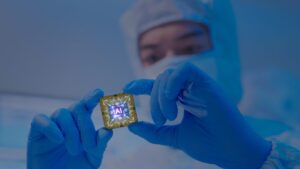

Adisyn’s 2D Generation is in the global race to bring graphene into advanced semiconductors

Adisyn's 2D Generation is in the race to bring graphene into semiconductors. Picture via Getty Images

- Adisyn’s acquisition of 2DG unlocks semiconductor potential

- Graphene breakthrough opens the door for next-gen chips

- 2DG’s low-temp graphene process tackles industry bottleneck

The semiconductor industry is at a pivotal juncture, with skyrocketing demand for faster, more energy-efficient chips to fuel everything from AI breakthroughs to the next generation of smartphones.

One of the most promising materials for meeting these demands is graphene, a highly conductive and exceptionally strong material made from a single layer of carbon atoms.

Despite its immense potential, the integration of graphene into semiconductor manufacturing has remained elusive.

However, that may soon change with a recent breakthrough by Israeli-based 2D Generation (2DG), a company which has just been acquired by ASX-listed Adisyn (ASX:AI1) .

Adisyn, primarily a provider of tech services for SMEs in the Australian defence sector, has expanded its focus to the semiconductor industry through this acquisition.

2DG, meanwhile, is a leading high-tech company specialising in graphene-based solutions for semiconductors.

The company is also one of the founders of Connecting Chips European Union Joint Undertaking, a collaboration that includes industry leaders like NVIDIA, Valeo, and Applied Materials.

This acquisition not only brings Adisyn cutting-edge technology, but potentially opens the door for the company to enter the hot semiconductor space.

The breakthrough: Growing graphene at low temperatures

Graphene is hailed as a “wonder material” due to its exceptional electrical, thermal, and mechanical properties. It’s well known as a conductor of electricity better than copper, lighter than paper, and stronger than steel.

For years, graphene has held great promise, especially in semiconductor applications where faster, smaller, and more power-efficient chips are in constant demand.

Yet, its widespread use has been hampered by one key challenge: the difficulty of integrating graphene into semiconductor manufacturing processes.

Graphene traditionally needs to be produced at temperatures around 1,000°C to preserve its properties. But this creates a significant obstacle, as such high temperatures would destroy the delicate structures of semiconductor chips.

Other companies have attempted to grow graphene using high temperatures, but none have managed to do so in a way that’s compatible with semiconductor production processes.

This is where 2DG, with its patented technology, has managed to set itself apart.

2DG’s co-founder and CEO, Arye Kohavi, explained that the company has developed a unique process that allows graphene to be grown at temperatures below 300°C.

This breakthrough makes it possible to integrate graphene into semiconductor manufacturing without damaging the chip’s sensitive components.

Achieving such low temperatures is a major innovation for the industry, something that has never been successfully done before.

2DG’s process uses Atomic Layer Deposition (ALD), a technique already employed in semiconductor fabs, to grow graphene at low temperatures by precisely layering it one atomic layer at a time, ensuring high-quality, controlled deposition.

“This low temperature is what sets us apart from everyone else. And this makes it possible to incorporate graphene into the semiconductor manufacturing process in a way that was previously not possible,” said Kohavi.

The bottleneck and ‘holy grail’ for semiconductors

The importance of this breakthrough cannot be overstated.

Kohavi said that if we can finally integrate graphene into semiconductors, we can overcome the main bottleneck of the industry—interconnects – the tiny connections between transistors on a chip.

As chips get smaller, the transistors themselves become more densely packed, and the interconnects that link them need to be thinner and thinner.

However, as interconnects shrink, they become more prone to heat generation, which slows down performance and can even lead to chip failure.

Graphene, with its exceptional conductivity and resistance to heat, is ideally suited to address this issue.

But again, for graphene to replace traditional materials like copper in the interconnects, it needs to be applied in a way that doesn’t compromise the integrity of the chip.

“If we want chips to keep getting faster, we need to solve the heat generation problem, and graphene can do that. Without a solution to this, the industry will stall,” said Kohavi.

2DG’s innovation could provide the ‘holy grail’ the semiconductor industry has been searching for, allowing for the continued miniaturisation of chips without the corresponding increase in heat generation.

“We are developing something that could solve one of the biggest problems in the semiconductor industry today.

“This is not just a nice-to-have technology; it’s a critical one and we see a huge potential here.”

The market potential

The market for advanced semiconductors is clearly vast and growing fast.

The space is already valued in the hundreds of billions of dollars, with various research showing the market could explode and grow significantly in the coming years.

While the potential for 2DG’s technology is clear, Kohavi admitted there are still challenges ahead.

The company is currently in the process of acquiring new, more advanced ALD machines to improve the quality and coverage of graphene.

“We’ve already demonstrated that our process works, but we need to scale it up to meet the demands of the semiconductor industry,” Kohavi said.

Once these new ALD machines are in place, 2DG plans to work with leading semiconductor manufacturers to begin testing the technology.

“We’ve already had discussions with major players like TSMC and Nvidia, and they’re all waiting for us to show that we can scale this.”

If all goes to plan, Kohavi said the company could soon see its graphene-based solutions integrated into next-generation chips, powering everything from EVs to AI systems.

“If 2DG’s graphene technology successfully becomes a core part of semiconductor manufacturing, it could impact the entire sector and significantly increase the company’s value.”

The views, information, or opinions expressed in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.