Zinc industry’s battery initiative fosters new zinc battery technologies

Think zinc! The International Zinc Association has launched a Zinc Battery Initiative. Image: Getty

- International Zinc Association launches Zinc Battery Initiative to promote and foster zinc battery technology

- ‘Chinese imports of zinc contained in zinc concentrates in 2020 amounted to a record 1.8 million tonnes’ – ILZSG

- Zinc is the world’s fourth most traded metal in a trade worth $US40bn ($51bn) a year

The International Zinc Association (IZA) – a representative trade body for zinc producers – is promoting rechargeable zinc batteries through a new initiative that launched this week.

The Zinc Battery Initiative is a program created by the IZA to foster cooperation among zinc producers to develop new technologies for the base metal that is facing sharp competition from lithium and graphite alternatives.

“The advancement of zinc battery technologies, resulting in low-cost, sustainable and safe options for key applications, represents a disruptive innovation with significant impacts on these markets going forward,” IZA executive director, Andrew Green, said.

The IZA highlighted some of the key characteristics of zinc batteries which have been a mainstay of the traditional zinc and lead battery market for more than a century.

“They are versatile, offering flexible designs with broad operating temperatures, high power discharge, and are capable of long duration storage,” said the IZA.

Zinc Battery Initiative backed by sector’s leaders

The IZA also highlighted the “excellent” safety record of zinc batteries, and the industry’s strong supply chain with production in North and South America, Europe and Australia.

“Addressing climate change and creating energy grids resistant to extreme weather will require a variety of technologies,” said the IZA.

Recent extreme weather in the US has highlighted the need for resilient energy grids and the role of cost-effective battery energy storage systems to balance out peaks in demand.

Members of the Zinc Battery Initiative include leading companies in the zinc battery sector such as ZincFive, Salient Energy, Urban Electric Power, e-Zinc, ZAF Energy Systems and Aesir Technologies.

“We are enthusiastic about creating a partnership between our zinc-producing members and leading companies in the zinc battery sector to help promote the development and use of these technologies,” said Green.

Zinc is a $US40bn a year market and the metal is the fourth most used worldwide after iron, aluminium and copper, according to the IZA.

China’s zinc imports at record levels

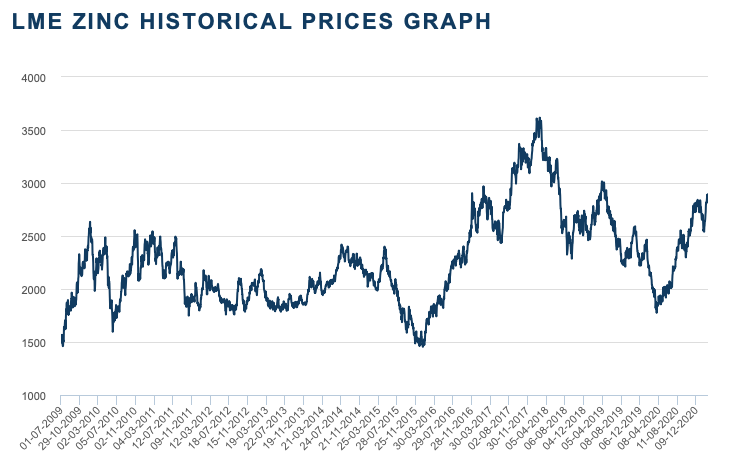

Zinc is approaching a two-year high of $US3,000 per tonne, but is still off its recent peak of $US3,500 per tonne in February 2018, according to London Metal Exchange data.

The base metal sank to a low of $US1,840 per tonne in March 2020, but has since risen 56 per cent to trade at $US2,895 per tonne on a cash price basis, this week.

Stocks of the metal stored at LME warehouses, the global distribution network for the metal, are a comfortable 237,700 tonnes, Thursday.

Influential industry body the International Lead and Zinc Study Group (ILZSG) said in its latest update Thursday, that the global zinc market had a surplus of 533,000 tonnes.

This is despite a 5.9 per cent fall in zinc mine production last year resulting from the impact of COVID-19 restrictions, although some countries, China and Australia increased output.

“Chinese imports of zinc contained in zinc concentrates in 2020 amounted to a record 1.8 million tonnes, an increase of 20.7 per cent compared to 2019,” said the ILZSG’s update.

Total global stocks of the metal are much higher than just LME warehouse stocks, and hit 1 million tonnes at the end of 2020.

Zinc producers (364,000 tonnes), consumers (134,000 tonnes) and China’s State Reserves Bureau (254,000 tonnes) also held inventories of zinc, according to the ILZSG.

ASX companies with exposure to zinc

There are several ASX companies with interests in zinc projects that can provide investors with exposure to the international zinc market.

They include, Alta Zinc (ASX:AZI) with its Gorno and Pian Bracca projects in Italy, and Zinc of Ireland (ASX:ZMI) with its Kildare project in the Republic of Ireland.

Consolidated Zinc (ASX:CZL) has its Plomosas mine in Mexico, and Variscan Mines (ASX:VAR) is progressing its Novales-Udias zinc project in Spain.

Zinc has a wide range of other uses in addition to applications in batteries such as providing a protective rust-proof galvanised coating on steel.

ASX share prices for Alta Zinc (ASX:AZI), Consolidated Zinc (ASX:CZL), Variscan Mines (ASX:VAR), Zinc of Ireland (ASX:ZMI)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.