Airtasker moves up a gear with third straight half of positive free cash flow

VCARB F1 team partner Airtasker has achieved its third straight half of positive free cash flow. Pic via Getty Images.

- Airtasker achieves third straight half of positive free cash flow with marketplaces revenue up 14.8%

- Company becomes an official team partner of Visa Cash App Racing Bulls Formula One Team

- It’s also an early collaborator with OpenAI, which brings its Operator agent to Australia.

Special Report: Airtasker has achieved a third straight half year of positive free cash flow with marketplaces revenue growing 14.8% on the previous corresponding period as the company gears up to raise its profile through a VCARB F1 team partnership and Open AI collaboration.

Airtasker (ASX:ART) delivered positive free cash flow of $600,000 in HY25, achieving a 105.3% improvement on the previous corresponding period (pcp).

Group revenue was up by 10% on pcp to $25.7 million with Airtasker’s marketplace’s revenue growing 14.8% on pcp to $21.7m, supported by an increased investment in above-the-line brand marketing across all key markets.

The group also delivered positive operating cash flow of $1.9m in HY25, up 35.8% on pcp.

Airtasker said the positive operating cash flow result was achieved by increasing cash receipts 16.4% to $28.4m, with cash outflows increasing 16.1% to $26.8m from a lower base.

The company noted that net cash used in investing activities, which decreased by a net $10.3m against pcp to $1m, was invested in intangible assets representing capitalised platform development expenditure.

Airtasker ended H1 FY25 with $18.3m in cash and term deposits.

Source: Airtasker

Growth in Australian operations

The Airtasker Australia marketplace generated revenue of $20.4m in HY25, up 11.6%, driven by a $3.6m increase in marketing including a non-cash marketing investment through media services provided by oOh!media and ARN.

The company has introduced several funnel optimisation programs, including the introduction of a revised cancellation policy and fee structure designed to improve platform reliability and address task leakage.

Airtasker said these programs have now had a complete half-year impact in HY25, reducing the cancellation rate by 10% against pcp.

The company said the programs, combined with continuous refinement of pricing and yield management, have resulted in the monetisation rate improving 5.1% to 20.8% in H1 FY25.

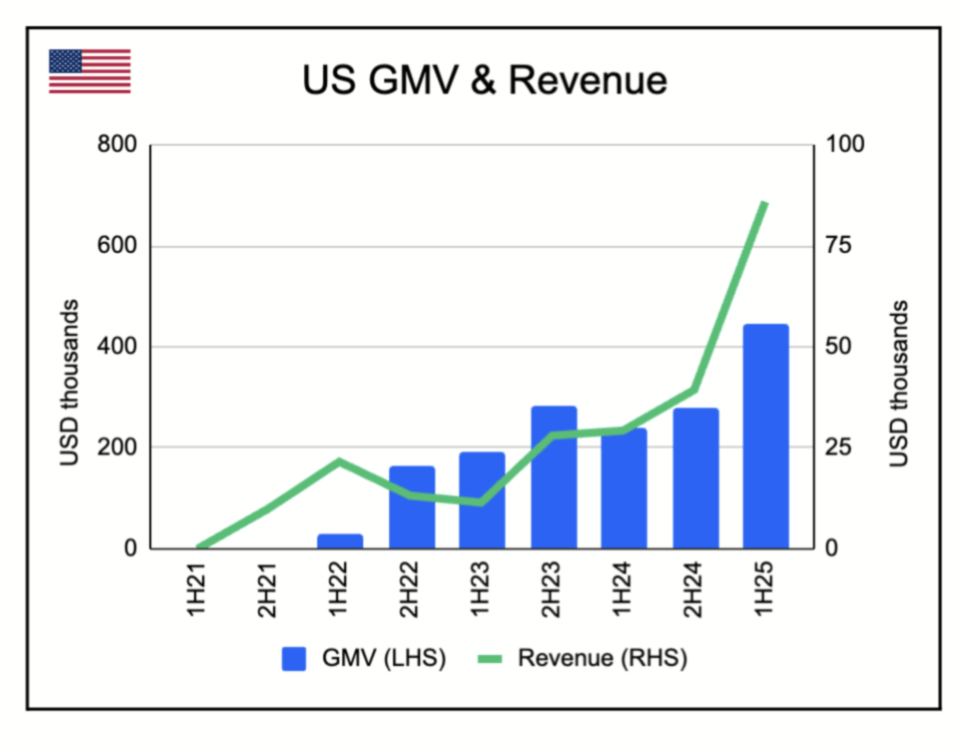

US market delivers 193.3% revenue growth

US Airtasker revenue was US$86k (A$131k), up 193.3%, while GMV was US$446k (A$677k) up 86.0%.

