Airtasker sustains positive cash flow as revenue rises

Airtasker sustains positive cash flow. Image: Getty.

- Airtasker records positive free cash flow of $100k in Q1 FY25 and positive operating cash flow of $900k, a 31.6% improvement on pcp

- Airtasker marketplace revenue up 13.6% on pcp, while Airtasker UK revenue doubles and is up 104.4% on pcp

- Airtasker Australia secures $5m in media capital from ARN, bringing total media capital to $11m

Special Report: Gig economy platform Airtasker has continued to deliver positive cashflow with Q1 FY25 free cashflow of $100k and operating cashflow of $900k, up 31.6% on pcp.

Airtasker (ASX:ART) said the latest quarterly positive free cash flow result was achieved through growing group revenue by 8.5% on pcp to $12.1m, and in particular, Airtasker marketplace revenue by 13.6% on pcp to $10m.

Airtasker reported a $1.6 or 13.2% rise in cash receipts from customers following a $1.9m (109.2%) increase in marketing expenditure on pcp, which it said also drove a 12% increase in total operating expenditure outflows versus pcp.

“The cash marketing investment turbocharged the non-cash, above-the-line brand marketing investment through the company’s media partners in Australia, the UK, and the US,” Airtasker said.

Cash flow from operating activities improved ~165% to $2.4m from the previous quarter, reflecting a 9.2% or $1.1m improvement in cash receipts and a 9.1% decrease in operating expenditure outflows.

The prior quarter included annual software subscription renewals and annual insurance premiums as well as 24.1% higher payments related to marketing investments in out-of-home advertising campaigns in Australia and the UK.

Positive Australian net EBITDA $2.9m

After covering all global head office expenditure, Airtasker’s established marketplaces delivered positive Australian net EBITDA of $2.9m.

Airtasker said as use of Australian non-cash media advertising from oOh!media (ASX:OML) and ARN Media (ASX:A1N) increased during the next two quarters, net Australian EBITDA was expected to decline with the investment in brand marketing.

The company noted that payback from the brand marketing investment was expected to be over a 2-3-year horizon.

Group EBITDA was a loss of $2.7m, which included a $5.6m net investment in new marketplaces.

The group EBITDA loss was expected to widen through the next two quarters because of the declining Australian net EBITDA and the increased US marketing investment following use of media advertising services in that market.

During FY25, Airtasker’s established marketplaces delivered positive cash flow of $7.8m, which contributed to fixed global head office cash expenditure of $5.5m, leaving $2.3m of cash flow available to invest in international expansion.

The company said it invested $2.2m of that cash flow to scale distribution in new marketplaces – principally the US and UK – without increasing its fixed costs, thereby leveraging its fixed global head office investment.

As a result, the group generated positive free cash flow of $100k for the quarter, while scaling US revenue by 116.8% on pcp and UK revenue by 104.4% on pcp.

Strong Airtasker marketplace performance

Momentum in revenue growth for the Airtasker marketplace was driven by strengthening consumer demand, noted the company, with booked tasks up 6.1% on pcp, as well as the marketplace reliability improvement programs implemented in FY24.

The marketplace reliability improvement programs were designed to improve platform reliability and address task leakage and were phased in over the first three quarters of FY24.

The programs were expected to deliver a full-year benefit in FY25 with the Q1 FY25 cancellation rate reduced by 19% on pcp, resulting in the monetisation rate up 6.7% on pcp to 20.8%.

Media partnerships to boost visibility

In late June and early July, Airtasker announced two new multi-million dollar media partnerships in Australia with OML and A1N.

Advertising services kicked off in the middle of Q1 FY25 and was set to accelerate over the course of the next two quarters, being the peak spring/summer season in the Australian marketplace.

The company formed a five-year media-for-equity partnership with Channel 4 in the UK in June 2023, which provided the company with $6.7m in media advertising services and access to Channel 4’s reach of 47 million UK people or 78% of the population.

Following the successful release of the UK television advertising campaign ‘Airtasker.Yeahtasker!’ in Q2 FY24, Airtasker UK achieve record numbers in posted tasks in Q1 FY25, up 66.7% on pcp. GMV rose 63.9% on pcp, and revenue was up 104.4% on pcp.

