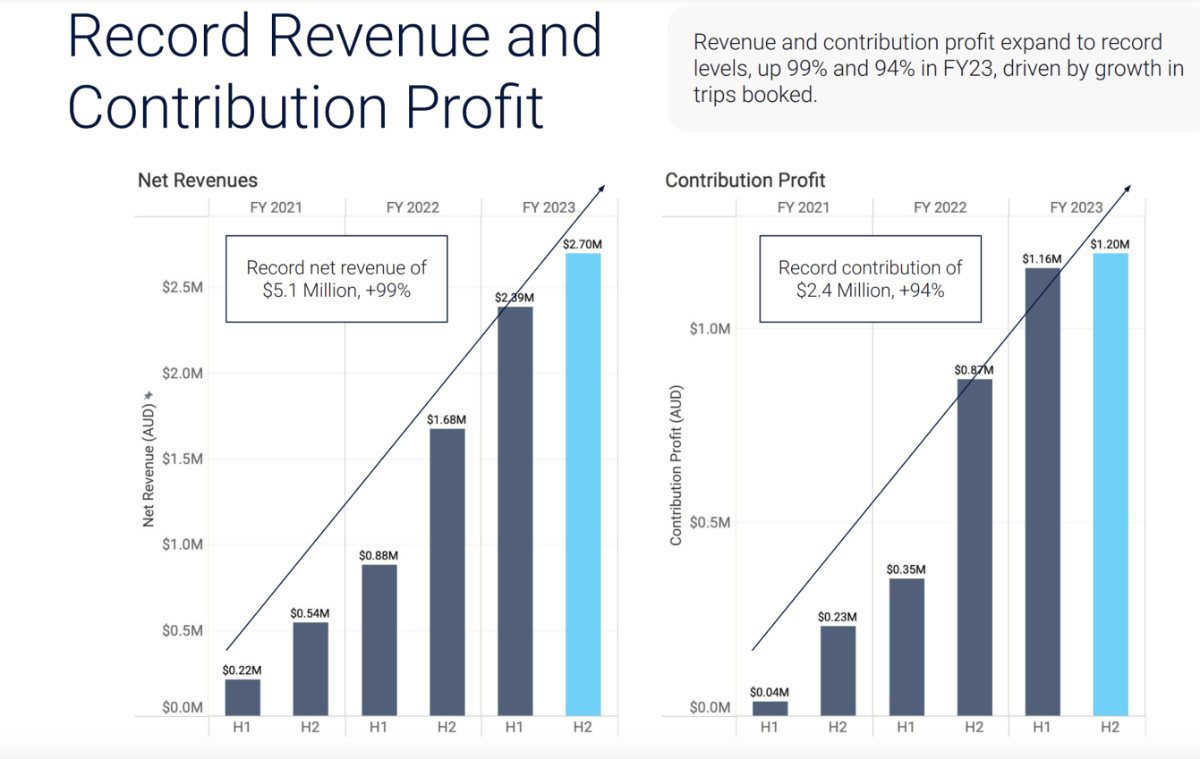

As the world embraces travel again and the sector recovers from the Covid-19 pandemic, JAY saw passenger trips booked rise 97% in FY23 with its revenue growing by 99% to $5.085 million. That’s record levels.

Cash receipts also were up 153% to $6.282 million.

The Northern Hemisphere summer surge in demand and an ongoing structural shift for travellers to book their rides online including through major partners like Booking.com has helped boost customers on JAY’s platform.

In July the company not only achieved but exceeded its objective of a 1 million run rate for passenger trips booked for its first full month.

Managing director and co-founder Rod Bishop says over the past year JAY has introduced a series of enhancements and is positioned to be cash flow positive for FY24.

“Our results are the outcome of our work to leverage the global travel recovery, to create expanded operating leverage and enhanced value propositions for both travel partners and travellers, and to capture the structural transition towards online and connected trips,” he says.

Bishop says JAY is now a fundamentally improved and more profitable business with greater opportunities ahead.

“We are on track with our vision and our next important milestones including cash flow positive for FY24,” he says.

Source: Jayride

Expanded geography and growing international partnerships

Bishop says JAY is now covering 95% of world airport trips with $30 million invested in scaling the tech platform.

“We reaffirm our vision to provide door-to-door rides that suit every traveller’s needs, in every country, from anywhere to anywhere,” he says.

Furthermore, he says JAY has formed partnerships with the world’s leading travel brands.

The company has a new travel agents portal, building on its strong track record with Flight Centre (ASX:FLT) in Australia and New Zealand.

“The new portal brings all the power of our platform, plus new power-user tools, to travel agents – business and luxury rides, large groups, etc – for higher average order values and great unit economics,” Bishop says.

Launched globally in July, Bishop says it hugely increases JAY’s total addressable market and is already in use by larger agencies, in much larger markets including the US and UK, which is a step change to its Australia and New Zealand-only travel agents business.

“Agencies with more than 3,000 travel agents have signed on at launch,” he says.

“We are positioned to capture this once-in-a-generation opportunity to become the world’s leader in rides for travellers.

“Jayride is growing quickly in the early stages of a long-term growth trajectory with significant growth ahead in FY24 and beyond.”

Search for new CEO after scaling ‘from zero to one’

Bishop says the time has come to find a CEO to lead the company on its next 10X growth story, with a search now underway.

“We have successfully scaled Jayride from zero to one,” he says.

“Figuratively, and literally as we have successfully scaled Jayride from launch to a run rate of one million trips per year.

“And now as we’re here and looking forward to that next growth horizon, we want to locate the best CEO to take Jayride from 1 million trips per year to 10 million trips per year and from $7 million revenue run rate, to $70 million.”

“With key components in place for JAY’s next phase of growth, I am pleased to support a new CEO to carry that growth forward.

“Thereafter, I will remain a supportive shareholder of the company as I embark upon my next startup venture.”

Executive chairman Rod Cuthbert says Bishop has been an exceptional leader over the past 12 years in establishing the business, taking the company through IPO in 2018 and then the pandemic, and achieving strategic milestones as it scales.

This article was developed in collaboration with Jayride, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.