AnteoTech’s silicon dominant anodes are making waves in the battery sector

AnteoTech’s high silicon battery anodes are already starting to capture attention from potential end users. Pic: Getty Images

- AnteoTech is advancing its Anteo X performance additive solution for increasing silicon content in anodes and its Ultranode silicon dominant anode

- Ultranode already proven to increase energy density of lithium-ion batteries

- Company progressing charge cycles, to achieve lowest cost per KWh

Lithium-ion batteries are very much the go-to for energy storage solutions and efforts are continually underway to eke out improvements in areas such as energy density and safety.

Given the scale of these efforts, it probably comes as a bit of a surprise that a company which had its start in life sciences – and still has fingers in that pie – is rapidly progressing technology that could drastically improve the energy density of lithium-ion batteries.

AnteoTech (ASX:ADO) realised early on that its patented binding technology used in the Life Sciences business had applications in the clean energy sphere and had filed in mid 2015 a patent relating to its use in increasing the amount of silicon in lithium-ion battery anodes.

Speaking to Stockhead, managing director David Radford said that at its most simplistic, a lithium-ion battery is made up of three parts, the anode, cathode and electrolyte.

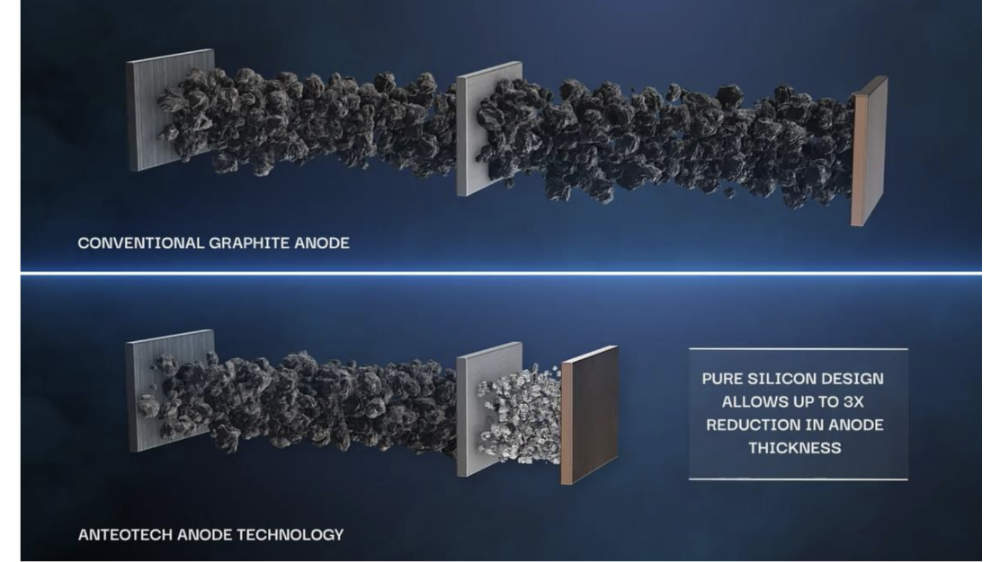

“The cathode and electrolyte have both been highly optimised – cost reduced, performance improved, etc, but in the anode, the only way to do that in a lithium-ion battery is to add more silicon into the anode,” he explained.

Silicon has a significantly higher energy density compared to graphite, with the potential to store roughly 10 times more lithium ions per gram.

Higher levels of silicon in anodes – rather than graphite – translates into higher energy densities, which means the battery can hold more energy for the same weight.

However, exceeding 10-12% silicon in an anode typically makes it unstable to the point that it fractures.

This is where ADO’s binding tech shines by enabling much higher levels of silicon in battery anodes with Radford noting that there are two key products on offer.

The first is the Anteo X additive, a performance enhancing solution that allows anodes to contain more silicon, increasing energy density. We are able to develop anodes with more than 20% (silicon),” Radford added.

The other product is the company’s proprietary Ultranode anode, which contains 70% silicon.

Silicon benefits

“The reason people swap graphite for silicon in anodes is that you get much higher density in the battery” Radford said.

“If you think about it from an EV perspective, we have been working with Mercedes-Benz and have been able to demonstrate a 38% improvement in their cycle life, which translates into a longer overall life of a car battery.

“The other issue with EVs is the charging time. As you put more silicon into the anode, you can actually make the anode much thinner, which reduces its resistance to charging, so you get a faster charging time,

“That’s at the EV level, if you think about it from the mobile phone perspective, if you can get an extra 30% of charge, the phone will last ~16 hours rather than 12 hours. It basically means you can get more charge for the same weight of battery.”

Using locally sourced silicon, in North America or Europe also reduces dependence on graphite, which is sourced primarily from China, reducing the supply chain risk.

It could also reduce costs, with the company flagging that costs of anodes could be significantly cheaper r per kilowatt hour (depending on the type of silicon used) while allowing the use of existing battery manufacturing facilities.

ADO is now working to clear the final hurdle, which is the number of charge cycles – the full discharge and accompanying recharge of the battery’s energy – that its Ultranode product can support.

“We have demonstrated 700+ cycles and 80% energy retention as well as 900 cycles and 70% retention with our Ultranode and we have a very focused team looking to get us to our targeted benchmark of 1000 cycles and 80%,” Radford said.

“The relevance of the 1000 cycles is that it has become the milestone standard for EVs.

“If you look at consumer electronics, it is about 700 and some high-tech equipment is as low as 250 cycles.

“We can already market the Anteo X and Ultranode products for consumer electronics such as drones, wearable devices and mobile phones.”

He added that the tech can be customised to work with different lithium battery chemistries including lithium iron phosphate though in this situation, the anode for each chemistry would be slightly different.

Interest in Anteotech is already high

The company’s achievements have already drawn a great deal of interest – a point that is clearly illustrated by its announcement in October 2024 that it had received the first commercial order for Ultranode battery anodes from German luxury car manufacturer Mercedes-Benz.

It noted than that the $40,000 purchase order was for an initial quantity of anodes for testing and evaluation.

This sale represented a continuation of their existing relationship, which involved the German car maker’s ongoing evaluation of Anteo X.

“The key driver for engagement was our ability to gain attention in a market that is full of multiple technologies all demanding attention and consideration,” he said.

“And we got their attention through the production of credible and data that they have been able to validate and replicate.

“It has been very beneficial that we have had some good meetings with their senior management and they have confirmed that we are on the right track. And if we continue to progress, and show good results in more advanced cell formats, then we could be having a more meaningful commercial conversation later this financial year.”

Radford added that the company is also in discussions with other EV companies though these are at different stages of engagement.

“The EV market is in a state of flux with what’s coming in from China, everyone is looking for the optimal solution for their cars, in both range and priceADO high silicon battery anodes are winners.” he noted.

“They see this high silicon technology as potentially an enabler to give them a differentiator when competing with Chinese imports.”

US tariffs and the tit-for-tat export restrictions from China could also push up the price of graphite, which will make high silicon anodes that much more valuable.

“There’s a rush to get to low price, high efficiency silicon anodes. That’s exactly our sweet spot,” Radford concluded.

At Stockhead, we tell it like it is. While AnteoTech is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.