Airtasker delivers positive free cash flow and shrinks loss in major turnaround

dramatically cut its losses to just $0.2 million in FY24, skyrocketed free cash flow by 115%, and achieved robust growth in global markets driven by a savvy media blitz. Image: Getty

- Airtasker delivers turnaround, cutting losses to just $0.2 million from $8m

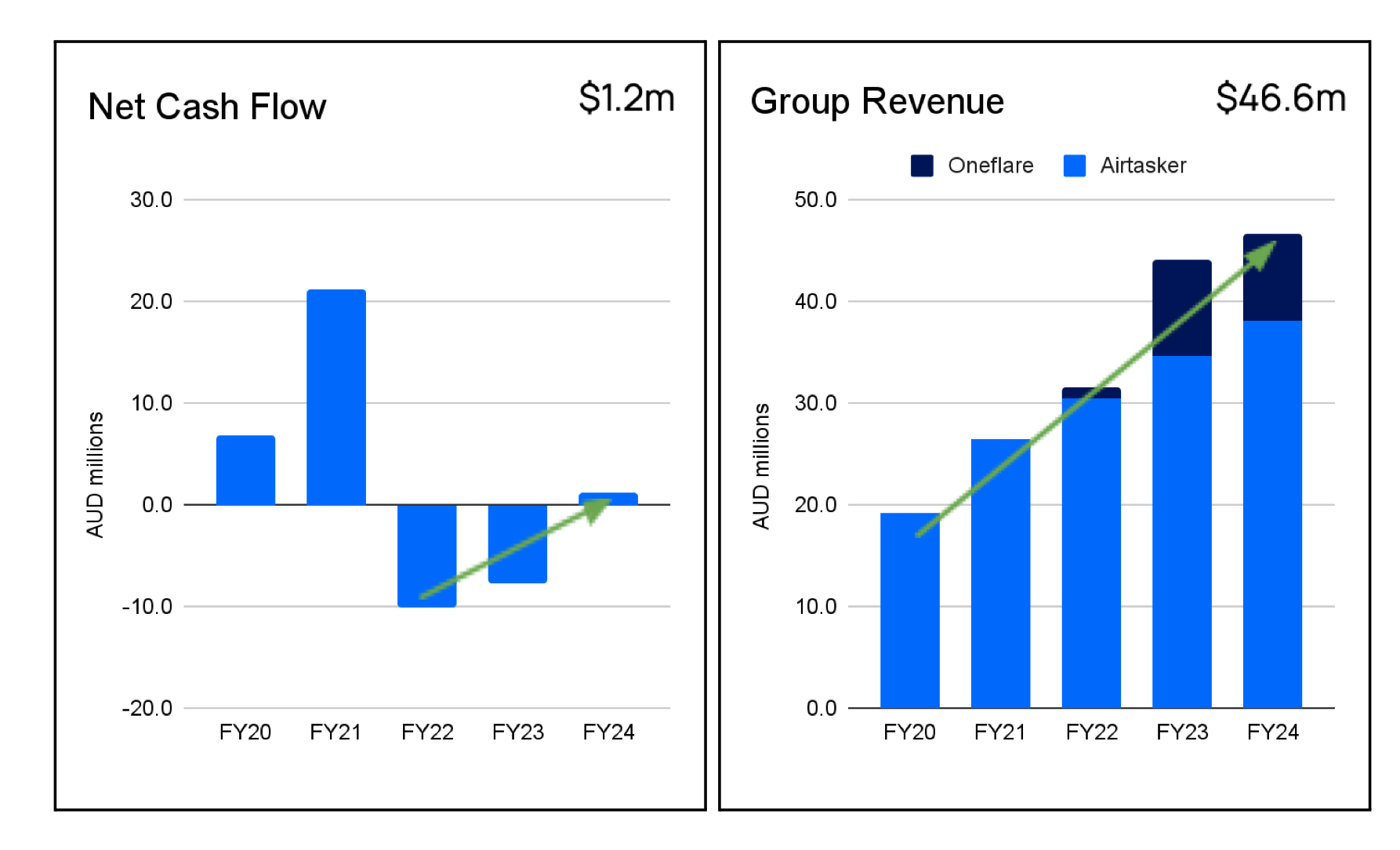

- Free cash flow boosted by 115.3pc to $1.2 million in FY24

- Media partnerships and reduced expenses are driving the company’s rapid growth

Special Report: Airtasker has dramatically cut its losses to just $0.2 million in FY24, skyrocketed free cash flow by 115%, and achieved robust growth in global markets driven by a savvy media blitz.