During the half, Airtasker in the US completed four media partnerships with TelevisaUnivision, iHeartMedia, Sinclair and Mercurius, collectively providing access to US$21.75m (A$32.6m) in media advertising services over the next two to three years.

The company said while the US marketplace was still in the ‘zero to one’ stage and focused primarily on the city of Los Angeles, top-of-funnel posted tasks increased 42.4% in the half-year.

Source: Airtasker

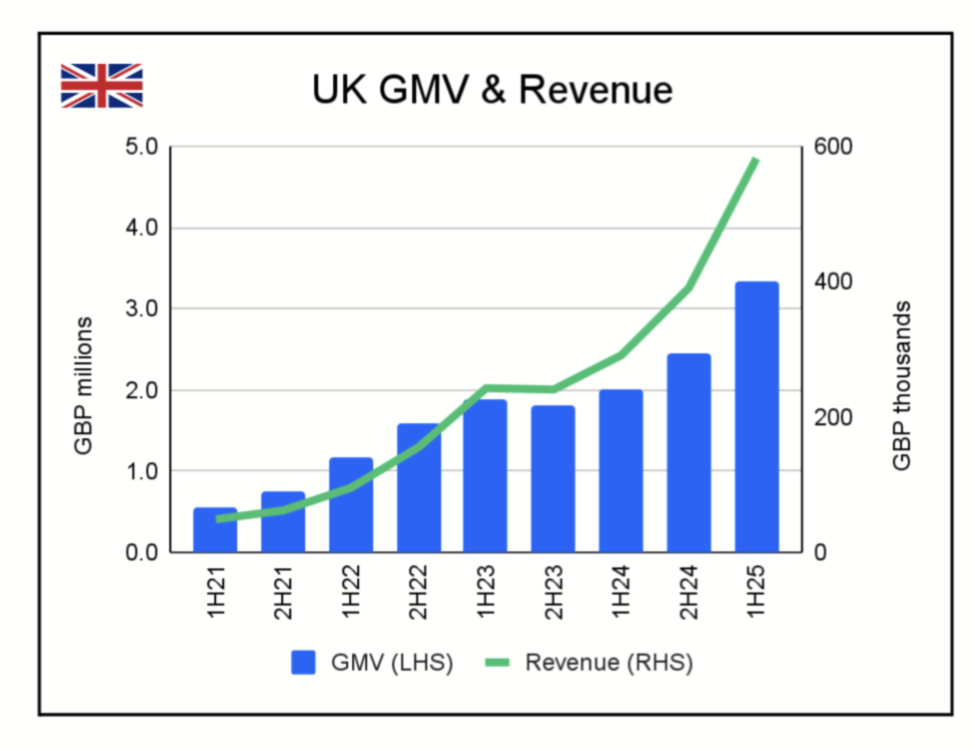

UK marketplace achieves 98% revenue growth

During HY25, Airtasker UK experienced strong growth in posted tasks, GMV and revenue in the UK marketplace.

The company generated GMV of £3.3m (A$6.5m) up 64.9% on pcp, and revenue of £582k (A$1,136k), up 99.8%.

In November Airtasker announced its UK operations had secured a follow-on investment of £4m (~$7.8m) in media capital from Channel 4 Television Corporation.

Airtasker attributed the strong GMV and revenue performance to increasing brand awareness, as well as the expansion in active cities beyond London to include Birmingham and Manchester.

Source: Airtasker

Airtasker partners with VCARB F1 team and launches open AI collaboration

In February Airtasker announced it was entering the world of F1 motorsport through a partnership with the Visa Cash App Racing Bulls Formula One Team (VCARB) as it continues its international expansion, building on its $51 million investment in media partnerships across Australia, the UK and US in 2024.

The partnership puts the company in front of a global audience of 1.2 billion.

The company has also become an early collaborator with OpenAI as the latter brings its Operator agent to Australia.

Airtasker said the collaboration will enable ChatGPT Pro customers to use Airtasker via OpenAI and book a Tasker with assistance from the Operator AI-powered agent.

The collaboration provides Airtasker with additional distribution through OpenAI as well as industry-first insights into how users may interact with and purchase local services in Australia using AI.

A ‘turbo result’ to continue momentum

Airtasker Founder and CEO Tim Fung said he was proud that Airtasker had delivered a third straight half of positive free cash flow whilst also re-accelerating Airtasker marketplace growth to achieve a “turbo result” in the UK and US marketplaces.

“We’re in a great position with $18.3m in cash and term deposits, supplemented by $45.2m in media assets, an incredible partnership with the Visa Cash App Racing Bulls Formula One Team, and a collaboration with OpenAI Operator,” he said.

“I’m really pumped to reaffirm our full-year free cash flow and revenue growth guidance and keep up the momentum in the second half.”

This article was developed in collaboration with Airtasker, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.