5 Ways inflation will impact stock markets

The 1970s was an era defined by flares, bright colours (my parents had bold orange dining chairs), blue eyeshadow, big hair (again there’s photos of mum looking very Farrah Fawcett), Saturday Night Fever and Abba.

But it was also an era of high inflation with US President Jimmy Carter addressing the American people: “We can not accept high rates of inflation as a permanent fact of American life.”

Since the start of 2021, inflation has been rising steadily globally. Originally put down as transitory, caused by supply shortages combined with massive government stimulus packages associated with the Covid-19 pandemic, there now seems to be consensus inflation is not a temporary problem.

Capital.com Chief Market Strategist David Jones said the fiscal stimulus super-charged consumer spending.

“There’s been lower interest rates, so the cost of borrowing is low and QE which is effectively pumping money into the economy a lot of which finds its way into markets to try and prop up and avoid any massive sort of crash,” he said.

While governments were out to protect markets and economic growth it has led to inflation. The US consumer price index for February hit a new high of 7.9% year-over-year, the highest in 40 years since Mum had her big hair.

Energy, food, housing, vehicle costs have all risen and are expected to hike further as the war in Ukraine puts added pressure on prices.

Central banks are now accepting that they have to reign in inflation. The hawks are out with the US Fed last week increasing its cash rate by 0.25%, signalling six more rate hikes to follow.

So, what are five ways inflation will impact share markets?

1.Bad news for market overall

Historically, inflation has spelled bad news for company stocks. At times when inflation went above 3% between 2007 and 2021 the Dow Jones Index reacted negatively.

When inflation spiked during the subprime mortgage crisis in 2008 the Dow lost almost half its value. Again in 2011, when inflation rose the index fell.

Furthermore, Duke University undertook research into returns over 95 years from 1926 to 2020 on different sectors when inflation moved above 5%. They focused on eight sustained periods of inflation where supply patterns were jolted by conflict, oil embargoes, revolution and economic booms.

“When it comes to inflation markets and investing can get a lot trickier with some stocks out performing,” Jones said.

2.Energy stocks outperform

The researchers found across all periods during times of inflation, energy stocks performed the best.

“Companies that produce gas, oil, renewables energy will all be thriving during inflation because inflation is caused by increasing energy prices,” Capital.com features editor Jekaterina Drozdovica said.

The price of WTI and Brent Crude Oil fell to historic lows in April 2020 but have recovered sharply.

3. Soft commodities also shine

Soft commodities such as corn, wheat, fruit or livestock have also historically held or increased coinciding with associated stock prices. This is true today where they have soared in price.

The research found the soft commodities offered an average 14% return during times of inflation.

4. Bank stocks unknown

Historically, bank stocks during times of inflation have been hard to gauge.

“When inflation hits there’s expectation of an interest rate hike from central banks so in theory banks should benefit from that because an interest rate hike makes it more profitable for banks to lend money,” Drozdovica said.

Inflationary pressure however can also signal an economy is in difficulty and be ideal conditions for debt defaults to arise.

“Banks are very, very embedded in the economic cycle dynamics so might get hit by a recession which may follow an inflation spike,” Drozdovica said.

5. Move from high growth to value stocks

The less flashy stocks which typically offer steady but not spectacular growth rates known as value stocks also tend to do well during inflation.

“As investors become a bit more concerned about the economy and effects higher inflation could have on it they could turn away from some of the more aggressive go-getter tech stocks and look to a more traditional blue-chip, slightly safer play,” Jones said.