Gig economy platform Airtasker (ASX:ART) saw its cash flow turnaround by $8.9m to $1.2m in the last financial year.

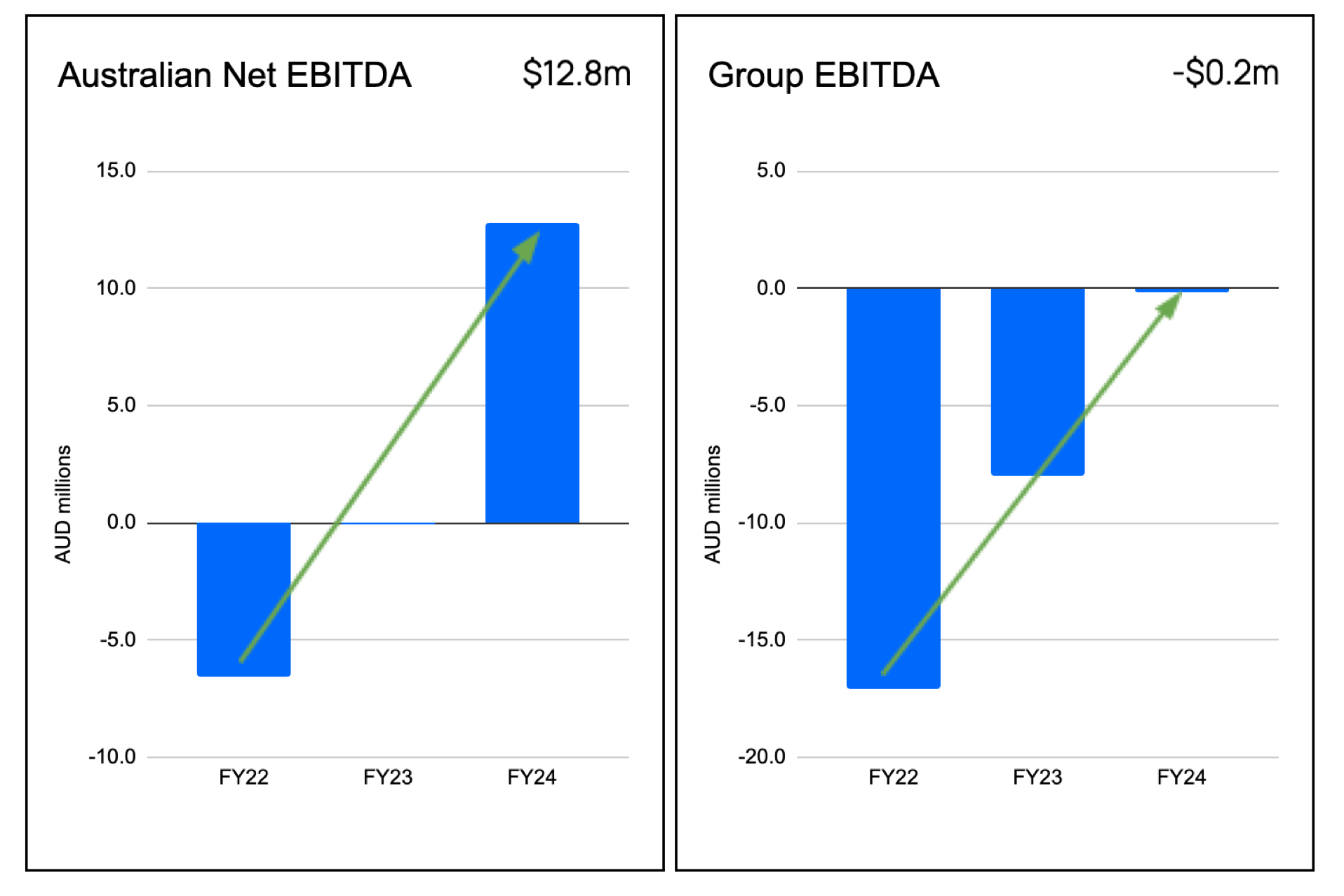

It’s a major achievement for the Australian tech startup, which went public in 2021 and reported an EBITDA loss of $8 million last year.

