BitFunds to float first ASX crypto futures company

Investors are abuzz with blockchain euphoria, but gaining direct exposure to cryptocurrencies such as bitcoin is more difficult to do within the bounds of the regulated market.

That’s what BitFunds‘ ASX-aspirant XBT Investments wants to change.

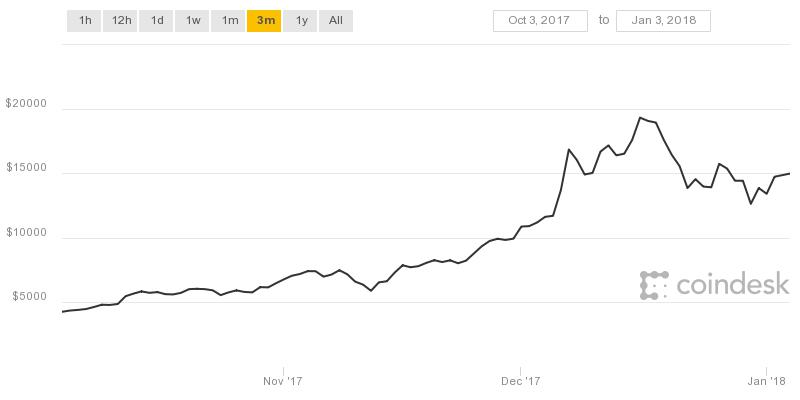

The digital asset manager hopes to leverage the launch of bitcoin futures in the US and provide a means for Australian investors to gain off bitcoin’s colossal climb.

Bitcoin was this week climbing again after falling to lows of $16,000 at the end of the year, but the unfamiliar platform has deterred many more sophisticated investors, until now.

In December, two of the world’s largest exchanges, CMO and CBOE, started trading in bitcoin futures – where traders can bet on whether the price of the cryptocurrency will rise or fall to a specified future date.

BitFunds managing director Jason Davis described the run up to launch of the futures market as an ‘arms race’ between the major players but that it provided opportunities for everyday investors to take on the potential gains with less of the risk.

“Futures have been around for a long time and are a core component of our financial system – because these contracts are being issued by reputable exchanges there is no settlement risk,” he said.

“From a trust point of view, we think it is an optimal way of exposing our investors to the bitcoin price without the risk of direct bitcoin transactions.”

While investing directly in cryptocurrencies is not permitted on the ASX, investing in derivatives is well within the rules.

BitFunds hopes to set up their first listed investment company (LIC) to leverage the launch of futures on the US CBOE and CME markets.

“In order to buy bitcoin directly you need to open an account with an exchange and those fall outside of regulation and most have limited ability to facilitate transaction beyond a few thousand dollars,” he said.

They are looking to raise up to $100 million in their first IPO for XBT Investments before rolling out further digital investment products.

It’s not Mr Davis’ first rodeo either, he founded fintech companies Sell My Shares and Upcoming Floats, both companies that have disrupted the market through the introduction of technology.

Bitcoin was just the next logical move.

“Cryptocurrencies are the ultimate expression of the peer-to-peer movement as it completely circumvents the financial system,” he said.

“We are now at the coal face of regulation and hope to be the first to market.”

This special report is brought to you by BitFunds.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.