‘AI is set to play an increasing role in investing’: Bailador

Bailador sees AI playing a big role in growth equity investing. Pic: Getty Images.

- Bailador believes AI will play increasing role in investing as it continues to advance

- Bailador is investigating AI’s potential in investing

- CSIRO Data61 and AI-driven public equities investment fund Minotaur Capital presented at a recent AI session

Special Report: Bailador Technology Investments believes artificial intelligence is set to play an increasing role in growth equity investing as the team looks to leverage AI efficiencies.

Bailador Technology Investments (ASX:BTI) recently held a professional development offsite dedicated to exploring the transformative role of artificial intelligence (AI) in investing and its potential to unlock growth opportunities for the tech-centric capital fund’s portfolio companies.

Speakers from the data and digital specialist arm of Australia’s national science agency CSIRO Data61 and AI-driven public equities investment fund Minotaur Capital shared insights into AI’s capabilities, and its evolving role in investing and operational efficiency.

CSIRO Data61 research director and conjoint professor at UNSW Professor Liming Zhu provided a comprehensive overview of AI’s evolution from supervised, human-prompted learning to deep learning – autonomously processing data to generate output.

Three strategies for harnessing AI

In his overview Zhu shared key strategies for effectively harnessing AI including:

- Optimise productivity gains from outperformers and junior users – The most significant productivity gains from AI tools were typically linked to the AI user, not the specific task.

For instance, in one study outputs of top-decile scientists increased by 81% and productivity amongst junior programmers increased around 50%, with less pronounced improvements amongst other employees.

- Experiment and iterate – AI thrives in environments with bottom-up experimentation and deep human expertise.

The best outcomes were not achieved by hiring AI specialists, but through embedding AI in an organisation’s culture and allowing it to evolve organically through experimentation, and then sharing the best uses and outputs.

- Recognise that results are probabilistic – AI produces probabilistic outcomes, meaning that its responses can vary even with identical inputs, presenting both challenges and opportunities for refining interactions with AI.

Zhu also highlighted the next frontiers for AI development, noting implications for investment in advanced chips and data warehouses, and replacement of human content creation and software development as AI becomes more intelligent over unstructured data.

Using AI to enhance internal investment processes

Minotaur Capital’s Armina Rosenberg and Thomas Rice presented on how they use AI to enhance their internal investment processes.

The duo provided the BTI team with a demonstration of Minotaur’s idea generation and portfolio management software Taurient and delved into notable use cases for AI including:

- Automation of routine tasks – AI can reduce the time spent on administrative tasks such as high-level summarisation and drafting, allowing teams to focus on more strategic activities.

- Enhancement of deal sourcing – AI-driven tools now scour the internet for valuable data signals, such as tracking LinkedIn, social media activity, and customer feedback with insights helping identify potential investment opportunities more quickly and accurately.

- Augmentation of investor relations – AI can assist in portfolio management by automating the extraction of data from emails, CRM systems, and distribution lists, enriching the investor’s insights into prospective partners or portfolio companies.