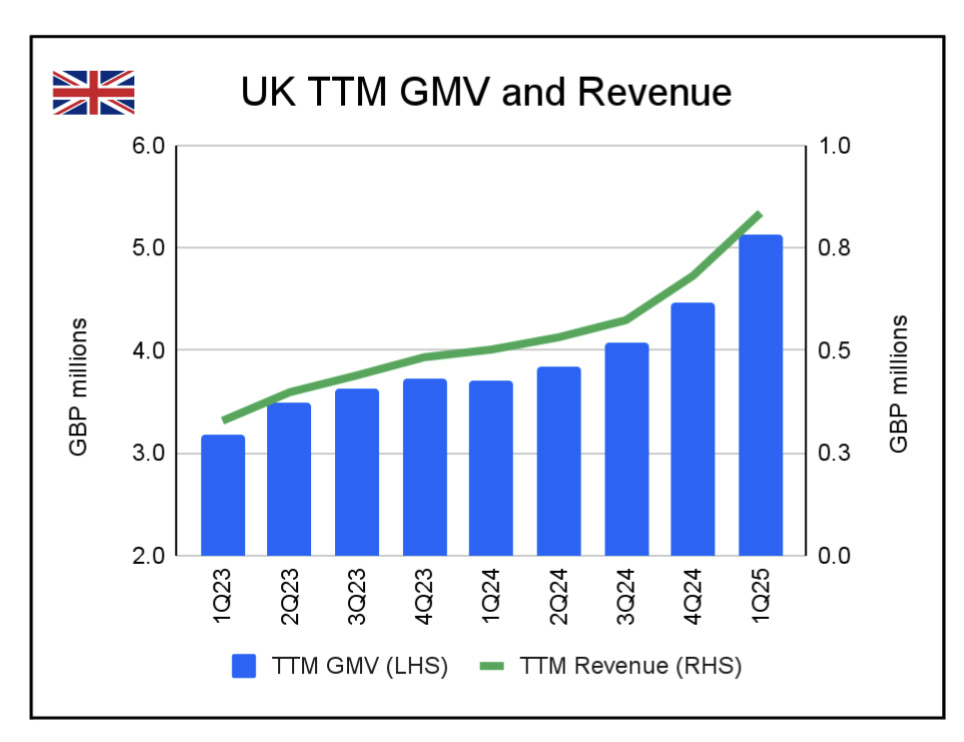

In Airtasker’s UK marketplaces, Q1 FY25 TTM GMV was up 38.3% on pcp to £5.1m (A$9.9m) and TTM revenue up 66.3% on pcp to £835k (A$1.6m).

Source: Airtasker

Source: Airtasker

In September, the company announced its US operating company Airtasker USA Inc had raised a combined US$9.75m (~A$14.4m) in media capital from the country’s number one audio company, iHeartMedia, and TelevisaUnivision – a leading Spanish-language content and media company.

In the US, Airtasker said it was seeing healthy growth in marketplace activity as it prepares for the launch of the ‘Airtasker.Yeahtasker!’ advertising campaign in 2025.

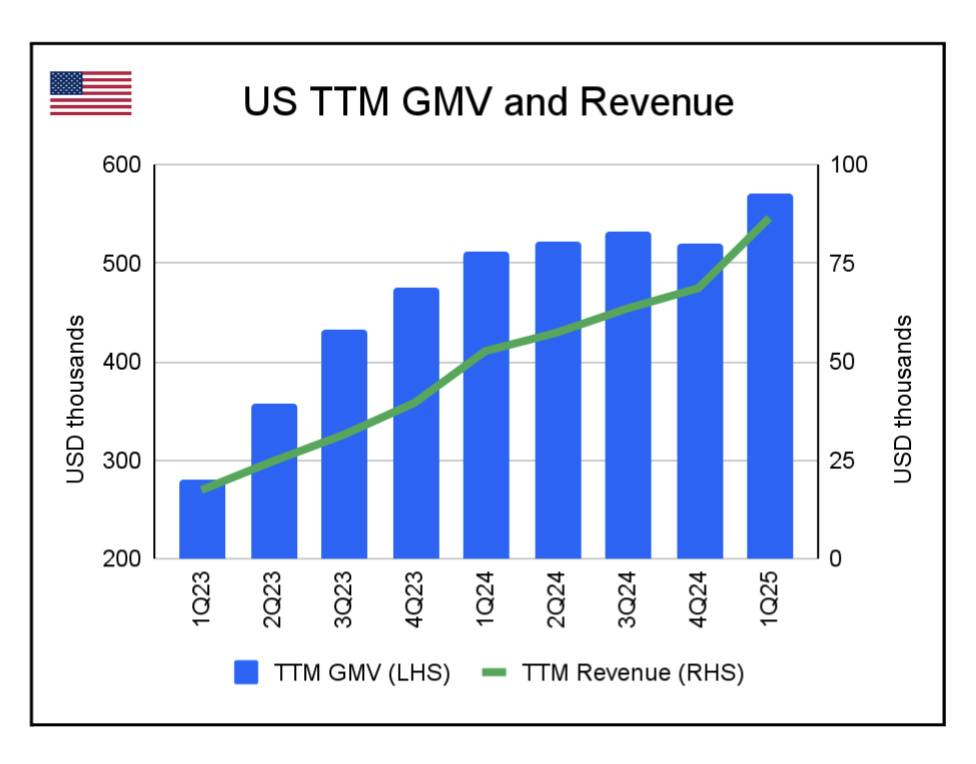

During the quarter Q1 FY25 TTM GMV increased 11.7% on pcp to US$571k (A$860k) and revenue increased 64.1% on pcp to US$86k (A$130k), while quarterly GMV was up 40.2% on pcp and revenue was up 116.8% on pcp.

Source: Airtasker

Source: Airtasker

Reaffirm guidance for positive free cashflow in FY25

Airtasker said the Australian marketplace seasonality peaks over the next two quarters. At the same time, there will also be an increase marketing investment in the Australian, UK, and US marketplaces.

The company plans to further use the advertising services provided by its media partners in each market.

“We remain confident in our ability to maintain our current momentum in revenue growth and reaffirm guidance for positive group free cash flow in FY25,” read a company statement.

Founder and CEO Tim Fung said he was pleased to announce that Airtasker was continuing to deliver positive free cash flow and seeing strong momentum in its Australian marketplace, supported by increased marketing alongside media partnerships with OML and A1N.

“In the UK, we continue to be blown away by the results of our ‘Airtasker.Yeahtasker!’ campaign and partnership with Channel 4, which has accelerated quarterly revenue growth year-on-year from 42% in March 2024, to 76% in June 2024 and now 104% in September 2024!” he said.

The company finished the quarter with $17.9m in cash and term deposits.

This article was developed in collaboration with Airtasker, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.