Airtasker on a roll with another quarter of revenue growth

Airtasker has been making great strides in the US and UK markets, increasing ARR by more than 150%. Pic: Getty Images.

- Airtasker marketplaces revenue up 15.8% on pcp

- Annual recurring revenue increases of 153% for UK market and 399% for US market

- Airtasker Australia net EBITDA hits A$1.5m

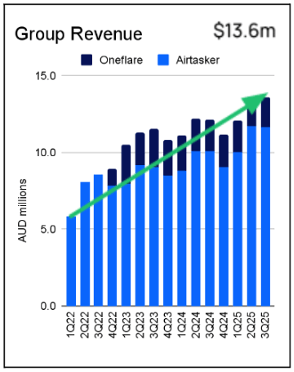

Special Report: Online local services marketplace provider Airtasker has once again achieved strong growth across its targeted markets this quarter, achieving an increase in total group revenue of 11.6% compared to the previous corresponding period.

Airtasker (ASX:ART) also delivered positive free cash flow and operating cash flow of A$800k for the quarter, achieved by growing group revenue 11.6% on pcp to A$13.6m, and Airtasker marketplaces revenue by 15.8% on pcp to A$11.7m.

The company also increased cash receipts from customers by A$2.3m (17.9%), while increasing operating cash outflows A$4.5m, mostly in the form of marketing and upfront payments related to a new television advertisement.

ART finished the quarter in a strong cash position with A$18.3m in hand, reaffirming its guidance for positive Group free cash flow in the 2025 financial year.

Source: Airtasker

Marketplaces sees stable demand from customers

The third quarter of the 2025 financial year marked another double-digit increase in revenue for the Australian arm of the Airtasker marketplace, lifting 10.6% on pcp to A$10.8m.

The implementation of a more customer-centric refund process in 1H24 continued to lower overall cancellations, reducing breakage revenue by 29.2% pcp while platform revenue increased by A$1.3m (15.2%).

Airtasker says it’s enjoying steady customer demand across the Airtasker marketplaces – booked tasks have increased 1.5% on pcp, cancellation rates have fallen 7.2% and yield management initiatives enabled a 10.3% increase in ART’s monetisation rate, bringing it to 22.3%.

153% increase in UK marketplace revenue

Airtasker has been growing steadily in the UK, with posted tasks rising by 69.2% on pcp and gross marketplace volume (GMV) lifting by 76.8% to £1.7m (A$3.5m).

ART points to a continued brand investment through Channel 4 and increasing momentum in the Birmingham and Manchester areas as the key points of impact.

Overall, the company increased its UK marketplace revenue by 153.2% on pcp to £355k, and GMV (on a trailing 12-month basis) by 63.8% to A$12.8m (£6.5m).

Source: Airtasker

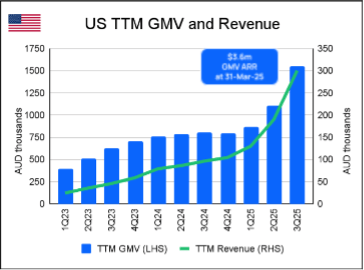

US Marketplace revenue quadruples

Continuing the theme of accelerating momentum, Airtasker’s US marketplace has experienced very strong revenue growth of 399% compared to the previous corresponding period, rising to US$86k.

Advertising partnerships with TelevisaUnivision, iHeartMedia, Sinclair and Mercurius as well as new city launches in Austin and Las Vegas drove GMV up 197% to US$411k (A$655k).

On a TTM basis, GMV grew to A$1.5m (a 92% increase) and revenue increased by 212% to A$300k. The Airtasker US marketplace achieved a GMV annualised run rate (ARR) of A$3.6m as of March 31, 2025.

Source: Airtasker

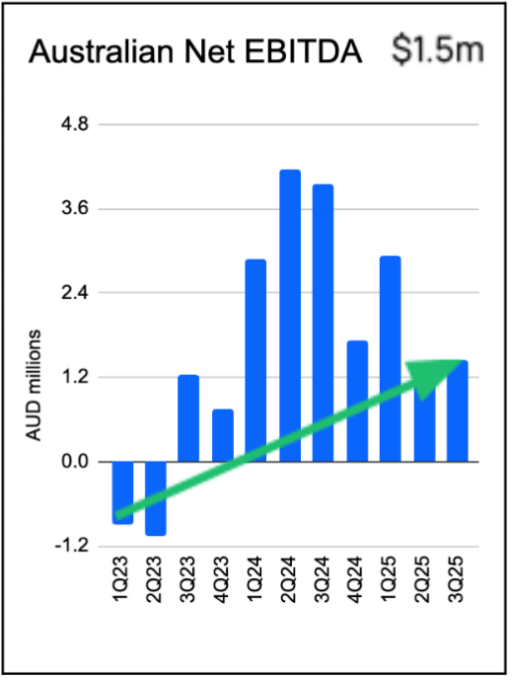

Australian EBITDA of A$1.5m

Airtasker’s Established Marketplaces – which includes Airtasker Australia and Oneflare – delivered positive earnings before interest, tax, depreciation or amortisation (EBITDA) of A$6m during the quarter, with $2.1m comprising non-cash marketing.

After covering all global head office expenditure, the Established Marketplaces segment delivered a positive Australian net EBITDA of $1.5m.

Source: Airtasker

The aforementioned $2.1m investment in non-cash brand marketing continued through the third quarter via oOh!media and ARN in conjunction with the Melbourne Formula One Grand Prix, decreasing net EBITDA.

ART expects to realise the value of this above-the-line brand marketing over a three-year period.

Due to a $12.9m investment in New Marketplaces, Group EBITDA was negative at $11.4m, mostly consisting of non-cash marketing of $7.9m across various media channels in the UK and US.

Airtasker expects the current state of affairs to continue into the fourth quarter as the company continues to use its non-cash media advertising services in Australia, the UK and the US.

Importantly, the positive cash flow generated in the Established Marketplaces segment contributed A$4.5m in available funds to invest in New Marketplaces.

The A$4.5m was invested in UK and US marketplaces without increasing their fixed costs, simultaneously growing both segments significantly and delivering positive Group free cash flow.

Airtasker founder and CEO Tim Fung said he was “super pleased” with the large revenue increases achieved in the UK and US, while still securing strong double-digit revenue growth in Australia.

“A huge shout out to the amazing Visa Cash App Racing Bulls Formula One Team and our incredible media partners across Australia, the UK and the US for their contribution to this awesome result,” Fung said.

This article was developed in collaboration with Airtasker, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.