Zinc and indium: American West is leveraging its North American assets

American West Metals is dashing ahead with its critical minerals projects. Pic: Getty

As the world marches towards net zero emissions, demand for critical minerals like zinc are climbing and ASX newcomer American West is keen to carve out a place for itself.

The company, which listed on the ASX in December after raising $12m, holds three projects in North America with an initial focus on its flagship West Desert zinc-copper-indium (and silver) project in Utah.

It also holds the Storm and Seal project in Canada and the Copper Warrior project in Utah.

American West Metals (ASX:AW1) also features an experienced board and management team with St George Mining executive chairman John Prineas serving as its non-executive chairman, Firefinch managing director Michael Anderson as a non-executive director and experienced geologist Dave O’Neill as its managing director.

Rocky and Pfau

It also counts international mining geologist Mark Pfau as its principal geologist and Rocky Pray as its Vice President operations on the ground in North America.

Speaking to Stockhead, O’Neill said while AW1 was one of a large number of initial public offerings to hit the ASX in the latter half of 2021, it laid its foundations some years ago when he was looking at base metal assets globally for companies such as BHP and Western Areas.

“West Desert was one that stood out as a very large project that might be better suited to the BHPs, but I realised when I looked at the data that the high-grade core represented a different value proposition which a mid-tier company or even a junior could exploit,” he added.

“That potential development scenario wasn’t being exploited and it wasn’t understood by the market.”

A bargain in the mining

O’Neill said they saw this as an opportunity and, the team that would become American West’s founders, decided to see if the vendors would be willing to do a deal.

“The timing was good for us because the TSX was struggling and it was difficult to get funding for mining projects, so they accepted our offer which was approximately $3.5m in cash and $2m in shares, which we think is a bargain given that there is over 1 million tonnes of zinc, 130,000t of copper and 1,500t of indium already defined” he added.

“That was the start of COVID as well, so we were able to deal at a very opportunistic time.”

American West also picked up its other assets that met its criteria of having existing resources and/or evidence of significant mineralisation and something that the company could potentially develop itself, or that could be de-risked to the point that bigger companies would be interested.

US and North America a drawcard

As for why the company focused on assets in North America, O’Neill said that it was because there were not many opportunities left in Australia and the ones that were available were overpriced.

“The other thing about the US is that a lot of Aussies don’t understand that it is very easy to operate in, there’s a deep wealth of local talent, , costs are generally lower than in Western Australia, and as a Tier 1 mining jurisdiction, they are used to dealing with big mines,” he explained.

“If you understand the permitting side of things then it is very easy to navigate.”

Critical base metals and some bonuses

The company’s current focus is on the West Desert zinc-copper-indium project in west-central Utah about 160km southwest of Salt Lake City within the heart of the Sevier Orogenic Belt, which hosts Rio Tinto’s giant Bingham Canyon copper deposit.

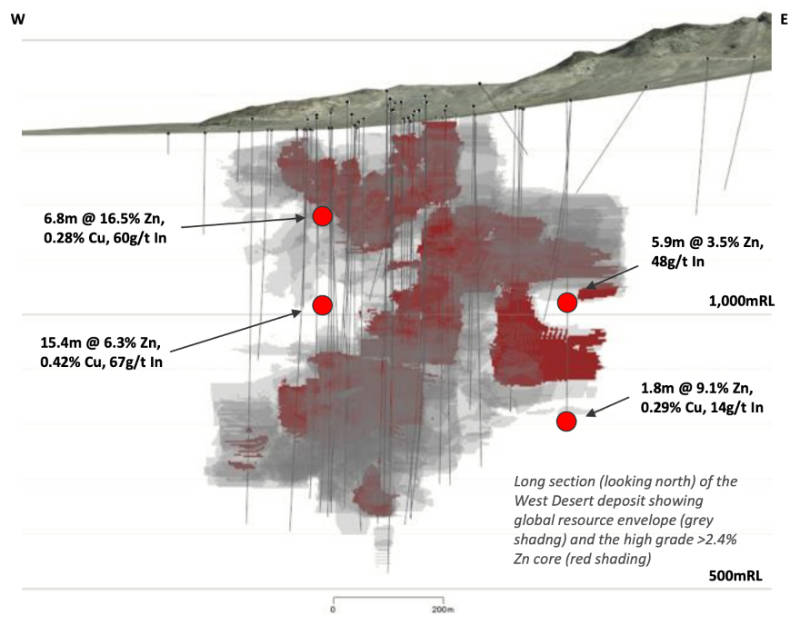

West Desert already hosts a non-JORC resource of 59 million tonnes grading 5.78% zinc equivalent including a higher-grade core of about 16.5Mt at 6.3% zinc, 0.3% copper and 33 grams per tonne (g/t) indium.

There is substantial potential to grow this resource as the deposit remains open in all directions.

Indium and zinc

Both indium, which is used in electronics and semiconductors, and zinc are considered to be critical minerals in the US.

O’Neill was quick to point out that, zinc is now a critical metal in the US.

“A lot of the zinc used domestically in the US is imported, and with the Red Dog mine potentially coming off in 2024 to 2025, there will a deficit in local supply” he noted.