Airtasker divides its business into two main areas: ‘Established Marketplaces,’ which includes its Australian operations, and ‘New Marketplaces,’ which covers its activities in the US and UK.

In FY24, revenue from Airtasker’s marketplaces globally grew by 9.8% to $38.1 million, and its overall revenue rose by 5.6% to $46.6 million.

The UK marketplace saw a 20% increase in gross marketplace volume and a 41.1% rise in revenue, driven by a successful Channel 4 television campaign that accelerated demand.

The fourth quarter alone saw a remarkable 76.3% revenue growth in that market.

The US marketplace also performed well, with a 73.7% increase in revenue. The company has seen promising growth in the US by carefully managing its marketing expenses and actively pursuing new media partnerships.

Pic: Airtasker

Meanwhile, Airtasker’s Australian marketplaces also showed impressive gains, generating $45.2 million in revenues and $31 million in EBITDA, up 24% from FY23.

The strong performance from this segment more than covered the global head office expenses and technology investments, which amounted to $18.2 million.

Overall, Airtasker achieved a 97.8% improvement in group EBITDA for FY24, reducing its loss to $0.2 million from $8.0 million in the previous year, while gross profit improved by 6.6% to $44.5 million.

Pic: Airtasker

Throughout the year, Airtasker focused heavily on cost reduction, cutting employee expenses by 26.1% (or $7.9 million) to $22.4 million and slashing technology, general, and administrative costs by 16.4% to $10.7 million.

The company also ended the year with a robust balance sheet, holding $17.8 million in cash and term deposits.

“Whilst macroeconomic conditions have been challenging, I’m pleased to announce that Airtasker has delivered on our promise of positive full year free cash flow of $1.2m,” said Airtasker’s CEO and founder, Tim Fung.

“This was achieved whilst delivering solid revenue growth and building on our momentum in international markets.”

Media partnerships, strategic decisions driving growth

The cost of living crisis has driven record numbers of people to seek jobs through Airtasker, but the number of available tasks has decreased as people cut back on spending.

Despite these tough economic conditions, Airtasker has managed to grow its revenue and achieve positive free cash flow through several strategic actions.

The company first boosted its brand awareness by partnering with media companies. In July, Airtasker secured a $5 million deal with ARN Media and another $5 million agreement with oOh!media for $6 million worth of billboard and screen advertising.

ARN operates 58 radio stations, including popular shows like Kyle & Jackie O, Will & Woody, and Jonesy & Amanda, and runs a podcast platform on iHeartRadio.

oOh!media, on the other hand, manages 35,000 billboards and screens across the country, including in airports, stations, and along major roads.

Pic: Airtasker

A similar strategy was employed in the UK, where Airtasker sold a stake in its British subsidiary to Channel 4 in 2023 for $6.5 million in advertising.

That deal aimed to leverage Channel 4’s audience of 47 million monthly viewers to enhance Airtasker’s marketing reach, and has led to a substantial increase in its UK revenue.

Additionally, Airtasker’s revised cancellation policy, introduced last August, has reduced task cancellations by 26.3% compared to the previous year.

Under the new policy, customers who cancel a task receive Airtasker Credits, which can be redeemed as cash upon request.

These changes have led to a record number of completed tasks and a 13.7% increase in the monetisation rate, reflecting improved revenue capture.

However, the full impact of these changes is not yet fully reflected in the FY24 monetisation rate, as the policy was rolled out in stages and regions throughout the year.

Fung said he was very optimistic about the year ahead.

“With our Australian marketplaces generating $31.0m EBITDA, $17.8m of cash and term deposits on balance sheet plus $11.0m in media assets from oOh!media and ARN we’re looking forward to a positive FY25,” he said.

This article was developed in collaboration with Airtasker, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.