Liontown exceeds expectations with maiden 21m tonne lithium and tantalum resource

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special report: A decision a couple of years ago to switch its focus from Tanzanian gold to Australian battery metals has paid off in spades for Liontown Resources.

The $35 million junior today emerged from a trading halt to announce its maiden lithium resource.

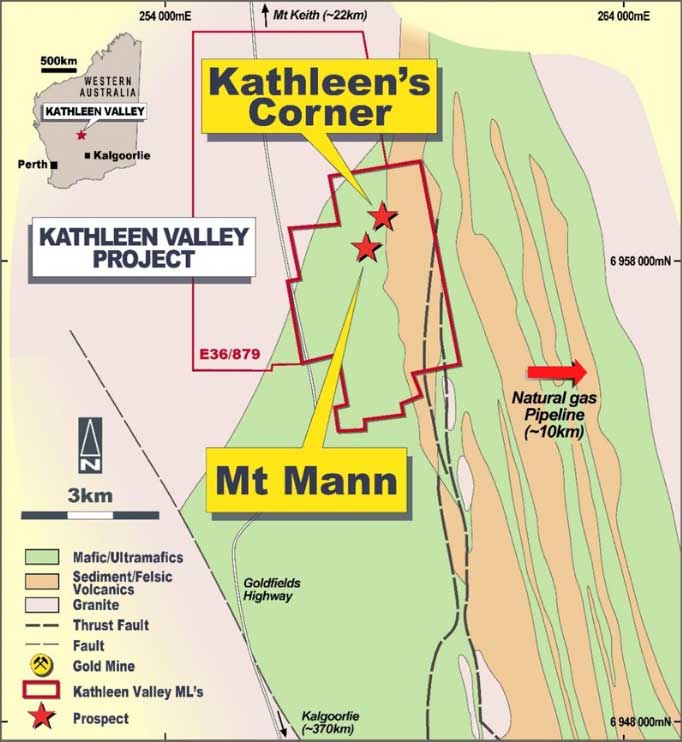

Liontown (ASX:LTR) reported a maiden “Measured, Indicated and Inferred” mineral resource at its Kathleen Valley project 670km north-east of Perth, totalling 21.2 million tonnes at an impressive grade of 1.4% Li2O (lithium) and 170ppm Ta205 (tantalum).

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

The maiden mineral resource exceeded the company’s published exploration target of 10-15 million tonnes at 1-1.5% Li2O by a significant margin.

Liontown made the decision to focus on Kathleen Valley after an initial drill program last year returned thick, high-grade spodumene intercepts, indicating the potential for a high-grade hard rock lithium discovery.

Two rounds of resource drilling this year have confirmed this potential, resulting in the delineation of a significant initial resource across the Kathleen’s Corner and Mt Mann deposits.

Liontown managing director David Richards says the maiden resource is a “major milestone” which has provided a strong foundation for its aspiration to develop a high-quality battery metals business in Australia.

“We always had high hopes for Kathleen Valley, for a number of reasons,” Richards says.

“It’s in a great position, in a well-established mining jurisdiction near Leinster, it lies close to existing transport, energy and camp infrastructure, and the mineralisation sits on granted Mining Leases.

“The other attractive features are its high grade, the significant tantalum component, and the fact that it comprises mainly spodumene-hosted lithium mineralisation that is likely to be amenable to conventional processing.”

“These are big pluses for any emerging lithium project – and they put us in relatively rare company. Outside of the leading mid-tiers like Pilbara Minerals, Kidman Resources and Altura Mining, there actually aren’t many ASX-listed companies with emerging high-grade spodumene deposits in Australia.”

To put Liontown’s maiden resource for Kathleen Valley in context, the current published resource for Tawana Resources’ (ASX: TAW) new Bald Hill lithium mine is 18.9 million tonnes at 1.18% Li2O and 149ppm Ta205.

And Galaxy Resources’ (ASX: GXY) Mt Cattlin lithium mine in WA has a resource of 9.7 million tonnes at 1.35% Li2O and 198ppm Ta2O5.

Then, to put the potential upside for Liontown in perspective, Tawana has a market capitalisation of around $196 million and Galaxy $1.2 billion (albeit with other significant offshore assets) compared to Liontown’s $35 million.

Richards and his team are confident they will be able to follow in the footsteps of some of Liontown’s bigger lithium peers like Tawana, Galaxy, Pilbara Minerals and Altura Mining – which collectively have helped transform Australia into a lithium super-power in the past five years.

Fast-growing market

As lithium has become one of the world’s fastest growing commodity markets, thanks to the burgeoning electric vehicle and energy storage industries, Australia has grown its market share of raw lithium production from around 13 per cent in 2000 to 50 per cent in 2017.

And leading consultancy Roskill predicts that it will hit 62 per cent this year.

“While there’s no doubt the industry has grown quickly, we still see significant opportunities for new players with quality spodumene resources in Tier-1 jurisdictions,” Richards says.

“The Chinese lithium conversion and battery industries have geared up their lithium raw material supply chains around quality spodumene concentrate from Australia and we can only see that demand increasing in the years ahead,” Richards said.

“Outside of the world-scale deposits like Greenbushes, Pilgangoora and Kidman’s Mt Holland deposit, there are actually not that many new high-quality spodumene discoveries in Australia. That’s where we see a big opportunity for Liontown as we grow our spodumene resource inventory.”

With the new Kathleen Valley Mineral Resource now on the table, Liontown plans to engage in “preliminary discussions” with off-takers and potential strategic partners, while at the same time moving ahead with a Scoping Study next quarter.

Drilling is also currently underway at its Buldania Project near Norseman, where the company delivered some impressive lithium intercepts earlier this year. Liontown is confident of the potential to generate a second lithium resource there, perhaps as early as Q4 this year.

And in the meantime there’s clear potential to keep growing the resource at Kathleen Valley.

“The Mineral Resource remains open along strike and at depth, and offers outstanding potential for further growth with additional drilling,” the company said.

This special report is brought to you by Liontown Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.