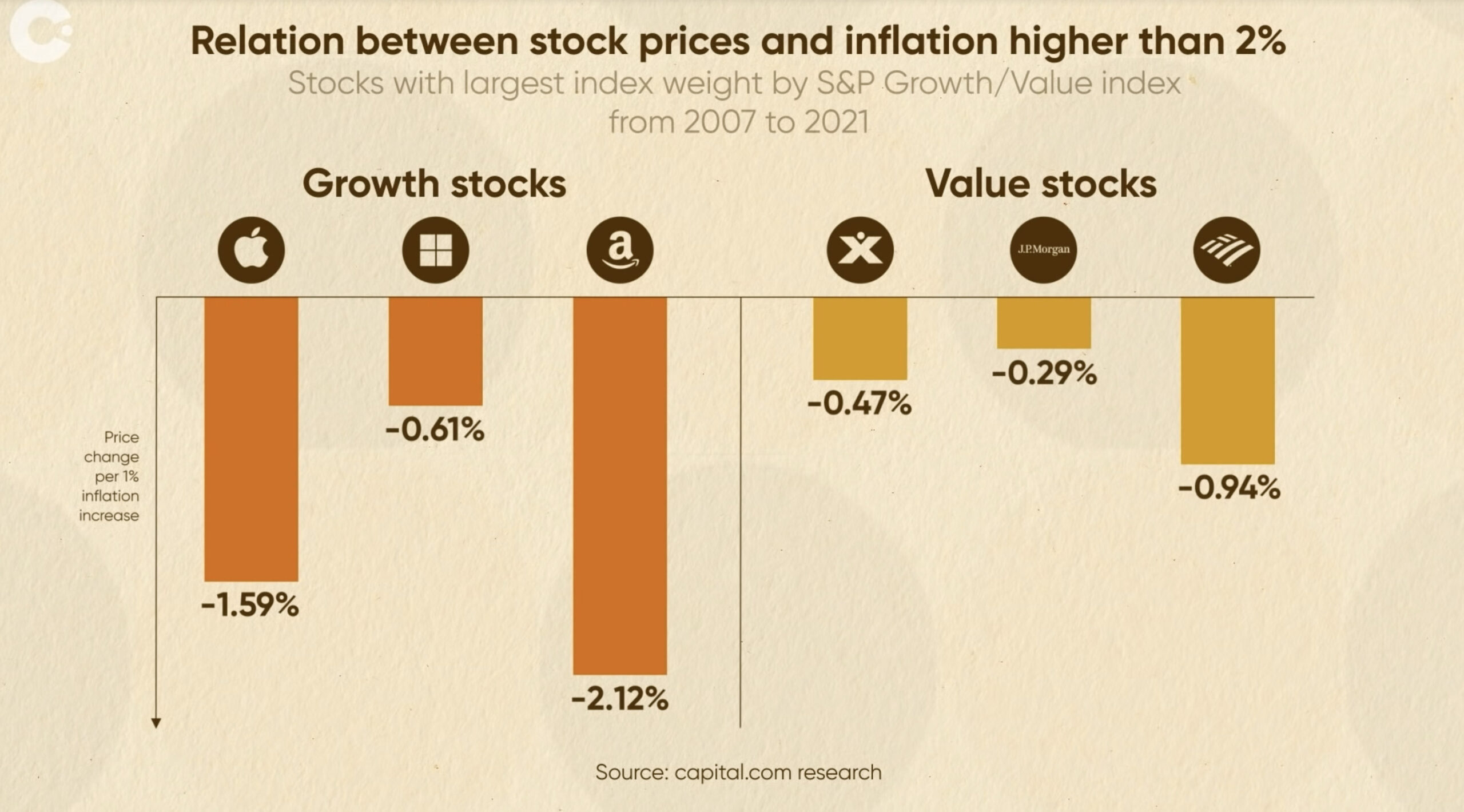

Capital.com analysed the top three US growth stocks Apple, Microsoft and Amazon along with the top three value stocks Berkshire Hathaway, JP Morgan and Bank of America from 2007 to 2021.

As inflation starts to rise more than 2%, the price of growth stocks tends to decrease more quickly than the value stocks.

“Technology stocks could suffer with high inflation, some of them anyway,” Jones said.

“Some of the big names Meta, Amazon, Netflix, Google weren’t around in the 1970s when we had runaway inflation so it’s difficult to know how they will be impacted.”

Investors will look at how much debt a company has taken on during inflationary periods, with value stocks typically better placed.

“If we do see interest rates gradually go up that could be a bigger shock than stock markets were expecting.” Jones said.

Stagflation where inflation rises as the economy slows is a likely scenario, which could still provide opportunities for investors to capitalise on changing economic climate.

This article was developed in collaboration with Capital.com Australia (AFSL 513393), a Stockhead advertiser at the time of publishing.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.