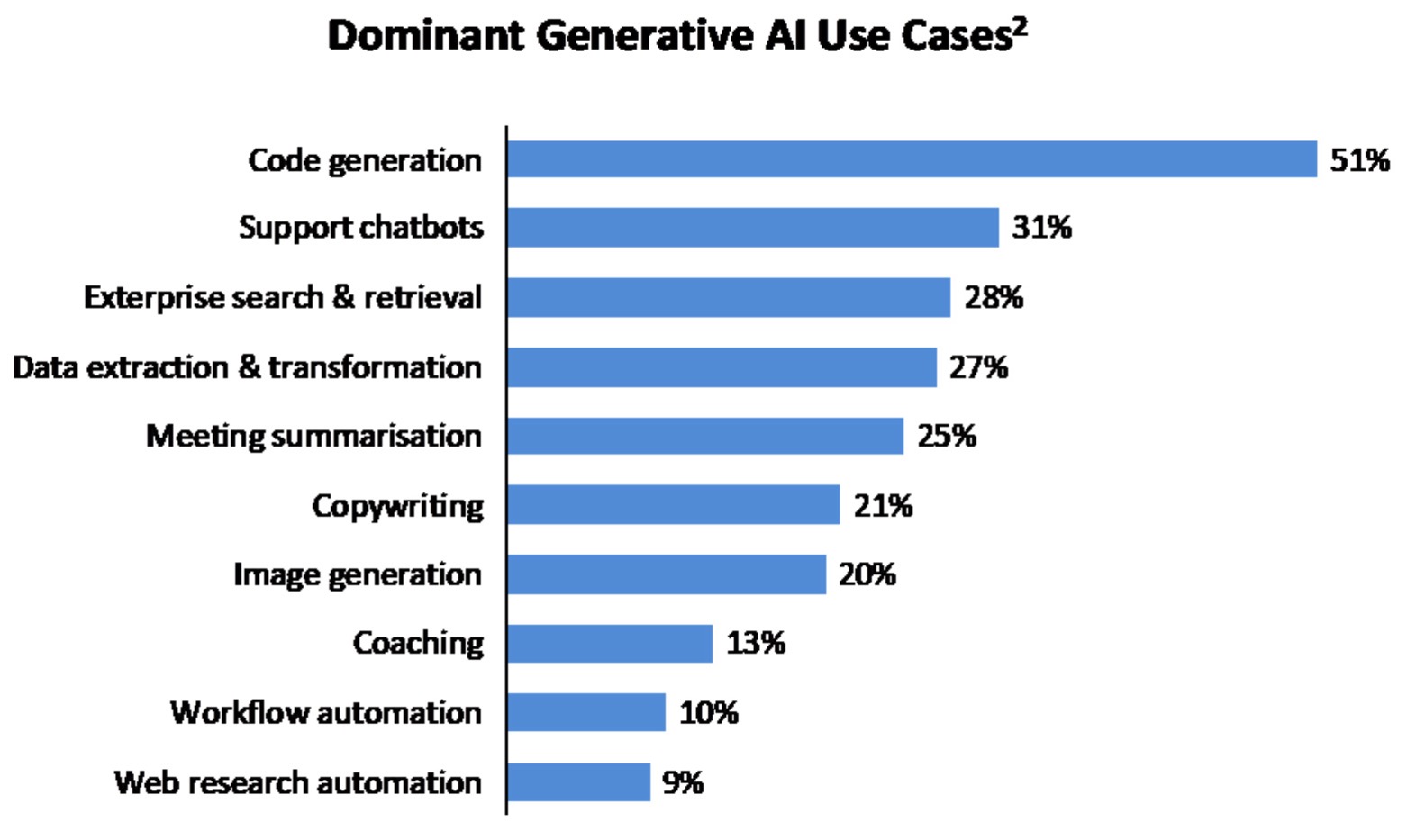

In a November report, BTI co-founders David Kirk and Paul Wilson meanwhile noted adoption trends point to a subset of use cases already delivering tangible ROI through enhanced productivity or operational efficiency:

Source: BTI

Preventing mistakes, exploring key risks and benefits

Kirk and Wilson said there were key learnings about how to prevent mistakes such as by adding human checks, tailoring and standardising prompting techniques, adding de-hallucination code to check the veracity of quotes or links and robust evaluation frameworks.

During the working sessions, the BTI team explored the potential benefits and risks AI presented for its portfolio companies with several key opportunities emerging including:

- Customer service efficiency – Kirk and Wilson said AI-driven tools could enhance customer support, making interactions faster, more responsive and personalised.

- Content and documentation generation – The pair noted AI could streamline the creation of presentation materials and drafting of standardised documentation, reducing operational bottlenecks.

- Fraud detection and software development – Kirk and Wilson said AI systems could improve fraud detection and optimise software development processes, enhancing efficiency and security for portfolio companies.

Opportunities for BTI to use AI

Kirk and Wilson said BTI had evaluated its own internal investment processes and see opportunities to employ AI in a range of ways, including:

- Deal sourcing and screening – AI could assist in extracting key signals, such as revenue growth, employee expansion and customer feedback, across various platforms, in turn reducing time spent on manual searches and improving decision-making.

- Portfolio management – AI tools could automate the collection of portfolio metrics, monitor industry trends and assist with investor relations.

- M&A and exit strategy support – AI can track potential merger candidates, buyers and market conditions, providing valuable insights to ensure the team are well-prepared to act when opportunities arise.

“AI is set to play an increasing role in growth equity investing,” emphasised Kirk and Wilson.

“As AI technology continues to advance, it may influence how the team sources deals, evaluates investment opportunities, and manages the portfolio.”

“Factors to consider include adoption of a forward-thinking approach that prioritises ongoing experimentation, iteration, and the integration of AI into both our internal operations and those of our portfolio companies.”

This article was developed in collaboration with Bailador Technology Investments a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.