“There is a massive opportunity for us to fill some of that local supply gap, and given that zinc is now a critical metal, and with the emergence of new technologies like zinc-air batteries, we are well placed to supply these needs.”

On indium, O’Neill explained that it isn’t particularly rare as it is found in most zinc deposits, but that West Desert is the largest undeveloped resource of the metal. While the market is relatively small and opaque in terms of pricing, the market for the metal is growing.

There is also no requirement for any special processing onsite if the smelter can process indium and will pay for it.

Thankfully, for West Desert, it not only has the second highest grades of indium in the world, it is also close to the rail line to Teck’s smelter at Trail, British Columbia, which is able to process indium.

Best in class

“In terms of price it is approximately two-thirds the value of silver. We have defined 52Moz of indium already, so that’s the equivalent value of about 25-30Moz of silver,” O’Neill noted.

“The indium is essentially a free carry for us, as it travels with the zinc concentrate to the smelter and they simply give us a cheque, less processing costs, to get it out of the concentrate.”

West Desert also has substantial magnetite with high iron ore content though American West has excluded this from its valuation. There are also large quantities of silver, lead, molybdenum and gold that have not been estimated in the resource.

“There is basically silver all through the deposit, and it’s associated with both the zinc and copper zones, but it hasn’t been exploited before so that’s also potentially an instant win for us to re-estimate the resource with silver,” O’Neill said.

“There are also local pockets within the deposit which are extremely high in gold as well.”

He added that the mineralised skarn at West Desert is larger than that at Bingham Canyon while the porphyry is identical in terms of its genesis and geology.

“The copper-molybdenum porphyry is completely unexplored , and we’re are finding increasing grades at depth in the areas of the porphyry that we have drilled to date.

Other projects

American West also owns the Storm and Seal project within the Polaris mineral district on Somerset Island in Nunavut, northern Canada.

Historical drilling at Storm has intersected structurally controlled, high-grade copper including stand-out intercepts such as 110m grading 2.45% copper from surface and 56.3m at 3.07% copper from 12.2m.

This mineralisation is chalcocite dominant, which the company believes will be amenable to traditional ore sorting and beneficiation techniques and may have the ability to produce direct shipping ores that require minimal processing before being sold.

Seal is a high-grade zinc and silver deposit with a non-JORC resource of 1Mt grading 10.24% zinc and 46.35g/t silver that is open at depth and along strike.

Importantly, the mineralisation has been confirmed to be of the same age and event that formed the world class Polaris Zinc-Lead deposit, which closed in 2002 after producing more than 21 million tonnes of zinc-lead ore over more than 20 years.

There is potential for more discoveries given that the stratigraphic horizon is largely unexplored and contains numerous zinc soil anomalies along its 75km strike.

American West’s remaining project is the Copper Warrior project that targets sediment-hosted copper just 15km northwest of Lisbon Valley, Utah’s second largest copper mine.

Copper Warrior

O’Neill describes Copper Warrior as the dark horse of the company’s projects thanks to how similar it is to Lisbon Valley.

“It has very simple geology and its identical to that of the Lisbon Valley Copper Mine. It is all about volume as we known the mineralisation is there, and its widely exposed at surface. If we can define a volume that is of interest to Lisbon Valley, we are only 15km down a sealed highway,” he added.

“It could well be developed ahead of our other projects without the need for us to build any processing infrastructure.”

Busy days ahead

American West is currently carrying out a 7,500m drill program at West Desert to test the continuity of the high-grade core.

“We want to test our assumptions that this strings together at the high grades. Alongside that we are looking to expand the resource and will test some of the oxide and transitional material, which to date has really good metallurgical properties,” O’Neill noted.

Proving up the oxide and transitional material could mean that the company could start with an open pit, which was not included in the historical plans, before going underground with the high-grade model.

The company also expects to start drilling in a couple of months on exploration targets that it has defined with a recent gravity surveyonce a second rig arrives on site.

“At the same time, we have engaged a number of consultants to look at what we need to do to convert the resource to be JORC compliant,” O’Neill noted.

“Because it is a very robust historical resource, this has the potential to be a simple tick and flick exercise but we are doing that work now to let us know exactly what we need to do to make it a JORC-compliant resource.

“Essentially the drilling at West Desert is open-ended, we just have to see how the results look and what additional work we have to do for the JORC resource. We also have the exploration program, which includes testing the porphyry, extensions to the known deposit, and other skarns in the area.”

Storm and Seal

At Storm and Seal, he noted that while exploration could only be carried out in summer, there is 24 hours of sunlight, meaning that almost twice as much could be done in that time.

“We are going to be drilling up there in summer with the objective of defining high-grade copper resources at Storm, and also testing for extensions to the Seal deposit,” O’Neill added.

American West also intends to carry out RC drilling and geophysical surveying at Copper Warrior.

O’Neill said the company was keen to understand Copper Warrior, reiterating that it could well be a “cheap and cheerful pathway” to production given that the company could either toll treat or outright sell ore to Lisbon Valley.

This article was developed in collaboration with American West, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.